A San Bernardino California Private Annuity Agreement is a legally binding contract between two parties, typically involving the transfer of assets in exchange for guaranteed payments over a predetermined period of time. It is an arrangement often used for estate planning purposes. The agreement involves an annuitant (the person transferring assets) and an obliged (the party who receives and makes the annuity payments). The annuitant transfers certain assets, such as real estate, business interests, or securities, to the obliged in exchange for regular annuity payments. One of the primary benefits of a Private Annuity Agreement is the potential for tax advantages. By entering into this arrangement, the annuitant can defer capital gains taxes on the transferred assets until the annuity payments begin. This allows individuals to effectively transfer assets to the next generation while minimizing the tax consequences. There are different types of San Bernardino California Private Annuity Agreements, depending on the specific circumstances and objectives of the parties involved. Some common variations include: 1. Straight Life Annuity: This type of annuity provides the annuitant with regular fixed payments for their entire life, regardless of how long they live. 2. Joint and Survivor Annuity: This option ensures that annuity payments continue to the surviving spouse or another designated beneficiary even after the annuitant's death. 3. Term Certain Annuity: With this variation, the annuity payments are guaranteed for a specific period, regardless of the annuitant's lifespan. This can be beneficial in situations where the annuitant wants to provide income for a set number of years or until a specific event occurs. 4. Indexed Annuity: In an indexed annuity, the annuity payments are linked to a specific market index, allowing for potential growth based on the performance of the underlying index. It is important to consult with a financial advisor or estate planning attorney to understand the specific details, benefits, and potential risks associated with a San Bernardino California Private Annuity Agreement. This will help individuals make informed decisions regarding their financial future and ensure that the agreement aligns with their unique goals and circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out San Bernardino California Acuerdo De Anualidad Privada?

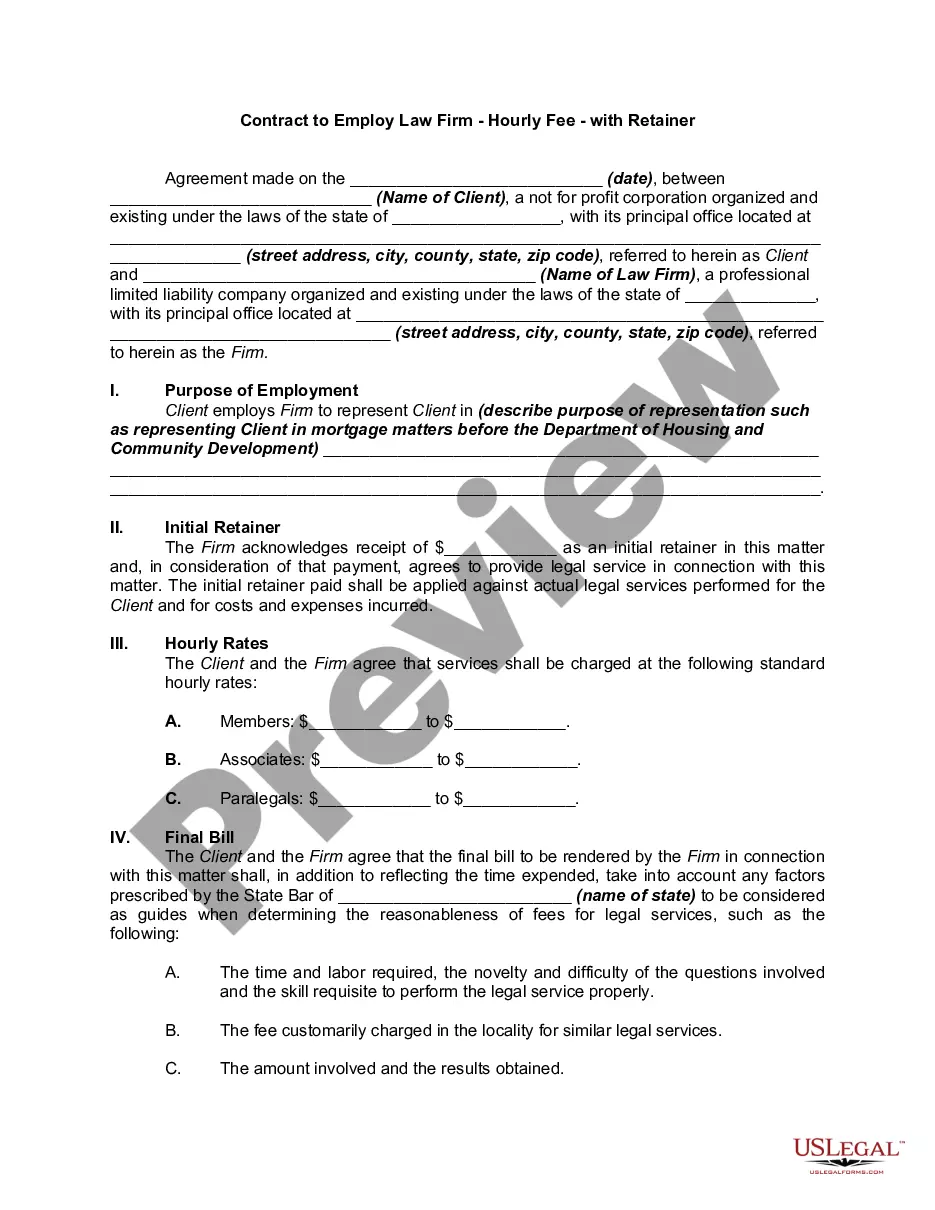

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, finding a San Bernardino Private Annuity Agreement meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the San Bernardino Private Annuity Agreement, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your San Bernardino Private Annuity Agreement:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Bernardino Private Annuity Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!