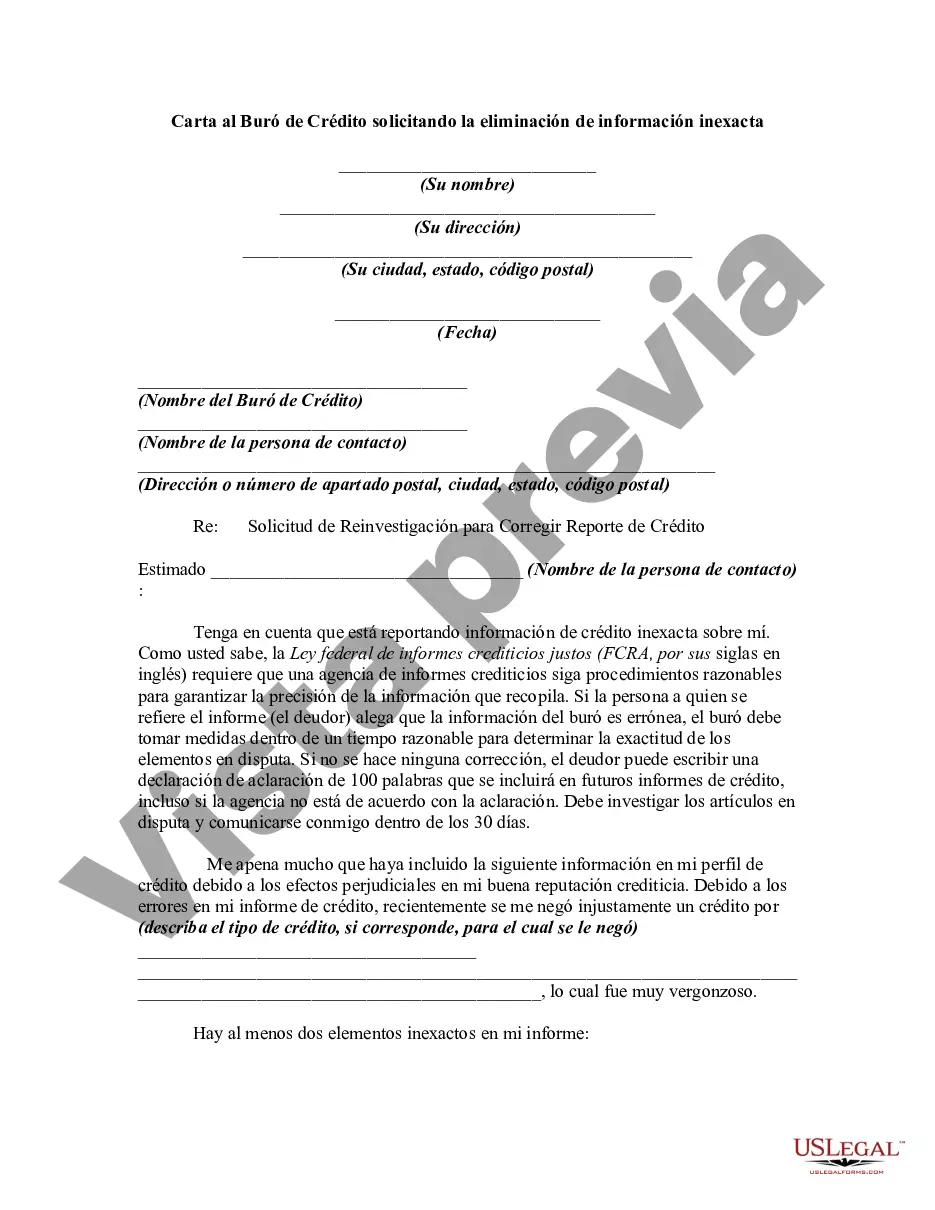

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Keywords: Franklin Ohio, letter to credit bureau, requesting removal, inaccurate information Title: Franklin Ohio Letter to Credit Bureau: Requesting Removal of Inaccurate Information Introduction: A Franklin Ohio Letter to Credit Bureau serves as a formal request to remove inaccurate information from a credit report. It is crucial to rectify any incorrect data as it could adversely impact an individual's creditworthiness and overall financial well-being. This detailed guide will walk you through the process of drafting a comprehensive letter, highlighting different types of letters you may need based on specific situations. I. Types of Franklin Ohio Letter to Credit Bureau Requesting Removal: 1. Initial Letter: When disputing inaccurate information for the first time, an initial letter is typically used. It alerts the credit bureau about the errors and provides supporting evidence to rectify them. 2. Follow-up Letter: If the credit bureau does not respond or fails to take appropriate action within the required timeframe, a follow-up letter should be sent. It emphasizes the urgency of the matter and may serve as a reminder or escalate the issue. 3. Identity Theft Letter: In cases of identity theft, where fraudulent accounts or unauthorized activities appear on your credit report, a specialized identity theft letter must be submitted. This letter requests immediate removal of the fraudulent items while including a police report or an identity theft affidavit. 4. Late Payment Removal Letter: If there are any erroneously reported late payments on your credit report, a specialized letter should be used to request their removal. Providing proof of on-time payment and highlighting creditor discrepancies can reinforce your case. 5. Paid Collection Letter: When you have paid off a collection account, but its negative impact remains on the credit report, a paid collection letter can be sent to credit bureaus. It requests removal or an update to reflect "paid in full" status accurately. Writing a Franklin Ohio Letter to Credit Bureau Requesting Removal: When writing any type of letter to request the removal of inaccurate information, ensure the following elements are included: 1. Your Personal Information: Funnymanam— - Current address - Phone number — Social Security Number 2. Date: Place the date the letter is being written. 3. Credit Bureau's Information: — Name of the crediBurmaea— - Address of the credit bureau 4. Detailed Explanation: Clearly explain the inaccuracies found in your credit report. Specify the account/payment information and describe why it is incorrect. Provide supporting documentation where possible. 5. Request for Correction/Removal: Expressly state that you are requesting the removal or correction of the inaccuracies. Be direct and concise in your wording. 6. Enclosure of Supporting Documents: — Attach copies, not originals, of any supporting documents (e.g., account statements, payment receipts, official letters, etc.) that validate your claims. 7. Formal Closure: — Sincerely— - Your Full Name - Signature (if sending a physical letter) Conclusion: A well-written Franklin Ohio Letter to Credit Bureau can be instrumental in having inaccurate information removed from your credit report. Be thorough, polite, and include all necessary supporting documents when submitting your request. Whether it's an initial letter, a follow-up, an identity theft-related issue, late payment dispute, or paid collection request, tailor your letter to fit the specific situation. Always keep copies of all correspondence and follow up with the credit bureau to ensure your concerns