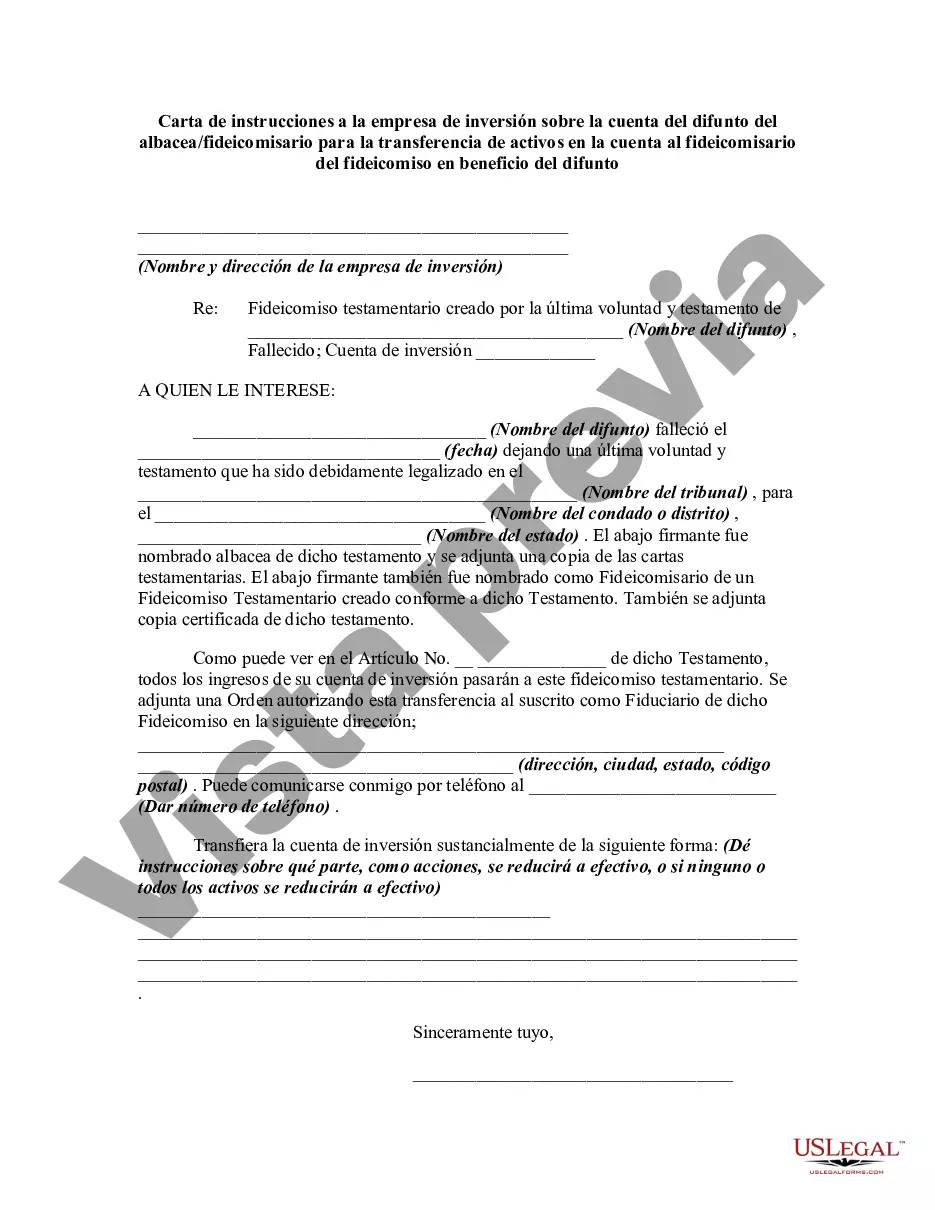

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Fairfax, Virginia is a vibrant city located in Fairfax County, part of the Washington Metropolitan Area. With its rich history, diverse culture, and thriving economy, Fairfax offers a desirable living environment for residents and businesses alike. The Fairfax Virginia Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of the Decedent is a legal document designed to provide specific instructions and guidelines to an investment firm in Fairfax, Virginia. This letter is typically sent by the executor or trustee of the estate for the purpose of transferring the assets held in the deceased person's investment accounts to the designated trustee of the trust, established for the benefit of the decedent. The main objective of this Letter of Instruction is to ensure a smooth transition of assets from the decedent's investment accounts to the trust, while adhering to all legal and financial regulations. It serves as an important tool for the executor or trustee to communicate their intentions clearly to the investment firm, providing necessary information and establishing guidelines to carry out the transfer process efficiently. Key topics covered in the Fairfax Virginia Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of the Decedent may include: 1. Identification and Contact Information: The letter should include detailed personal information about the decedent, including their full legal name, date of death, social security number, and contact information. 2. Executor/Trustee Information: The name, contact details, and authority of the executor or trustee responsible for overseeing the transfer must be clearly stated. 3. Investment Account Details: The account numbers, account types, and names of the investment firm(s) where the decedent held their assets should be provided to ensure proper identification and transfer. 4. Trustee Information: The name, contact details, and authority of the designated trustee of the trust established for the benefit of the decedent should be stated. 5. Transfer Instructions: Clear instructions on how the assets from the decedent's investment accounts are to be transferred to the designated trustee of the trust should be outlined in detail. This may include specifying the particular investment accounts, the exact amounts or percentages to be transferred, and any specific timing requirements. 6. Supporting Documents: It may be necessary to include necessary documentation, such as a certified copy of the decedent's death certificate or a valid copy of the trust instrument, to provide evidence and support the instructions. 7. Contact and Communication Procedures: The letter should specify preferred communication methods and contact information for the executor or trustee, ensuring effective coordination and clarification of any queries or concerns. Different types or variations of the Fairfax Virginia Letter of Instruction to the Investment Firm Regarding the Account of the Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of the Decedent may include specific legal language depending on the nature of the estate, the complexity of the trust, or the unique circumstances of the transfer of assets. Additionally, alternative names or titles for this document may include "Trust Instruction Letter," "Investment Firm Transfer Request," or "Executor's Letter of Instruction