A Fulton Georgia Private Annuity Agreement is a legal contract between two parties, typically an individual and a family member or trust, which allows for the transfer of assets in exchange for future annuity payments. This arrangement is most commonly used as an estate planning tool to transfer wealth while minimizing estate taxes. In a Fulton Georgia Private Annuity Agreement, one party, referred to as the annuitant, transfers assets, such as real estate, investments, or businesses, to another individual or entity known as the annuity issuer. In return, the annuity issuer promises to make regular annuity payments to the annuitant for the remainder of their life or a specified period. The key benefit of a Private Annuity Agreement is the potential to reduce estate taxes. By transferring assets through this agreement, the annuitant removes the assets and their future appreciation from their taxable estate. This can result in significant tax savings since estate taxes are based on the total value of an individual's estate at the time of their death. There are different types of Fulton Georgia Private Annuity Agreements that individuals can explore based on their specific needs and circumstances. Some of these variations include: 1. Standard Private Annuity Agreement: This is the most common type of agreement where the annuity payments are made solely to the annuitant for their lifetime. Once the annuitant passes away, the agreement terminates, and the remaining assets in the annuity issuer's possession pass on to the designated beneficiaries. 2. Joint and Survivor Private Annuity Agreement: This type of agreement allows for annuity payments to be made to the annuitant and their spouse or partner. After the annuitant's death, the surviving spouse continues to receive the annuity payments until their passing. 3. Term Certain Private Annuity Agreement: In this variation, the annuitant and annuity issuer agree on a fixed term for the annuity payments rather than basing it on the annuitant's lifetime. Once the specified term is over, the agreement terminates, and the remaining assets are distributed accordingly. It's important to note that Private Annuity Agreements are complex legal documents that require careful consideration and expert advice. Consulting with a qualified financial advisor or attorney specializing in estate planning is highly recommended ensuring compliance with Fulton Georgia's specific laws and regulations surrounding these agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Acuerdo de Anualidad Privada - Private Annuity Agreement

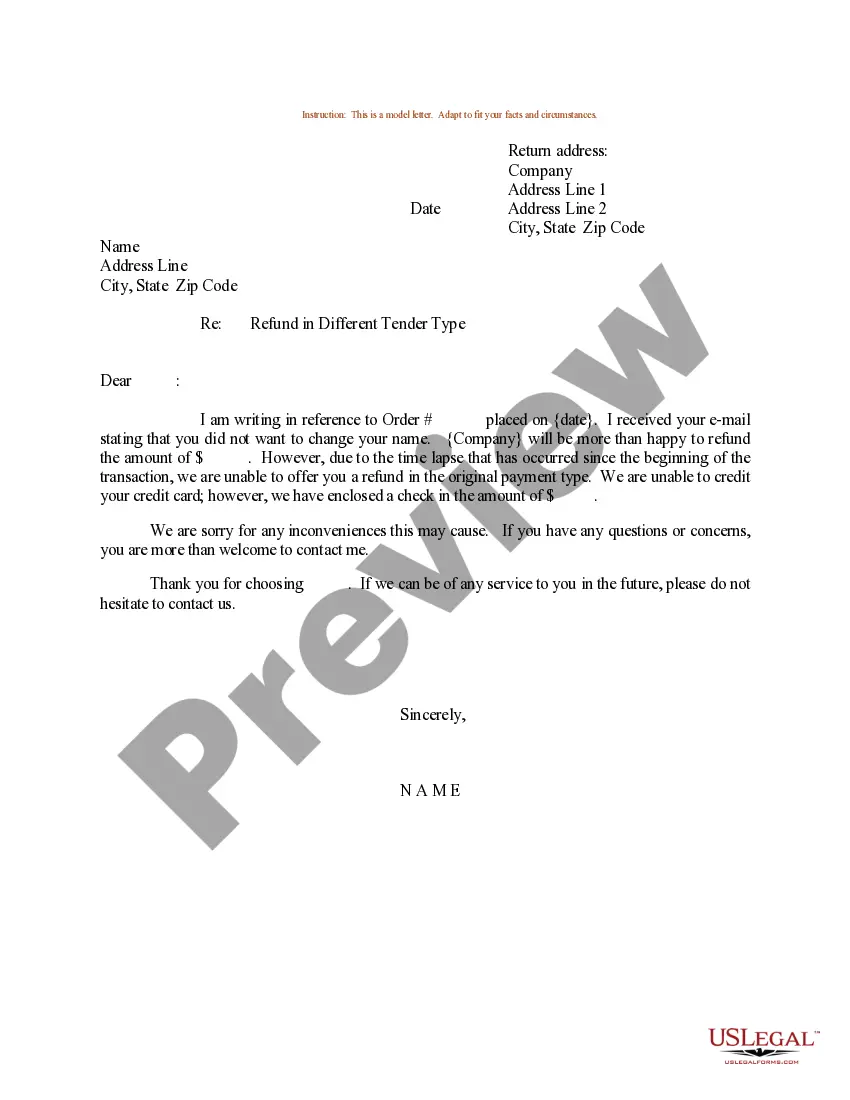

Description

How to fill out Fulton Georgia Acuerdo De Anualidad Privada?

Preparing paperwork for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Fulton Private Annuity Agreement without professional help.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Fulton Private Annuity Agreement by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Fulton Private Annuity Agreement:

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!