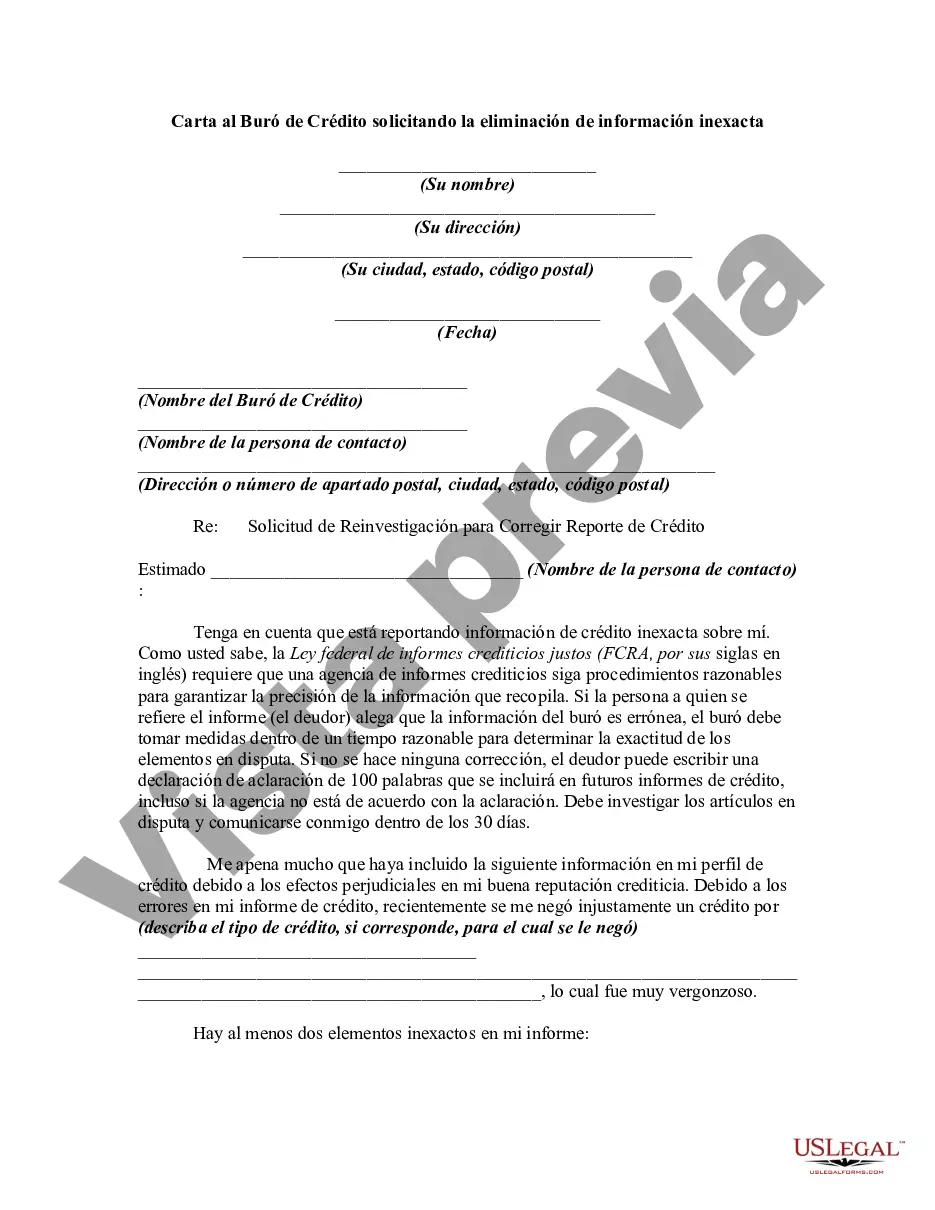

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

A Cook Illinois Letter to Credit Bureau Requesting the Removal of Inaccurate Information is a formal document submitted by a Cook Illinois resident to a credit bureau, requesting the correction or removal of inaccurate or outdated information from their credit report. This letter enables individuals to ensure that their credit report accurately reflects their financial history and provides an opportunity to address any errors that may negatively impact their creditworthiness. When drafting a Cook Illinois Letter to Credit Bureau Requesting the Removal of Inaccurate Information, there are various types you might consider, depending on the specific situation you're addressing. Some common types of letters include: 1. Cook Illinois Letter to Credit Bureau Requesting the Removal of Identity Theft-related Information: This type of letter is used when an individual detects fraudulent activity or unauthorized accounts on their credit report due to identity theft. The letter would highlight the discrepancies and request the immediate removal of those inaccuracies. 2. Cook Illinois Letter to Credit Bureau Requesting the Removal of Outdated or Incorrect Personal Information: In situations where personal information such as name, address, or phone number is inaccurately reported, this type of letter can be used. It emphasizes the importance of accurate identification and requests the credit bureau to update the information accordingly. 3. Cook Illinois Letter to Credit Bureau Requesting the Removal of Erroneous Accounts or Late Payment Records: If the credit report contains accounts that do not belong to the individual or late payments that were inaccurately reported, this type of letter is appropriate. The letter would identify the specific accounts or payments in question and provide supporting evidence to substantiate the request for their removal. 4. Cook Illinois Letter to Credit Bureau Requesting the Removal of Obsolete or Time-barred Information: Certain negative information, such as accounts in collection or bankruptcy records, may have a specific timeframe for removal according to Illinois laws. This letter serves to request the removal of such time-barred information that should no longer be negatively impacting the individual's credit. Regardless of the specific type of Cook Illinois Letter to Credit Bureau Requesting the Removal of Inaccurate Information, it is essential to provide accurate details, include any supporting documentation if available, and be polite yet assertive in requesting a prompt resolution. By taking action and submitting this letter, individuals can significantly improve the accuracy of their credit report and ensure a fair representation of their creditworthiness to potential