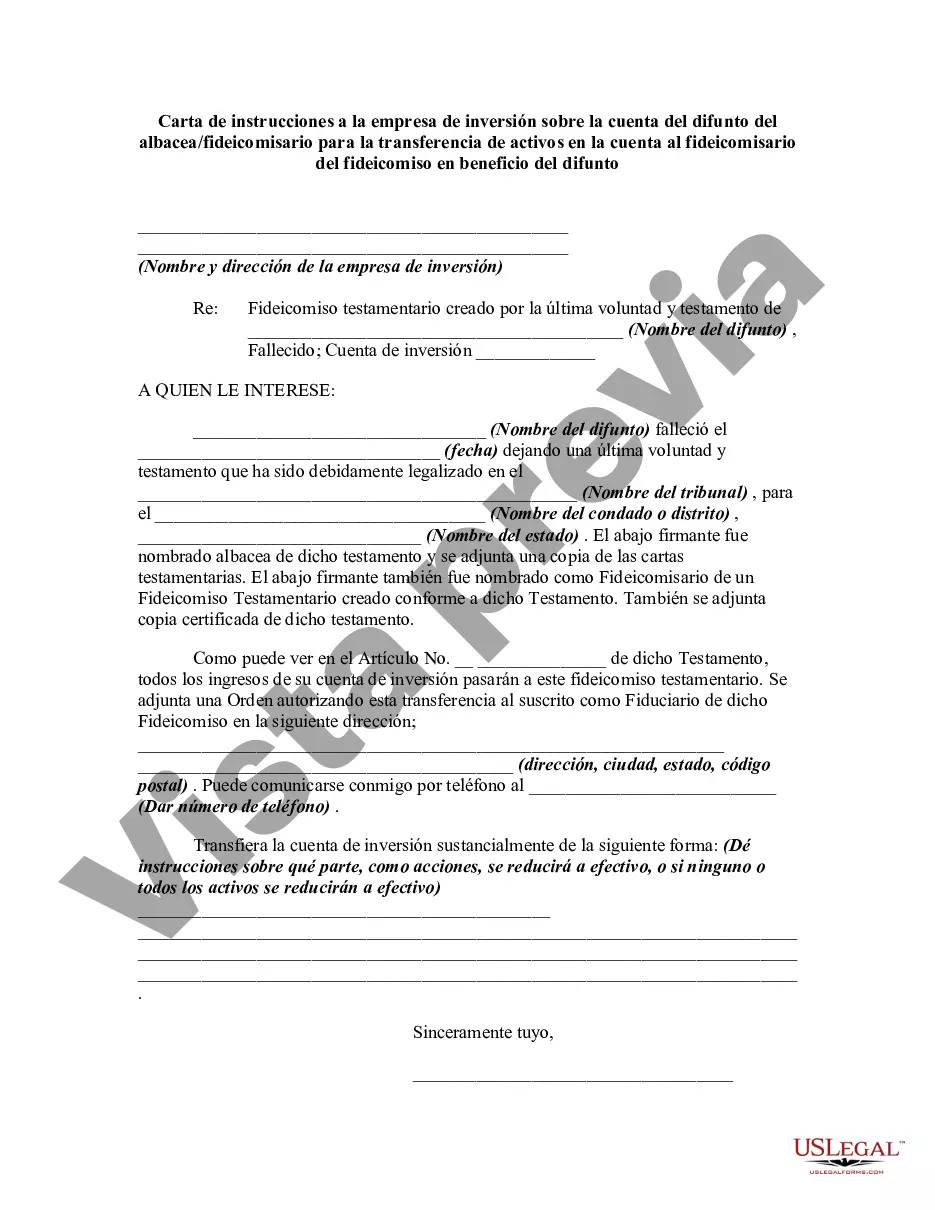

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

A Franklin Ohio Letter of Instruction to an Investment Firm is a detailed document that provides specific instructions to the investment firm regarding the transfer of assets in an account belonging to a decedent to a trustee of a trust for the benefit of the decedent. This letter is typically issued by the executor or trustee of the estate to facilitate the smooth transfer of assets and ensure compliance with applicable legal requirements. The purpose of this letter is to outline the steps and process involved in transferring the assets from the decedent's account to the designated trustee of the trust. It serves as a crucial communication tool between the executor/trustee and the investment firm, ensuring that all parties involved are informed and aware of their roles and responsibilities. The content of a Franklin Ohio Letter of Instruction may include the following key components: 1. Identification: The letter should include the full name and contact information of the executor/trustee, as well as the investment firm's details. 2. Account Information: Clear and specific details concerning the decedent's account, including the account number, holding institution, and any other relevant information. 3. Decedent's Estate Information: Provide a brief overview of the estate, including the date of death, probate case number, and any other relevant details. 4. Trust Information: Clearly identify the trust for the benefit of the decedent, including the trust's name, date of creation, and any other relevant information. 5. Asset Transfer Instructions: Outline the specific assets that need to be transferred from the decedent's account to the designated trust. This can include cash, stocks, bonds, or any other investment holdings. 6. Documentation and Forms: Specify any required documentation or forms that need to be completed and submitted to the investment firm for the asset transfer process. 7. Legal Compliance: Ensure that the letter includes language confirming compliance with Franklin Ohio laws, regulations, and any other relevant legal provisions related to the asset transfer process. 8. Communication and Contact: Provide contact information for the executor/trustee and designate a point of contact at the investment firm to facilitate efficient communication throughout the transfer process. 9. Execution and Delivery: Specify the date by which the investment firm should execute the asset transfer and request confirmation of receipt. Different variations of the Franklin Ohio Letter of Instruction may exist depending on factors like the specific asset types involved, the complexity of the estate, or any unique circumstances of the transfer. It's important to consult with legal professionals to ensure accuracy and compliance with Franklin Ohio laws when