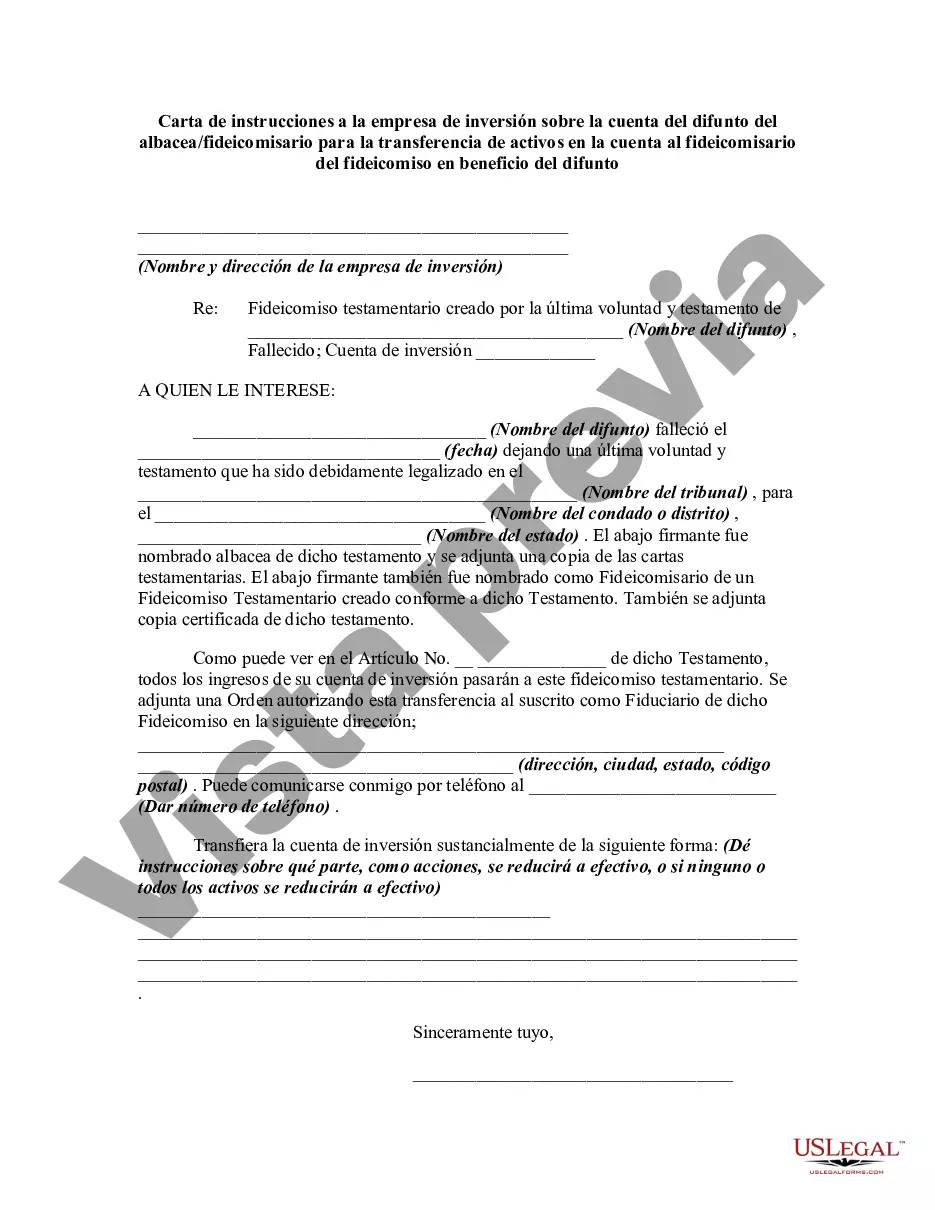

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

A Houston Texas Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor or Trustee is a legal document that guides the investment firm in transferring assets from the deceased person's account to a trust for the benefit of the decedent. This letter is typically sent by the executor or trustee responsible for managing the decedent's estate or trust. In such a Letter of Instruction, it is crucial to include specific details such as the full legal name of the deceased person, the account number, the investment firm's name and address, and the name and contact information of the trustee of the trust. The letter should also explicitly state that it is a Letter of Instruction to ensure clarity. The purpose of this letter is to provide clear instructions to the investment firm regarding the transfer of assets from the decedent's account. By addressing the letter to the investment firm, the executor or trustee can initiate the necessary steps to move the assets into the trust. Some potential types of Houston Texas Letters of Instruction to an Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent could be: 1. Revocable Living Trust Letter of Instruction: This type of letter is used when the decedent had established a revocable living trust during their lifetime, and now the assets in their investment account need to be transferred to the trust for distribution to beneficiaries. 2. Testamentary Trust Letter of Instruction: In cases where the decedent had a testamentary trust set up in their will, this letter would provide instructions to the investment firm on transferring the assets to the testamentary trust. 3. Special Needs Trust Letter of Instruction: If the decedent intended to create a special needs trust to provide for a disabled beneficiary, this letter would guide the investment firm to transfer the assets to the trust for the benefit of the disabled person. 4. Charitable Remainder Trust Letter of Instruction: If the decedent designated a charitable remainder trust in their estate plan, this letter would outline the transfer of assets from the decedent's account to the trust, which will eventually benefit a charitable organization. 5. Irrevocable Life Insurance Trust Letter of Instruction: In cases where the decedent had an irrevocable life insurance trust, this letter would provide instructions to transfer the life insurance proceeds from the investment account to the trust. Regardless of the specific type, a Houston Texas Letter of Instruction to an Investment Firm Regarding Account of Decedent serves as a vital legal document, ensuring that the wishes of the decedent and the requirements of the estate or trust are fulfilled by transferring the assets