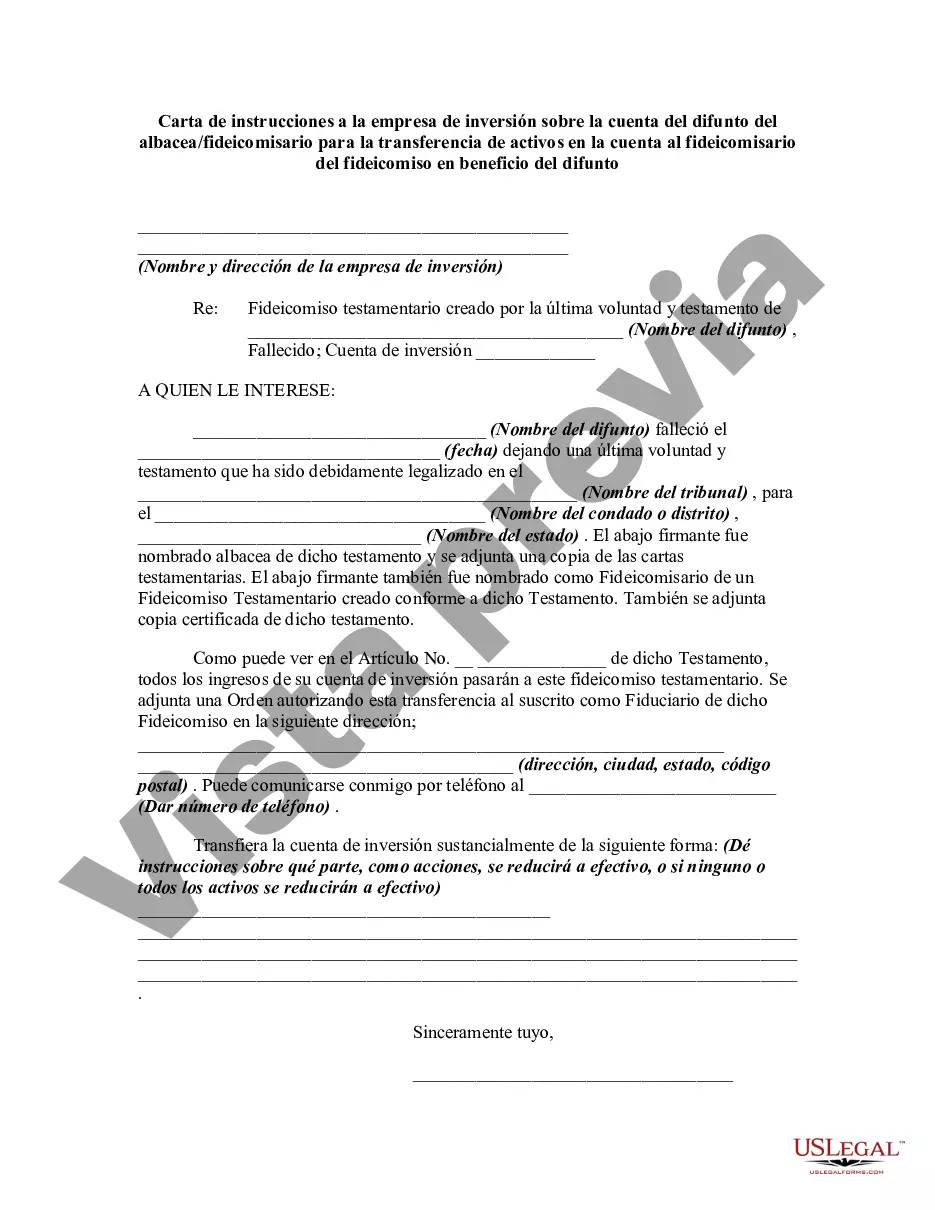

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Cook Illinois Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent In the event of a deceased individual's assets being held in an investment firm, the executor/trustee may need to provide a Cook Illinois Letter of Instruction to initiate the transfer of these assets to the trustee of a trust established for the benefit of the decedent. This detailed description aims to explain the purpose and process of such a letter, outlining its significance and the different types of Cook Illinois Letters of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent. A Cook Illinois Letter of Instruction to the investment firm serves as a crucial legal document that grants the executor or the trustee of an estate the authority to withdraw and transfer the deceased's assets held within an investment account to a trust established for the benefit of the decedent. This instruction ensures a smooth transition of the assets, safeguarding their transfer as per the wishes and directives of the decedent, all while adhering to the legal requirements governed by Cook Illinois laws. The Cook Illinois Letter of Instruction to the investment firm typically includes a range of essential information and instructions. It identifies the decedent's investment account details, such as the account number, type of account, and the specific investment firm holding the assets. This information helps the investment firm to easily locate and recognize the account in question. Furthermore, the letter outlines the executor's or trustee's authority to act on behalf of the estate, ensuring their ability to access and manage the assets in accordance with the decedent's wishes. It may provide explicit instructions regarding the transfer of assets to the trustee of the trust, including details such as the name of the trustee, their contact information, and the account or fund name where the assets are to be transferred. The Cook Illinois Letter of Instruction may also provide specific guidelines on any required documentation or forms that need to accompany the letter. This ensures compliance with any legal or administrative requirements involved in the transfer of assets. Additionally, it may include instructions for any necessary liquidation or transfer of specific investments held in the account, as specified in the trust agreement. Different types of Cook Illinois Letters of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent may vary based on the specific circumstances and complexities of the estate. For example: 1. Basic Cook Illinois Letter of Instruction: This type of letter includes general instructions for the transfer of assets, covering common situations where the assets are to be transferred to a trust in their entirety without specifying any particular investment or account details. 2. Detailed Cook Illinois Letter of Instruction: This type of letter provides specific instructions for each investment held within the account, specifying the exact funds or securities to be transferred, their quantities, and the desired destination account within the trust. 3. Restricted Cook Illinois Letter of Instruction: This type of letter restricts the transfer of assets to specific types of investments or certain accounts within the trust, ensuring the assets are distributed according to specific conditions or preferences mentioned in the trust agreement. In conclusion, a Cook Illinois Letter of Instruction to the investment firm regarding the decedent's account is a critical legal document that authorizes the executor/trustee to transfer assets to a trust for the benefit of the decedent. By providing pertinent information and specific directions, this letter streamlines the asset transfer process while adhering to Cook Illinois laws. The different types of Cook Illinois Letters of Instruction allow for variations based on the complexities and specifications of the estate, ensuring the accurate and desired