lenders or employers.A Cook Illinois Letter to Credit Bureau Requesting the Removal of Inaccurate Information is a formal document submitted by a Cook Illinois resident to a credit bureau, requesting the correction or removal of inaccurate or outdated information from their credit report. This letter enables individuals to ensure that their credit report accurately reflects their financial history and provides an opportunity to address any errors that may negatively impact their creditworthiness. When drafting a Cook Illinois Letter to Credit Bureau Requesting the Removal of Inaccurate Information, there are various types you might consider, depending on the specific situation you're addressing. Some common types of letters include: 1. Cook Illinois Letter to Credit Bureau Requesting the Removal of Identity Theft-related Information: This type of letter is used when an individual detects fraudulent activity or unauthorized accounts on their credit report due to identity theft. The letter would highlight the discrepancies and request the immediate removal of those inaccuracies. 2. Cook Illinois Letter to Credit Bureau Requesting the Removal of Outdated or Incorrect Personal Information: In situations where personal information such as name, address, or phone number is inaccurately reported, this type of letter can be used. It emphasizes the importance of accurate identification and requests the credit bureau to update the information accordingly. 3. Cook Illinois Letter to Credit Bureau Requesting the Removal of Erroneous Accounts or Late Payment Records: If the credit report contains accounts that do not belong to the individual or late payments that were inaccurately reported, this type of letter is appropriate. The letter would identify the specific accounts or payments in question and provide supporting evidence to substantiate the request for their removal. 4. Cook Illinois Letter to Credit Bureau Requesting the Removal of Obsolete or Time-barred Information: Certain negative information, such as accounts in collection or bankruptcy records, may have a specific timeframe for removal according to Illinois laws. This letter serves to request the removal of such time-barred information that should no longer be negatively impacting the individual's credit. Regardless of the specific type of Cook Illinois Letter to Credit Bureau Requesting the Removal of Inaccurate Information, it is essential to provide accurate details, include any supporting documentation if available, and be polite yet assertive in requesting a prompt resolution. By taking action and submitting this letter, individuals can significantly improve the accuracy of their credit report and ensure a fair representation of their creditworthiness to potential lenders or employers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.