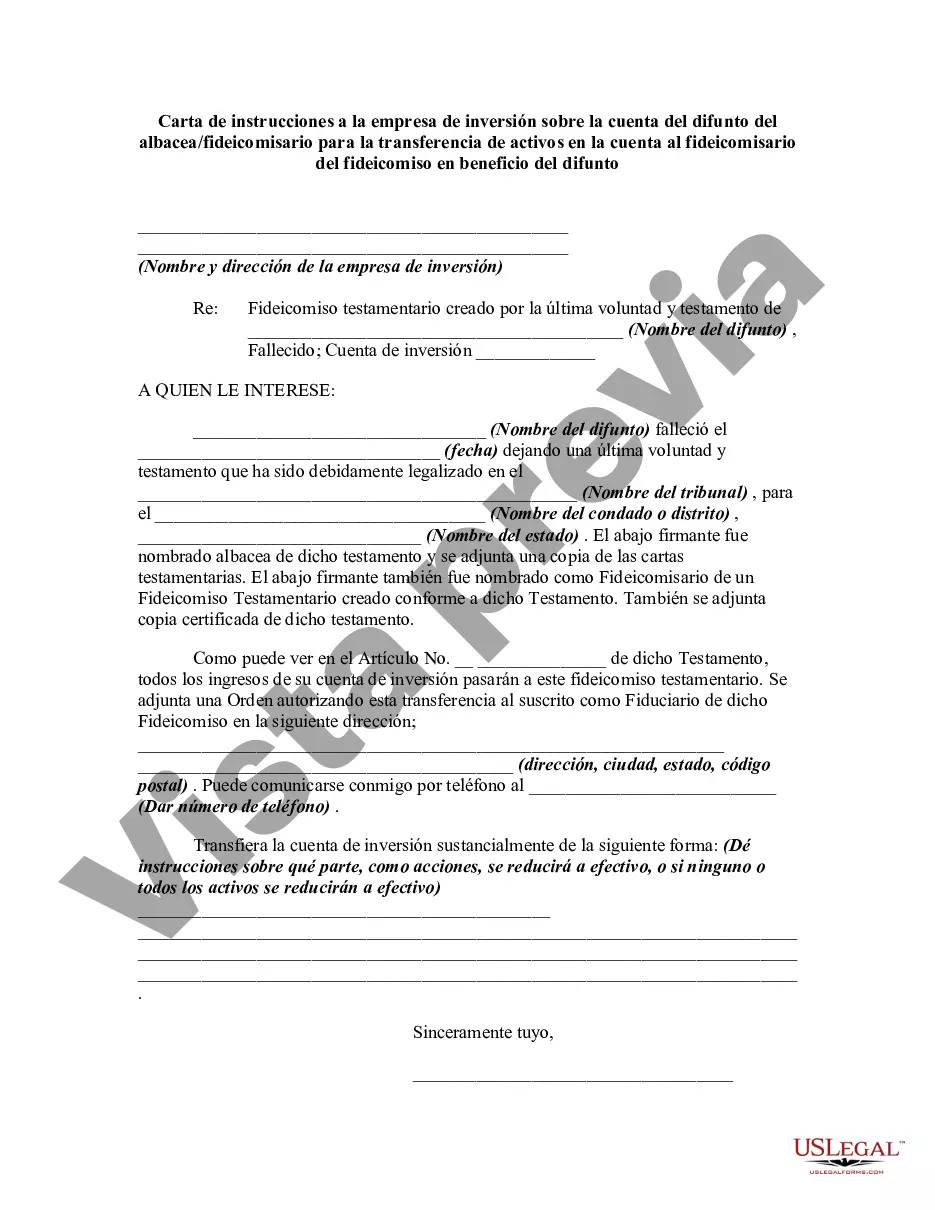

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Montgomery, Maryland is a county located in the state of Maryland, United States. It is home to several cities and towns, including Rockville, Bethesda, Gaithersburg, and Silver Spring. Known for its vibrant community and diverse population, Montgomery offers a range of cultural, recreational, and educational opportunities. A "Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent" is a legal document that guides an executor or trustee in transferring assets from a deceased individual's investment account to a trust established for their benefit. It is crucial to ensure a smooth and efficient transfer of assets according to the deceased's wishes and the applicable laws. Keywords: Montgomery Maryland, letter of instruction, investment firm, account of decedent, executor, trustee, transfer of assets, trustee of trust, benefit of decedent. Different types of Montgomery Maryland Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can include: 1. Basic Letter of Instruction: This type of letter provides general instructions to the investment firm regarding the transfer of assets from the deceased's account to the trust, without specifying detailed investment strategies or preferences. 2. Specified Investment Letter of Instruction: This letter outlines specific investment preferences and strategies that the trustee should follow while managing the transferred assets in the trust. 3. Tax-Optimized Letter of Instruction: In this type of letter, the executor or trustee includes instructions on how to minimize tax liabilities while transferring assets to the trust or managing them within the trust. 4. Charitable Trust Letter of Instruction: If the trust established for the benefit of the decedent involves a charitable component, this letter of instruction provides guidance on how to handle charitable donations and investments in alignment with the decedent's philanthropic goals. 5. Restricted Asset Transfer Letter of Instruction: In cases where certain assets within the deceased's investment account have restrictions or special considerations for transfer, this letter provides specific instructions for facilitating the transfer. Note: The specific types of letters of instruction may vary based on individual circumstances and legal requirements. It is advisable to consult with an attorney specializing in estate planning and trust administration to ensure compliance with applicable laws and regulations.Montgomery, Maryland is a county located in the state of Maryland, United States. It is home to several cities and towns, including Rockville, Bethesda, Gaithersburg, and Silver Spring. Known for its vibrant community and diverse population, Montgomery offers a range of cultural, recreational, and educational opportunities. A "Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent" is a legal document that guides an executor or trustee in transferring assets from a deceased individual's investment account to a trust established for their benefit. It is crucial to ensure a smooth and efficient transfer of assets according to the deceased's wishes and the applicable laws. Keywords: Montgomery Maryland, letter of instruction, investment firm, account of decedent, executor, trustee, transfer of assets, trustee of trust, benefit of decedent. Different types of Montgomery Maryland Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can include: 1. Basic Letter of Instruction: This type of letter provides general instructions to the investment firm regarding the transfer of assets from the deceased's account to the trust, without specifying detailed investment strategies or preferences. 2. Specified Investment Letter of Instruction: This letter outlines specific investment preferences and strategies that the trustee should follow while managing the transferred assets in the trust. 3. Tax-Optimized Letter of Instruction: In this type of letter, the executor or trustee includes instructions on how to minimize tax liabilities while transferring assets to the trust or managing them within the trust. 4. Charitable Trust Letter of Instruction: If the trust established for the benefit of the decedent involves a charitable component, this letter of instruction provides guidance on how to handle charitable donations and investments in alignment with the decedent's philanthropic goals. 5. Restricted Asset Transfer Letter of Instruction: In cases where certain assets within the deceased's investment account have restrictions or special considerations for transfer, this letter provides specific instructions for facilitating the transfer. Note: The specific types of letters of instruction may vary based on individual circumstances and legal requirements. It is advisable to consult with an attorney specializing in estate planning and trust administration to ensure compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.