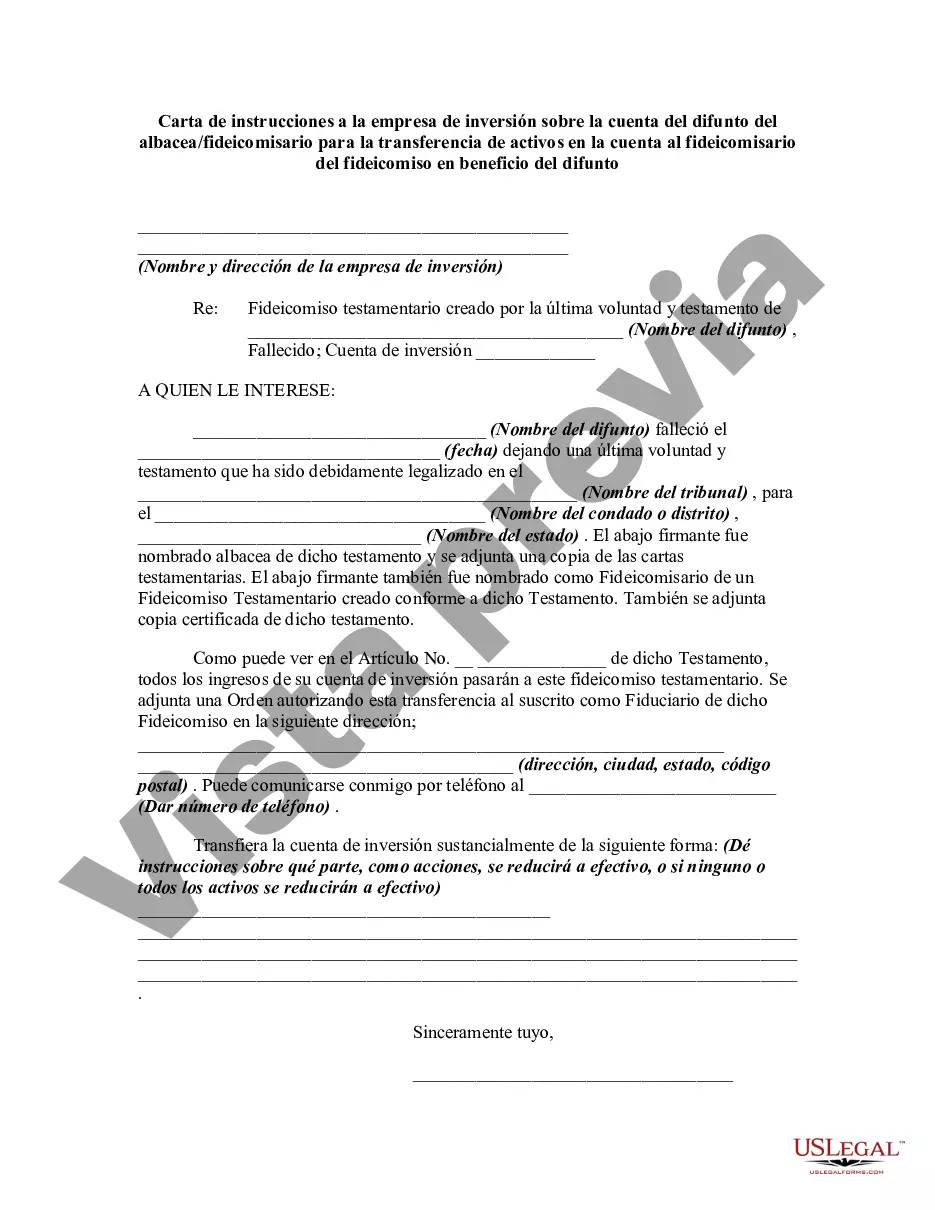

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Keywords: Queens New York, letter of instruction, investment firm, account of decedent, executor, trustee, transfer of assets, trustee of trust, benefit of decedent. 1. Introduction to Queens, New York: Queens, New York is one of the five boroughs of New York City. Known for its diversity and vibrant communities, Queens offers a mix of residential, commercial, and recreational areas. As the largest borough in terms of area, Queens is home to numerous cultural attractions, world-class cuisine, and thriving local businesses. 2. Understanding the Letter of Instruction: A Letter of Instruction is a legal document that provides specific instructions to the investment firm regarding the account of a deceased individual. In the context of Queens, New York, this document is drafted by the executor or trustee who is responsible for managing and overseeing the transfer of assets from the decedent's account to the trustee of a trust established for the benefit of the decedent. 3. Types of Letters of Instruction: — Letter of Instruction for Transfer of Assets: This type of letter specifically focuses on the transfer of assets held in the deceased individual's account. It outlines the necessary steps and information required to initiate the transfer process to the trustee of the designated trust. — Letter of Instruction for Account Closure: In some cases, the executor or trustee may need to close the decedent's account with the investment firm. This letter would provide the necessary instructions on the account closure process, including the required documentation and steps to be followed. 4. Executor's Role and Responsibilities: The executor, appointed in the decedent's will, is responsible for managing the deceased individual's estate, including their financial affairs. In the context of the letter of instruction, the executor's role is to communicate with the investment firm and provide instructions regarding the assets held in the decedent's account. They ensure that the transfer process is carried out accurately, efficiently, and in accordance with applicable laws and regulations. 5. Trustee's Role and Responsibilities: If the decedent's estate planning includes a trust for the benefit of the decedent, a trustee is assigned to manage the assets held within that trust. The trustee, often named in the decedent's will or trust agreement, receives the transferred assets as directed by the executor. The trustee bears the responsibility of preserving and distributing the assets in accordance with the terms outlined in the trust document. 6. Importance of Collaboration with Investment Firm: The letter of instruction serves as a vital communication tool between the executor/trustee and the investment firm. It ensures proper coordination and adherence to the decedent's wishes, safeguards the assets, and facilitates the smooth transfer process. Maintaining open lines of communication with the investment firm helps address any queries, resolve potential obstacles, and ensure efficient asset management on behalf of the decedent. In conclusion, a detailed letter of instruction in Queens, New York, allows the executor or trustee to provide specific guidance to the investment firm regarding the transfer of assets from the account of the decedent to the trustee of a trust for the benefit of the decedent. This document plays a crucial role in facilitating the proper administration of the decedent's estate and ensures adherence to their wishes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.