distribution of assets.Cook Illinois Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent In the event of a deceased individual's assets being held in an investment firm, the executor/trustee may need to provide a Cook Illinois Letter of Instruction to initiate the transfer of these assets to the trustee of a trust established for the benefit of the decedent. This detailed description aims to explain the purpose and process of such a letter, outlining its significance and the different types of Cook Illinois Letters of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent. A Cook Illinois Letter of Instruction to the investment firm serves as a crucial legal document that grants the executor or the trustee of an estate the authority to withdraw and transfer the deceased's assets held within an investment account to a trust established for the benefit of the decedent. This instruction ensures a smooth transition of the assets, safeguarding their transfer as per the wishes and directives of the decedent, all while adhering to the legal requirements governed by Cook Illinois laws. The Cook Illinois Letter of Instruction to the investment firm typically includes a range of essential information and instructions. It identifies the decedent's investment account details, such as the account number, type of account, and the specific investment firm holding the assets. This information helps the investment firm to easily locate and recognize the account in question. Furthermore, the letter outlines the executor's or trustee's authority to act on behalf of the estate, ensuring their ability to access and manage the assets in accordance with the decedent's wishes. It may provide explicit instructions regarding the transfer of assets to the trustee of the trust, including details such as the name of the trustee, their contact information, and the account or fund name where the assets are to be transferred. The Cook Illinois Letter of Instruction may also provide specific guidelines on any required documentation or forms that need to accompany the letter. This ensures compliance with any legal or administrative requirements involved in the transfer of assets. Additionally, it may include instructions for any necessary liquidation or transfer of specific investments held in the account, as specified in the trust agreement. Different types of Cook Illinois Letters of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent may vary based on the specific circumstances and complexities of the estate. For example: 1. Basic Cook Illinois Letter of Instruction: This type of letter includes general instructions for the transfer of assets, covering common situations where the assets are to be transferred to a trust in their entirety without specifying any particular investment or account details. 2. Detailed Cook Illinois Letter of Instruction: This type of letter provides specific instructions for each investment held within the account, specifying the exact funds or securities to be transferred, their quantities, and the desired destination account within the trust. 3. Restricted Cook Illinois Letter of Instruction: This type of letter restricts the transfer of assets to specific types of investments or certain accounts within the trust, ensuring the assets are distributed according to specific conditions or preferences mentioned in the trust agreement. In conclusion, a Cook Illinois Letter of Instruction to the investment firm regarding the decedent's account is a critical legal document that authorizes the executor/trustee to transfer assets to a trust for the benefit of the decedent. By providing pertinent information and specific directions, this letter streamlines the asset transfer process while adhering to Cook Illinois laws. The different types of Cook Illinois Letters of Instruction allow for variations based on the complexities and specifications of the estate, ensuring the accurate and desired distribution of assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.