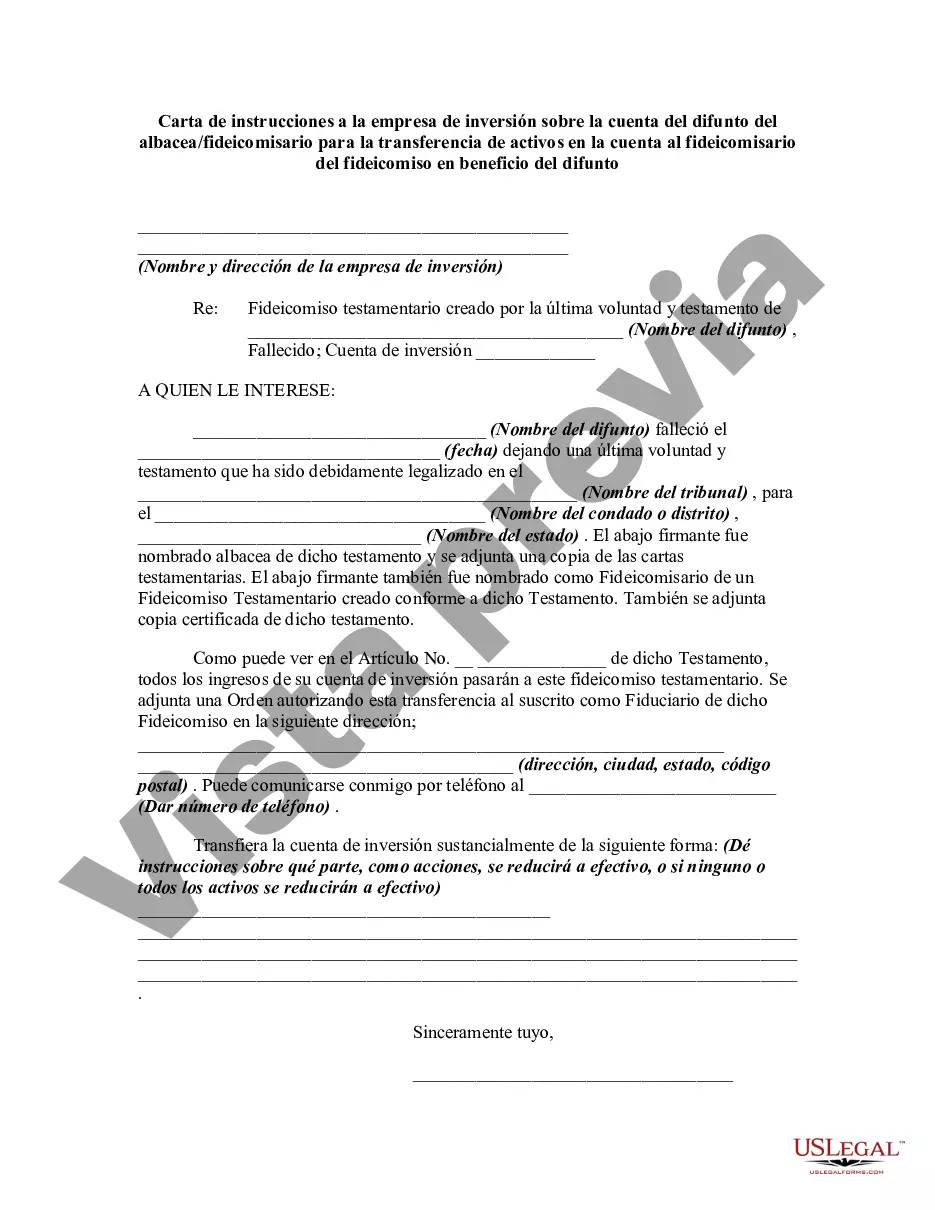

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Miami-Dade Florida is a county located in the southeastern part of the state of Florida. Known for its vibrant culture, beautiful beaches, and lively nightlife, Miami-Dade is a popular destination for tourists and residents alike. A "Letter of Instruction to Investment Firm Regarding Account of Decedent" is a legal document that provides detailed instructions to an investment firm regarding the transfer of assets from the account of a deceased individual. Typically, this letter is written by the executor or trustee of the decedent's estate or trust. In the case when the transfer of assets is being made to a trustee of a trust for the benefit of the decedent, the letter of instruction would specify the details of the trust and the respective trustees involved. Different types of Miami-Dade Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent may include: 1. Irrevocable Trust Letter of Instruction: This type of letter applies when the trust established for the benefit of the decedent is irrevocable, meaning it cannot be modified or revoked without the consent of the beneficiaries. 2. Revocable Trust Letter of Instruction: If the trust in question is revocable, allowing for modifications or revocation by the granter, a different set of instructions might be included in the letter. 3. Testamentary Trust Letter of Instruction: A testamentary trust is created through the provisions of a last will and testament. In this case, the letter of instruction would communicate the transfer of assets from the decedent's investment account to the trustee of the testamentary trust. 4. Living Trust Letter of Instruction: This letter pertains to a living trust, which is established during the granter's lifetime and typically becomes irrevocable upon their death. The executor or trustee would provide instructions for the transfer of assets to the trustee of the living trust. In summary, the different types of Miami-Dade Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent may vary depending on the specific nature of the trust and the legal requirements associated with it.Miami-Dade Florida is a county located in the southeastern part of the state of Florida. Known for its vibrant culture, beautiful beaches, and lively nightlife, Miami-Dade is a popular destination for tourists and residents alike. A "Letter of Instruction to Investment Firm Regarding Account of Decedent" is a legal document that provides detailed instructions to an investment firm regarding the transfer of assets from the account of a deceased individual. Typically, this letter is written by the executor or trustee of the decedent's estate or trust. In the case when the transfer of assets is being made to a trustee of a trust for the benefit of the decedent, the letter of instruction would specify the details of the trust and the respective trustees involved. Different types of Miami-Dade Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent may include: 1. Irrevocable Trust Letter of Instruction: This type of letter applies when the trust established for the benefit of the decedent is irrevocable, meaning it cannot be modified or revoked without the consent of the beneficiaries. 2. Revocable Trust Letter of Instruction: If the trust in question is revocable, allowing for modifications or revocation by the granter, a different set of instructions might be included in the letter. 3. Testamentary Trust Letter of Instruction: A testamentary trust is created through the provisions of a last will and testament. In this case, the letter of instruction would communicate the transfer of assets from the decedent's investment account to the trustee of the testamentary trust. 4. Living Trust Letter of Instruction: This letter pertains to a living trust, which is established during the granter's lifetime and typically becomes irrevocable upon their death. The executor or trustee would provide instructions for the transfer of assets to the trustee of the living trust. In summary, the different types of Miami-Dade Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent may vary depending on the specific nature of the trust and the legal requirements associated with it.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.