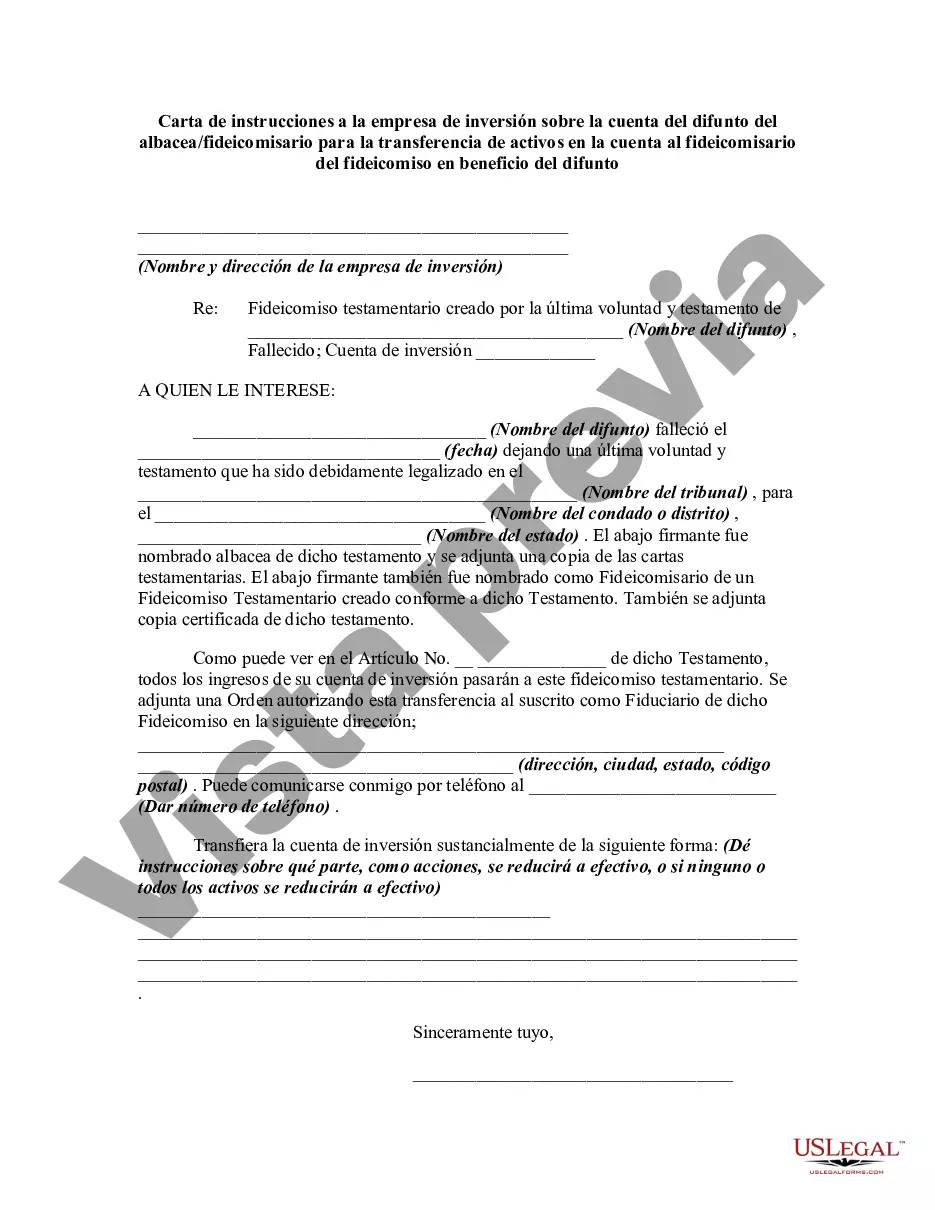

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Title: Mecklenburg, North Carolina — Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent Introduction: In Mecklenburg, North Carolina, when a loved one passes away, their financial assets need to be properly distributed and managed according to their wishes. This process often involves the executor or trustee of the decedent's estate working with an investment firm to transfer the assets from the account to a trust for the benefit of the decedent. This Letter of Instruction serves as a crucial document to guide and authorize the investment firm during this transfer process. Keywords: Mecklenburg, North Carolina, Letter of Instruction, Investment Firm, Executor, Trustee, Decedent, Transfer of Assets, Account, Trust, Benefit. 1. Mecklenburg, North Carolina — Overview of the Transfer Process: This section provides an overview of the transfer process, emphasizing the importance of proper documentation, compliance with legal requirements, and collaboration between the executor, trustee, and investment firm. 2. Purpose and Importance of the Letter of Instruction: This segment delves into the significance of the Letter of Instruction, stating that it serves as a legal instrument that outlines the executor's explicit directives to the investment firm regarding the transfer of assets from the decedent's account to the trust established for their benefit. 3. Key Elements of the Letter of Instruction: Here, we discuss the essential information that should be included in the Letter of Instruction, such as the identification of the decedent, the investment account details, contact information, explicit authorization for the transfer, any particular investment preferences, and the trustee's information. 4. Different Types of Mecklenburg, North Carolina Letters of Instruction: a) Standard Transfer of Assets: This type of Letter of Instruction covers the transfer of financial assets from the decedent's investment account to a trust for the benefit of the decedent as specified in their estate planning documents. b) Trust Distribution Instructions: A different type of Letter of Instruction may be required if the trustee needs to distribute specific assets from the trust to beneficiaries according to the decedent's wishes. 5. Legal Considerations and Compliance: This section emphasizes the importance of compliance with Mecklenburg, North Carolina laws, regulations, and any specific requirements related to the transfer of assets. It also highlights that legal consultation is advised to ensure all actions are conducted within the proper legal framework. 6. Communication and Collaboration: Effective communication and collaboration between the executor, trustee, and the investment firm are vital elements for a successful transfer process. Regular updates, documentation sharing, and clarifications should be maintained throughout the process to ensure smooth execution. Conclusion: In conclusion, the Mecklenburg, North Carolina Letter of Instruction to an investment firm serves as a key document in transferring assets from a decedent's account to a trust for their benefit. By providing explicit instructions and maintaining compliance with legal requirements, this letter plays a crucial role in ensuring the decedent's wishes are fulfilled while safeguarding their financial well-being. Note: It is essential to consult with legal professionals in Mecklenburg, North Carolina, for accurate guidance regarding specific requirements and regulations for the Letter of Instruction in the context of transferring assets from an investment