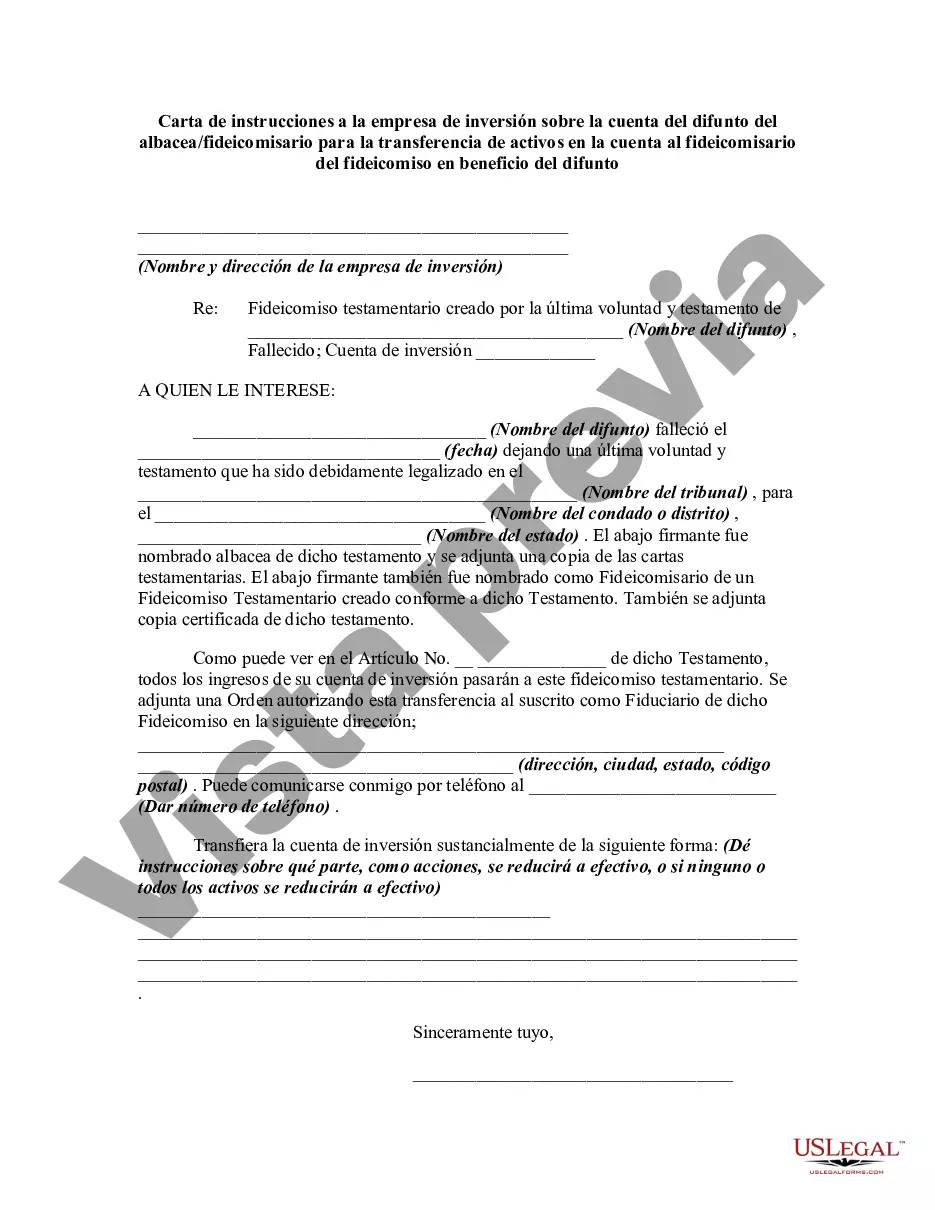

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

A Cuyahoga Ohio Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor / Trustee for the Transfer of Assets in the Account to the Trustee of a Trust for the Benefit of the Decedent is a legal document that outlines the necessary steps for transferring assets from the account of the deceased individual to a trust established for their benefit. This document is typically prepared and executed by the executor or trustee responsible for managing the deceased's estate and the trust. Keywords: Cuyahoga Ohio, Letter of Instruction, Investment Firm, Account of Decedent, Executor, Trustee, Transfer of Assets, Trust, Benefit of Decedent. Different types of Cuyahoga Ohio Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: 1. Basic Letter of Instruction: This type of letter outlines the basic information about the account, the deceased individual, and the trust, as well as the specific assets to be transferred. 2. Detailed Information Letter of Instruction: This type of letter provides more comprehensive details about the assets held in the account, including specific investments, account numbers, and any associated paperwork that needs to be submitted. 3. Legal Compliance Letter of Instruction: This type of letter ensures that the transfer of assets is in compliance with all relevant legal requirements, including probate laws, tax regulations, and any specific instructions outlined in the deceased's will or trust agreement. 4. Trustee's Responsibilities Letter of Instruction: This type of letter specifies the responsibilities and expectations of the trustee who will receive the assets from the investment firm, ensuring a smooth transfer and effective management of the trust assets. 5. Investment Firm's Acknowledgement Letter: This type of letter serves as an acknowledgement from the investment firm, confirming receipt of the letter of instruction and detailing the steps they will take to facilitate the transfer of assets to the designated trustee. It is essential to consult with legal and financial advisors to ensure the Cuyahoga Ohio Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor / Trustee for the Transfer of Assets in the Account to the Trustee of a Trust for the Benefit of the Decedent is custom-tailored to the specific circumstances and requirements of the decedent's estate and trust.A Cuyahoga Ohio Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor / Trustee for the Transfer of Assets in the Account to the Trustee of a Trust for the Benefit of the Decedent is a legal document that outlines the necessary steps for transferring assets from the account of the deceased individual to a trust established for their benefit. This document is typically prepared and executed by the executor or trustee responsible for managing the deceased's estate and the trust. Keywords: Cuyahoga Ohio, Letter of Instruction, Investment Firm, Account of Decedent, Executor, Trustee, Transfer of Assets, Trust, Benefit of Decedent. Different types of Cuyahoga Ohio Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: 1. Basic Letter of Instruction: This type of letter outlines the basic information about the account, the deceased individual, and the trust, as well as the specific assets to be transferred. 2. Detailed Information Letter of Instruction: This type of letter provides more comprehensive details about the assets held in the account, including specific investments, account numbers, and any associated paperwork that needs to be submitted. 3. Legal Compliance Letter of Instruction: This type of letter ensures that the transfer of assets is in compliance with all relevant legal requirements, including probate laws, tax regulations, and any specific instructions outlined in the deceased's will or trust agreement. 4. Trustee's Responsibilities Letter of Instruction: This type of letter specifies the responsibilities and expectations of the trustee who will receive the assets from the investment firm, ensuring a smooth transfer and effective management of the trust assets. 5. Investment Firm's Acknowledgement Letter: This type of letter serves as an acknowledgement from the investment firm, confirming receipt of the letter of instruction and detailing the steps they will take to facilitate the transfer of assets to the designated trustee. It is essential to consult with legal and financial advisors to ensure the Cuyahoga Ohio Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor / Trustee for the Transfer of Assets in the Account to the Trustee of a Trust for the Benefit of the Decedent is custom-tailored to the specific circumstances and requirements of the decedent's estate and trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.