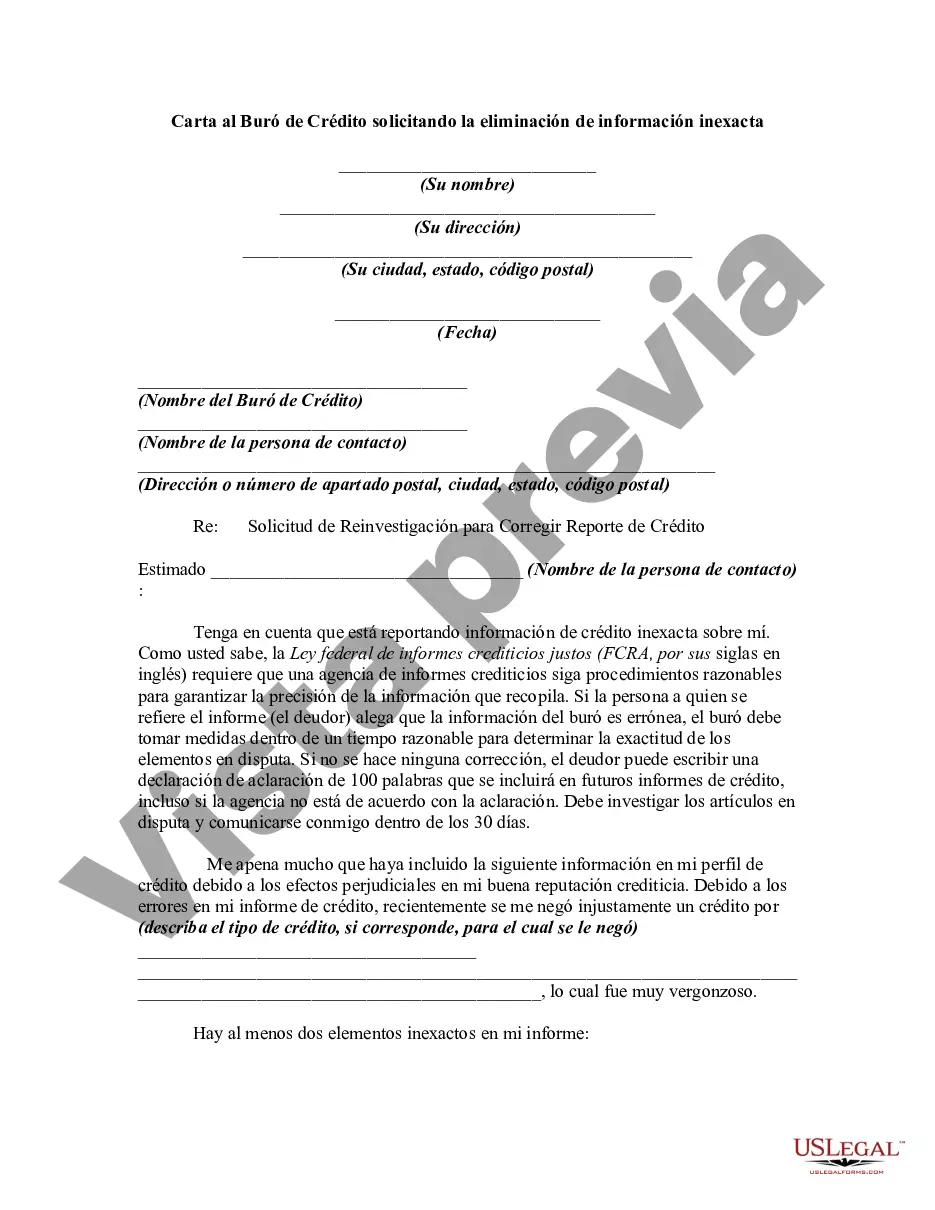

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Title: King Washington Letter to Credit Bureau Requesting the Removal of Inaccurate Information Keywords: King Washington, Letter, Credit Bureau, Removal, Inaccurate Information Introduction: A comprehensive and effective King Washington letter to a credit bureau is a valuable tool for rectifying inaccuracies in credit reports. When requesting the removal of inaccurate information, it is essential to provide a detailed explanation and supporting evidence to ensure a favorable outcome. Understanding the different types of King Washington letters tailored to specific credit reporting discrepancies can significantly improve the chances of success. Types of King Washington Letters to Credit Bureau Requesting Removal of Inaccurate Information: 1. Identity Theft Dispute Letter: If you suspect that you have fallen victim to identity theft and notice fraudulent accounts or unauthorized transactions on your credit report, a King Washington letter addressing identity theft is necessary. This type of letter should outline the discrepancies, provide documentary evidence such as police reports or affidavits, and request immediate removal of the inaccurate information. 2. Incorrect Accounting of Payment Letter: In instances where your credit report displays incorrect information regarding payments made on existing accounts, a King Washington letter emphasizing the incorrect accounting of payments is crucial. Include relevant details, such as payment dates, confirmation numbers, and copies of bank statements or canceled checks, to support your claim. Request the credit bureau to rectify the misreported data promptly. 3. Outdated or Inaccurate Personal Information Letter: Credit reports may sometimes contain outdated or inaccurate personal information, such as incorrect names, addresses, or employment history. Employ a King Washington letter specifically addressing these discrepancies, providing updated and accurate details along with supporting documents for verification purposes. Emphasize the importance of ensuring accurate personal data in your credit report. 4. Unauthorized Hard Inquiry Letter: Occasionally, unauthorized hard inquiries may appear on your credit report, potentially impacting your credit score. A King Washington letter should be sent to the credit bureau explaining the situation and demanding the removal of unauthorized inquiries. Include any supporting evidence, such as credit monitoring records or notifications from the company responsible for the inquiry. Conclusion: The importance of submitting a well-crafted King Washington letter to credit bureaus cannot be overstated when it comes to requesting the removal of inaccurate information from your credit report. By using the appropriate type of letter tailored to the specific credit reporting discrepancy, including supporting documents and a strong but polite tone, you can significantly increase the likelihood of rectifying any inaccuracies and maintaining a healthy, accurate