for Asset Transfer."Fairfax, Virginia is a vibrant city located in Fairfax County, part of the Washington Metropolitan Area. With its rich history, diverse culture, and thriving economy, Fairfax offers a desirable living environment for residents and businesses alike. The Fairfax Virginia Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of the Decedent is a legal document designed to provide specific instructions and guidelines to an investment firm in Fairfax, Virginia. This letter is typically sent by the executor or trustee of the estate for the purpose of transferring the assets held in the deceased person's investment accounts to the designated trustee of the trust, established for the benefit of the decedent. The main objective of this Letter of Instruction is to ensure a smooth transition of assets from the decedent's investment accounts to the trust, while adhering to all legal and financial regulations. It serves as an important tool for the executor or trustee to communicate their intentions clearly to the investment firm, providing necessary information and establishing guidelines to carry out the transfer process efficiently. Key topics covered in the Fairfax Virginia Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of the Decedent may include: 1. Identification and Contact Information: The letter should include detailed personal information about the decedent, including their full legal name, date of death, social security number, and contact information. 2. Executor/Trustee Information: The name, contact details, and authority of the executor or trustee responsible for overseeing the transfer must be clearly stated. 3. Investment Account Details: The account numbers, account types, and names of the investment firm(s) where the decedent held their assets should be provided to ensure proper identification and transfer. 4. Trustee Information: The name, contact details, and authority of the designated trustee of the trust established for the benefit of the decedent should be stated. 5. Transfer Instructions: Clear instructions on how the assets from the decedent's investment accounts are to be transferred to the designated trustee of the trust should be outlined in detail. This may include specifying the particular investment accounts, the exact amounts or percentages to be transferred, and any specific timing requirements. 6. Supporting Documents: It may be necessary to include necessary documentation, such as a certified copy of the decedent's death certificate or a valid copy of the trust instrument, to provide evidence and support the instructions. 7. Contact and Communication Procedures: The letter should specify preferred communication methods and contact information for the executor or trustee, ensuring effective coordination and clarification of any queries or concerns. Different types or variations of the Fairfax Virginia Letter of Instruction to the Investment Firm Regarding the Account of the Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of the Decedent may include specific legal language depending on the nature of the estate, the complexity of the trust, or the unique circumstances of the transfer of assets. Additionally, alternative names or titles for this document may include "Trust Instruction Letter," "Investment Firm Transfer Request," or "Executor's Letter of Instruction for Asset Transfer."

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.