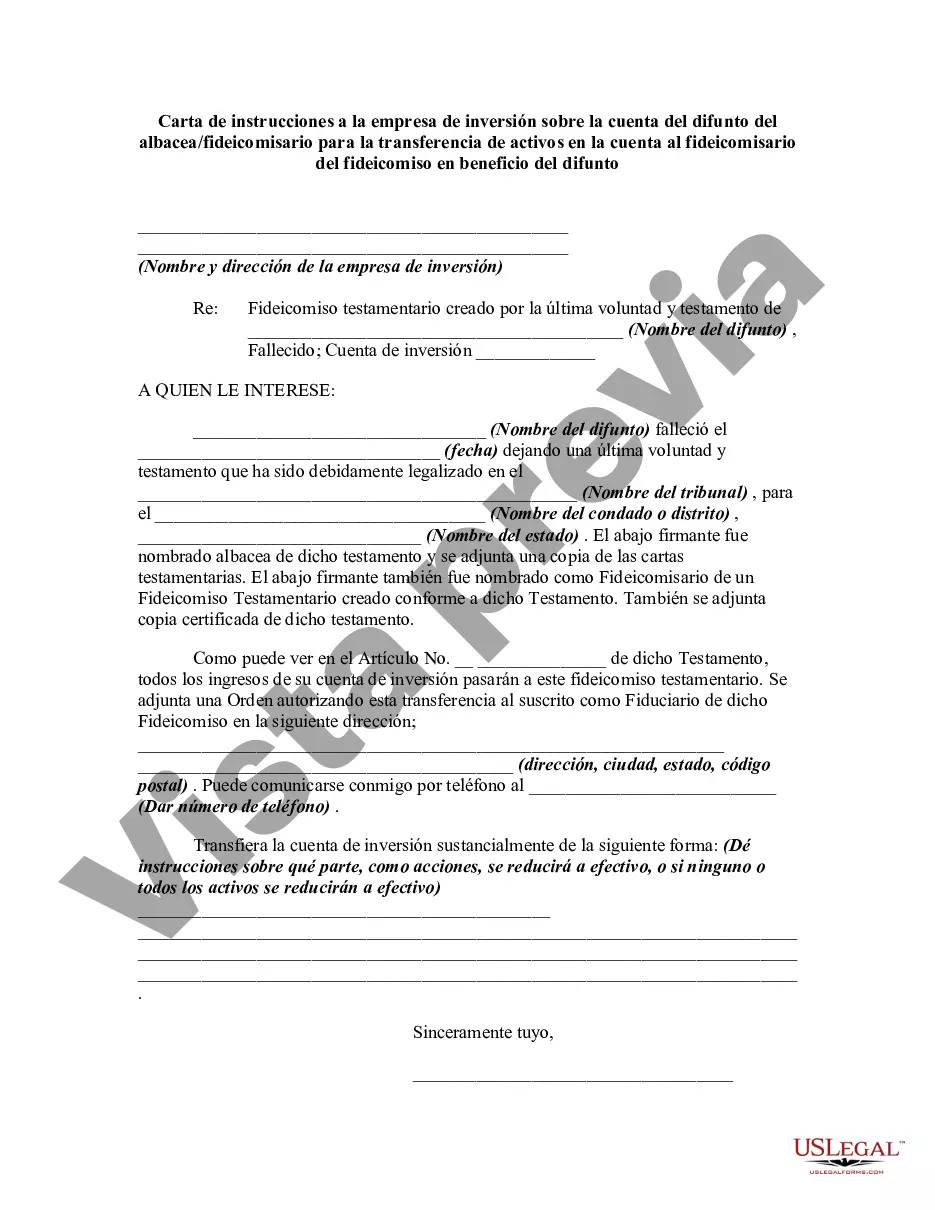

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

A Suffolk New York Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor/Trustee for the Transfer of Assets in the Account to a Trustee for the Benefit of the Decedent: This document serves as a comprehensive guide for estate planning professionals, attorneys, or individuals appointed as executors or trustees in Suffolk County, New York, who need to initiate the transfer of assets held in an investment account to a trust established for the benefit of a decedent. Key elements to include in the letter of instruction: 1. Starting with the Letterhead: — Executor/Trustee's Name and Contact Information — Date of the Letter 2. Opening— - Investment Firm's Name and Address — Investment Manager/Agent's Name and Contact Information 3. Introduction: — Statement introducing the purpose of the letter — Identification of the decedent and their relevant details (full name, address, date of death) 4. Executor/Trustee's Details: — Full legal name, address, contact information — Executor/Trustee appointment details (court appointment, will, trust document reference, or relevant legal authority) 5. Trustee's Details: — Full legal name, address, contact information of the trustee appointed to manage the trust for the benefit of the decedent — Trust document reference, details, or a copy of the trust document 6. Investment Account Details: — Account holder's name, account number, and type (individual, joint, retirement, etc.) — Investment firm's name, address, and contact information — Instructions to freeze the account to prohibit further transactions until the asset transfer is complete 7. Asset Transfer Instructions: — Clear instructions to transfer the assets from the investment account to the trustee's designated account within the trust — Specific mention of the type of assets (stocks, bonds, mutual funds, cash, etc.) to be transferred — Any restrictions or special instructions relating to particular assets 8. Legal Documentation and Identification: — Request for investment firm's required legal documentation and identification necessary for the asset transfer process — Instructions specific to Suffolk County, New York, regarding any additional local legal requirements or forms 9. Timeline and Communication: — Request for acknowledgement of the receipt of the letter and notification of the initiation of the asset transfer process — Expected timeline for completion of the asset transfer — Contact information for any queries, updates, or clarification Different types or variations of Suffolk New York Letter of Instruction to an Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent might include variations in the structure, wording, or specific requirements, such as: — Letters specific to retirement or pension accounts — Letters for joint accounts with different ownership structures — Letters for taxable or non-taxable accounts — Letters for transferring specific securities