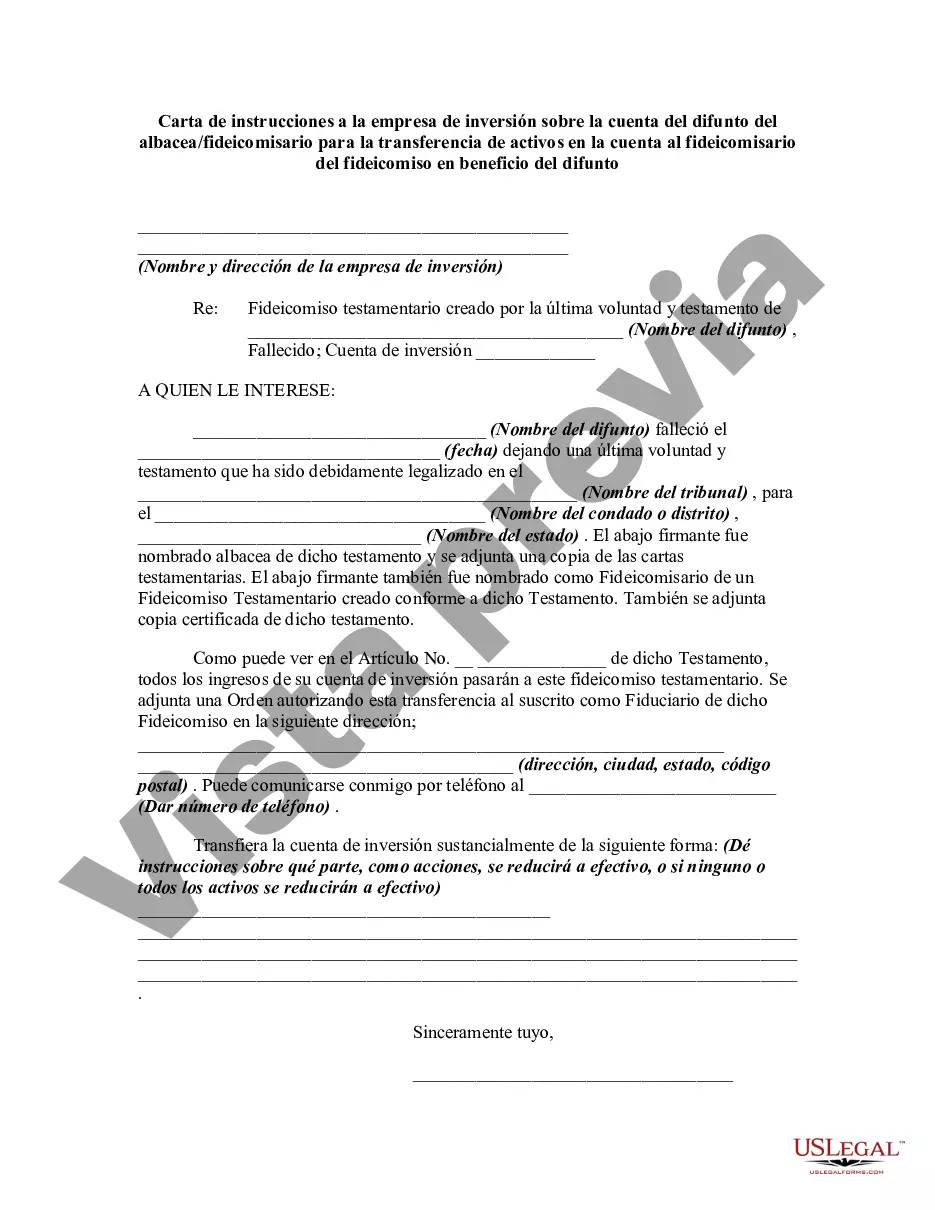

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Travis Texas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: In the Travis, Texas region, when a person passes away, their assets and investments may need to be transferred to a trustee who will manage them for the benefit of the decedent's trust. This process involves a series of legal steps, including the submission of a Letter of Instruction to the investment firm holding the decedent's account. This letter provides detailed instructions to the firm regarding the transfer of assets from the decedent's account to the newly appointed trustee. The Travis Texas Letter of Instruction is generally prepared and sent by the executor or trustee, who is responsible for managing the decedent's estate or trust. It serves as a crucial document to ensure a smooth transition of assets and investments to the trusteeship. The letter includes essential information and instructions to guide the investment firm in executing the transfer accurately and efficiently. Key components of the Travis Texas Letter of Instruction may include: 1. Identification of the decedent: The letter will begin by clearly identifying the deceased individual, providing their full legal name, address, social security number, and any other pertinent identifiers. 2. Appointment of trustee: The letter will outline the appointment of a trustee who will assume responsibility for managing the assets held in the decedent's investment account. The trustee's full name, contact information, and their relationship to the decedent will be included. 3. Description of assets: A comprehensive inventory of the assets held in the decedent's investment account will be detailed, including information such as stocks, bonds, mutual funds, real estate holdings, and other investment instruments. 4. Account details: The letter will provide specific information about the investment account, including the account number, name of the investment firm or bank, and any other relevant account details necessary for the transfer process. 5. Transfer instructions: Clear and specific instructions will be included to guide the investment firm on the transfer of assets to the newly appointed trustee. This may involve liquidating certain investments, transferring stocks or bonds, or taking other appropriate actions as required. 6. Compliance with legal requirements: The letter will emphasize that the transfer of assets must comply with all applicable laws, regulations, and legal obligations. It may also require the investment firm to provide a confirmation of the successful transfer once completed. Different Types of Travis Texas Letters of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent could include variations based on specific circumstances or preferences. However, the general purpose and content described above would remain consistent in these variations.Travis Texas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: In the Travis, Texas region, when a person passes away, their assets and investments may need to be transferred to a trustee who will manage them for the benefit of the decedent's trust. This process involves a series of legal steps, including the submission of a Letter of Instruction to the investment firm holding the decedent's account. This letter provides detailed instructions to the firm regarding the transfer of assets from the decedent's account to the newly appointed trustee. The Travis Texas Letter of Instruction is generally prepared and sent by the executor or trustee, who is responsible for managing the decedent's estate or trust. It serves as a crucial document to ensure a smooth transition of assets and investments to the trusteeship. The letter includes essential information and instructions to guide the investment firm in executing the transfer accurately and efficiently. Key components of the Travis Texas Letter of Instruction may include: 1. Identification of the decedent: The letter will begin by clearly identifying the deceased individual, providing their full legal name, address, social security number, and any other pertinent identifiers. 2. Appointment of trustee: The letter will outline the appointment of a trustee who will assume responsibility for managing the assets held in the decedent's investment account. The trustee's full name, contact information, and their relationship to the decedent will be included. 3. Description of assets: A comprehensive inventory of the assets held in the decedent's investment account will be detailed, including information such as stocks, bonds, mutual funds, real estate holdings, and other investment instruments. 4. Account details: The letter will provide specific information about the investment account, including the account number, name of the investment firm or bank, and any other relevant account details necessary for the transfer process. 5. Transfer instructions: Clear and specific instructions will be included to guide the investment firm on the transfer of assets to the newly appointed trustee. This may involve liquidating certain investments, transferring stocks or bonds, or taking other appropriate actions as required. 6. Compliance with legal requirements: The letter will emphasize that the transfer of assets must comply with all applicable laws, regulations, and legal obligations. It may also require the investment firm to provide a confirmation of the successful transfer once completed. Different Types of Travis Texas Letters of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent could include variations based on specific circumstances or preferences. However, the general purpose and content described above would remain consistent in these variations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.