credit history.Title: King Washington Letter to Credit Bureau Requesting the Removal of Inaccurate Information Keywords: King Washington, Letter, Credit Bureau, Removal, Inaccurate Information Introduction: A comprehensive and effective King Washington letter to a credit bureau is a valuable tool for rectifying inaccuracies in credit reports. When requesting the removal of inaccurate information, it is essential to provide a detailed explanation and supporting evidence to ensure a favorable outcome. Understanding the different types of King Washington letters tailored to specific credit reporting discrepancies can significantly improve the chances of success. Types of King Washington Letters to Credit Bureau Requesting Removal of Inaccurate Information: 1. Identity Theft Dispute Letter: If you suspect that you have fallen victim to identity theft and notice fraudulent accounts or unauthorized transactions on your credit report, a King Washington letter addressing identity theft is necessary. This type of letter should outline the discrepancies, provide documentary evidence such as police reports or affidavits, and request immediate removal of the inaccurate information. 2. Incorrect Accounting of Payment Letter: In instances where your credit report displays incorrect information regarding payments made on existing accounts, a King Washington letter emphasizing the incorrect accounting of payments is crucial. Include relevant details, such as payment dates, confirmation numbers, and copies of bank statements or canceled checks, to support your claim. Request the credit bureau to rectify the misreported data promptly. 3. Outdated or Inaccurate Personal Information Letter: Credit reports may sometimes contain outdated or inaccurate personal information, such as incorrect names, addresses, or employment history. Employ a King Washington letter specifically addressing these discrepancies, providing updated and accurate details along with supporting documents for verification purposes. Emphasize the importance of ensuring accurate personal data in your credit report. 4. Unauthorized Hard Inquiry Letter: Occasionally, unauthorized hard inquiries may appear on your credit report, potentially impacting your credit score. A King Washington letter should be sent to the credit bureau explaining the situation and demanding the removal of unauthorized inquiries. Include any supporting evidence, such as credit monitoring records or notifications from the company responsible for the inquiry. Conclusion: The importance of submitting a well-crafted King Washington letter to credit bureaus cannot be overstated when it comes to requesting the removal of inaccurate information from your credit report. By using the appropriate type of letter tailored to the specific credit reporting discrepancy, including supporting documents and a strong but polite tone, you can significantly increase the likelihood of rectifying any inaccuracies and maintaining a healthy, accurate credit history.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.