or types of assets.A Suffolk New York Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor/Trustee for the Transfer of Assets in the Account to a Trustee for the Benefit of the Decedent: This document serves as a comprehensive guide for estate planning professionals, attorneys, or individuals appointed as executors or trustees in Suffolk County, New York, who need to initiate the transfer of assets held in an investment account to a trust established for the benefit of a decedent. Key elements to include in the letter of instruction: 1. Starting with the Letterhead: — Executor/Trustee's Name and Contact Information — Date of the Letter 2. Opening— - Investment Firm's Name and Address — Investment Manager/Agent's Name and Contact Information 3. Introduction: — Statement introducing the purpose of the letter — Identification of the decedent and their relevant details (full name, address, date of death) 4. Executor/Trustee's Details: — Full legal name, address, contact information — Executor/Trustee appointment details (court appointment, will, trust document reference, or relevant legal authority) 5. Trustee's Details: — Full legal name, address, contact information of the trustee appointed to manage the trust for the benefit of the decedent — Trust document reference, details, or a copy of the trust document 6. Investment Account Details: — Account holder's name, account number, and type (individual, joint, retirement, etc.) — Investment firm's name, address, and contact information — Instructions to freeze the account to prohibit further transactions until the asset transfer is complete 7. Asset Transfer Instructions: — Clear instructions to transfer the assets from the investment account to the trustee's designated account within the trust — Specific mention of the type of assets (stocks, bonds, mutual funds, cash, etc.) to be transferred — Any restrictions or special instructions relating to particular assets 8. Legal Documentation and Identification: — Request for investment firm's required legal documentation and identification necessary for the asset transfer process — Instructions specific to Suffolk County, New York, regarding any additional local legal requirements or forms 9. Timeline and Communication: — Request for acknowledgement of the receipt of the letter and notification of the initiation of the asset transfer process — Expected timeline for completion of the asset transfer — Contact information for any queries, updates, or clarification Different types or variations of Suffolk New York Letter of Instruction to an Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent might include variations in the structure, wording, or specific requirements, such as: — Letters specific to retirement or pension accounts — Letters for joint accounts with different ownership structures — Letters for taxable or non-taxable accounts — Letters for transferring specific securities or types of assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.