account to a trust.Title: Mecklenburg, North Carolina — Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent Introduction: In Mecklenburg, North Carolina, when a loved one passes away, their financial assets need to be properly distributed and managed according to their wishes. This process often involves the executor or trustee of the decedent's estate working with an investment firm to transfer the assets from the account to a trust for the benefit of the decedent. This Letter of Instruction serves as a crucial document to guide and authorize the investment firm during this transfer process. Keywords: Mecklenburg, North Carolina, Letter of Instruction, Investment Firm, Executor, Trustee, Decedent, Transfer of Assets, Account, Trust, Benefit. 1. Mecklenburg, North Carolina — Overview of the Transfer Process: This section provides an overview of the transfer process, emphasizing the importance of proper documentation, compliance with legal requirements, and collaboration between the executor, trustee, and investment firm. 2. Purpose and Importance of the Letter of Instruction: This segment delves into the significance of the Letter of Instruction, stating that it serves as a legal instrument that outlines the executor's explicit directives to the investment firm regarding the transfer of assets from the decedent's account to the trust established for their benefit. 3. Key Elements of the Letter of Instruction: Here, we discuss the essential information that should be included in the Letter of Instruction, such as the identification of the decedent, the investment account details, contact information, explicit authorization for the transfer, any particular investment preferences, and the trustee's information. 4. Different Types of Mecklenburg, North Carolina Letters of Instruction: a) Standard Transfer of Assets: This type of Letter of Instruction covers the transfer of financial assets from the decedent's investment account to a trust for the benefit of the decedent as specified in their estate planning documents. b) Trust Distribution Instructions: A different type of Letter of Instruction may be required if the trustee needs to distribute specific assets from the trust to beneficiaries according to the decedent's wishes. 5. Legal Considerations and Compliance: This section emphasizes the importance of compliance with Mecklenburg, North Carolina laws, regulations, and any specific requirements related to the transfer of assets. It also highlights that legal consultation is advised to ensure all actions are conducted within the proper legal framework. 6. Communication and Collaboration: Effective communication and collaboration between the executor, trustee, and the investment firm are vital elements for a successful transfer process. Regular updates, documentation sharing, and clarifications should be maintained throughout the process to ensure smooth execution. Conclusion: In conclusion, the Mecklenburg, North Carolina Letter of Instruction to an investment firm serves as a key document in transferring assets from a decedent's account to a trust for their benefit. By providing explicit instructions and maintaining compliance with legal requirements, this letter plays a crucial role in ensuring the decedent's wishes are fulfilled while safeguarding their financial well-being. Note: It is essential to consult with legal professionals in Mecklenburg, North Carolina, for accurate guidance regarding specific requirements and regulations for the Letter of Instruction in the context of transferring assets from an investment account to a trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.