drafting this letter.A Franklin Ohio Letter of Instruction to an Investment Firm is a detailed document that provides specific instructions to the investment firm regarding the transfer of assets in an account belonging to a decedent to a trustee of a trust for the benefit of the decedent. This letter is typically issued by the executor or trustee of the estate to facilitate the smooth transfer of assets and ensure compliance with applicable legal requirements. The purpose of this letter is to outline the steps and process involved in transferring the assets from the decedent's account to the designated trustee of the trust. It serves as a crucial communication tool between the executor/trustee and the investment firm, ensuring that all parties involved are informed and aware of their roles and responsibilities. The content of a Franklin Ohio Letter of Instruction may include the following key components: 1. Identification: The letter should include the full name and contact information of the executor/trustee, as well as the investment firm's details. 2. Account Information: Clear and specific details concerning the decedent's account, including the account number, holding institution, and any other relevant information. 3. Decedent's Estate Information: Provide a brief overview of the estate, including the date of death, probate case number, and any other relevant details. 4. Trust Information: Clearly identify the trust for the benefit of the decedent, including the trust's name, date of creation, and any other relevant information. 5. Asset Transfer Instructions: Outline the specific assets that need to be transferred from the decedent's account to the designated trust. This can include cash, stocks, bonds, or any other investment holdings. 6. Documentation and Forms: Specify any required documentation or forms that need to be completed and submitted to the investment firm for the asset transfer process. 7. Legal Compliance: Ensure that the letter includes language confirming compliance with Franklin Ohio laws, regulations, and any other relevant legal provisions related to the asset transfer process. 8. Communication and Contact: Provide contact information for the executor/trustee and designate a point of contact at the investment firm to facilitate efficient communication throughout the transfer process. 9. Execution and Delivery: Specify the date by which the investment firm should execute the asset transfer and request confirmation of receipt. Different variations of the Franklin Ohio Letter of Instruction may exist depending on factors like the specific asset types involved, the complexity of the estate, or any unique circumstances of the transfer. It's important to consult with legal professionals to ensure accuracy and compliance with Franklin Ohio laws when drafting this letter.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.