This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Subject: Middlesex Massachusetts Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent Dear [Investment Firm's Name], I hope this letter finds you well. I am writing to provide detailed instructions on behalf of the [Executor/Trustee's Name], acting in their capacity as the executor/trustee of the [Decedent's Name] estate, regarding the transfer of assets from the account of the decedent to the trustee of the trust established for the benefit of the decedent's beneficiaries. As the representative of the [Decedent's Name] estate, it is crucial to ensure a seamless transfer of assets. Therefore, we kindly request your utmost attention and adherence to the following instructions: 1. Account Information: — Account holder's full name— - Account number: — Account type: - Current balance: 2. Trustee Information: — Trustee's full name— - Trustee's address: — Trustee's contact number: 3. Asset Transfer: — Transfer all assets held in the account to the trustee account of the [Decedent's Name] trust. — Please perform the transfer in one transaction to avoid any unnecessary delays. — Ensure that the assets are correctly assigned and allocated according to the trust's terms. — Provide a breakdown of the transferred assets, including their respective values and any associated taxes or fees. 4. Required Documentation: — Please forward the necessary forms or documentation required by the investment firm to execute the asset transfer. — If there are any additional legal or administrative documents needed from our end, kindly specify them in your response. 5. Confirmation: — Once the transfer is complete, please send an official confirmation statement to the address listed below. — Confirmation should include the date of the transfer, a detailed inventory of transferred assets, their respective values, and any tax implications if applicable. Mailing Address: [Executor/Trustee's Name] [Executor/Trustee's Address] [City, State, ZIP] We understand the importance of complying with legal requirements and maintaining the highest level of professionalism. Should you require any further information, please contact the undersigned at [Executor/Trustee's Phone Number] or via email at [Executor/Trustee's Email Address]. Your prompt attention to this matter is greatly appreciated. Thank you for your cooperation in facilitating a smooth transfer of assets for the benefit of the [Decedent's Name] trust's beneficiaries. Sincerely, [Executor/Trustee's Name] [Executor/Trustee's Title] [Executor/Trustee's Contact Information]Subject: Middlesex