effectively and efficiently.A Houston Texas Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor or Trustee is a legal document that guides the investment firm in transferring assets from the deceased person's account to a trust for the benefit of the decedent. This letter is typically sent by the executor or trustee responsible for managing the decedent's estate or trust. In such a Letter of Instruction, it is crucial to include specific details such as the full legal name of the deceased person, the account number, the investment firm's name and address, and the name and contact information of the trustee of the trust. The letter should also explicitly state that it is a Letter of Instruction to ensure clarity. The purpose of this letter is to provide clear instructions to the investment firm regarding the transfer of assets from the decedent's account. By addressing the letter to the investment firm, the executor or trustee can initiate the necessary steps to move the assets into the trust. Some potential types of Houston Texas Letters of Instruction to an Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent could be: 1. Revocable Living Trust Letter of Instruction: This type of letter is used when the decedent had established a revocable living trust during their lifetime, and now the assets in their investment account need to be transferred to the trust for distribution to beneficiaries. 2. Testamentary Trust Letter of Instruction: In cases where the decedent had a testamentary trust set up in their will, this letter would provide instructions to the investment firm on transferring the assets to the testamentary trust. 3. Special Needs Trust Letter of Instruction: If the decedent intended to create a special needs trust to provide for a disabled beneficiary, this letter would guide the investment firm to transfer the assets to the trust for the benefit of the disabled person. 4. Charitable Remainder Trust Letter of Instruction: If the decedent designated a charitable remainder trust in their estate plan, this letter would outline the transfer of assets from the decedent's account to the trust, which will eventually benefit a charitable organization. 5. Irrevocable Life Insurance Trust Letter of Instruction: In cases where the decedent had an irrevocable life insurance trust, this letter would provide instructions to transfer the life insurance proceeds from the investment account to the trust. Regardless of the specific type, a Houston Texas Letter of Instruction to an Investment Firm Regarding Account of Decedent serves as a vital legal document, ensuring that the wishes of the decedent and the requirements of the estate or trust are fulfilled by transferring the assets effectively and efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.