are addressed promptly.Keywords: Franklin Ohio, letter to credit bureau, requesting removal, inaccurate information Title: Franklin Ohio Letter to Credit Bureau: Requesting Removal of Inaccurate Information Introduction: A Franklin Ohio Letter to Credit Bureau serves as a formal request to remove inaccurate information from a credit report. It is crucial to rectify any incorrect data as it could adversely impact an individual's creditworthiness and overall financial well-being. This detailed guide will walk you through the process of drafting a comprehensive letter, highlighting different types of letters you may need based on specific situations. I. Types of Franklin Ohio Letter to Credit Bureau Requesting Removal: 1. Initial Letter: When disputing inaccurate information for the first time, an initial letter is typically used. It alerts the credit bureau about the errors and provides supporting evidence to rectify them. 2. Follow-up Letter: If the credit bureau does not respond or fails to take appropriate action within the required timeframe, a follow-up letter should be sent. It emphasizes the urgency of the matter and may serve as a reminder or escalate the issue. 3. Identity Theft Letter: In cases of identity theft, where fraudulent accounts or unauthorized activities appear on your credit report, a specialized identity theft letter must be submitted. This letter requests immediate removal of the fraudulent items while including a police report or an identity theft affidavit. 4. Late Payment Removal Letter: If there are any erroneously reported late payments on your credit report, a specialized letter should be used to request their removal. Providing proof of on-time payment and highlighting creditor discrepancies can reinforce your case. 5. Paid Collection Letter: When you have paid off a collection account, but its negative impact remains on the credit report, a paid collection letter can be sent to credit bureaus. It requests removal or an update to reflect "paid in full" status accurately. Writing a Franklin Ohio Letter to Credit Bureau Requesting Removal: When writing any type of letter to request the removal of inaccurate information, ensure the following elements are included: 1. Your Personal Information: Funnymanam— - Current address - Phone number — Social Security Number 2. Date: Place the date the letter is being written. 3. Credit Bureau's Information: — Name of the crediBurmaea— - Address of the credit bureau 4. Detailed Explanation: Clearly explain the inaccuracies found in your credit report. Specify the account/payment information and describe why it is incorrect. Provide supporting documentation where possible. 5. Request for Correction/Removal: Expressly state that you are requesting the removal or correction of the inaccuracies. Be direct and concise in your wording. 6. Enclosure of Supporting Documents: — Attach copies, not originals, of any supporting documents (e.g., account statements, payment receipts, official letters, etc.) that validate your claims. 7. Formal Closure: — Sincerely— - Your Full Name - Signature (if sending a physical letter) Conclusion: A well-written Franklin Ohio Letter to Credit Bureau can be instrumental in having inaccurate information removed from your credit report. Be thorough, polite, and include all necessary supporting documents when submitting your request. Whether it's an initial letter, a follow-up, an identity theft-related issue, late payment dispute, or paid collection request, tailor your letter to fit the specific situation. Always keep copies of all correspondence and follow up with the credit bureau to ensure your concerns are addressed promptly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.