Massachusetts Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent Dear [Investment Firm's Name], I hope this letter finds you well. I am writing to provide detailed instructions on behalf of the [Executor/Trustee's Name], acting in their capacity as the executor/trustee of the [Decedent's Name] estate, regarding the transfer of assets from the account of the decedent to the trustee of the trust established for the benefit of the decedent's beneficiaries. As the representative of the [Decedent's Name] estate, it is crucial to ensure a seamless transfer of assets. Therefore, we kindly request your utmost attention and adherence to the following instructions: 1. Account Information: — Account holder's full name— - Account number: — Account type: - Current balance: 2. Trustee Information: — Trustee's full name— - Trustee's address: — Trustee's contact number: 3. Asset Transfer: — Transfer all assets held in the account to the trustee account of the [Decedent's Name] trust. — Please perform the transfer in one transaction to avoid any unnecessary delays. — Ensure that the assets are correctly assigned and allocated according to the trust's terms. — Provide a breakdown of the transferred assets, including their respective values and any associated taxes or fees. 4. Required Documentation: — Please forward the necessary forms or documentation required by the investment firm to execute the asset transfer. — If there are any additional legal or administrative documents needed from our end, kindly specify them in your response. 5. Confirmation: — Once the transfer is complete, please send an official confirmation statement to the address listed below. — Confirmation should include the date of the transfer, a detailed inventory of transferred assets, their respective values, and any tax implications if applicable. Mailing Address: [Executor/Trustee's Name] [Executor/Trustee's Address] [City, State, ZIP] We understand the importance of complying with legal requirements and maintaining the highest level of professionalism. Should you require any further information, please contact the undersigned at [Executor/Trustee's Phone Number] or via email at [Executor/Trustee's Email Address]. Your prompt attention to this matter is greatly appreciated. Thank you for your cooperation in facilitating a smooth transfer of assets for the benefit of the [Decedent's Name] trust's beneficiaries. Sincerely, [Executor/Trustee's Name] [Executor/Trustee's Title] [Executor/Trustee's Contact Information]

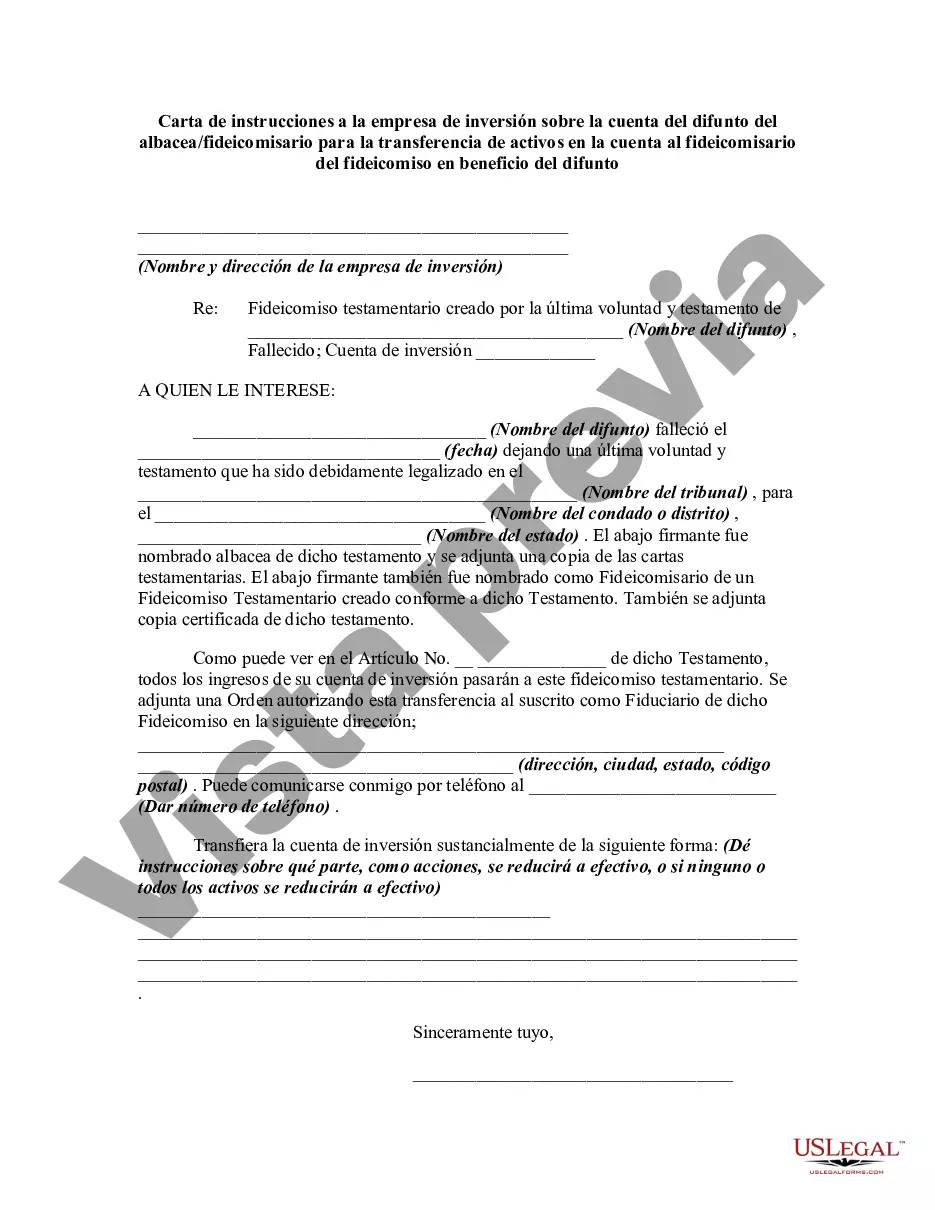

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.