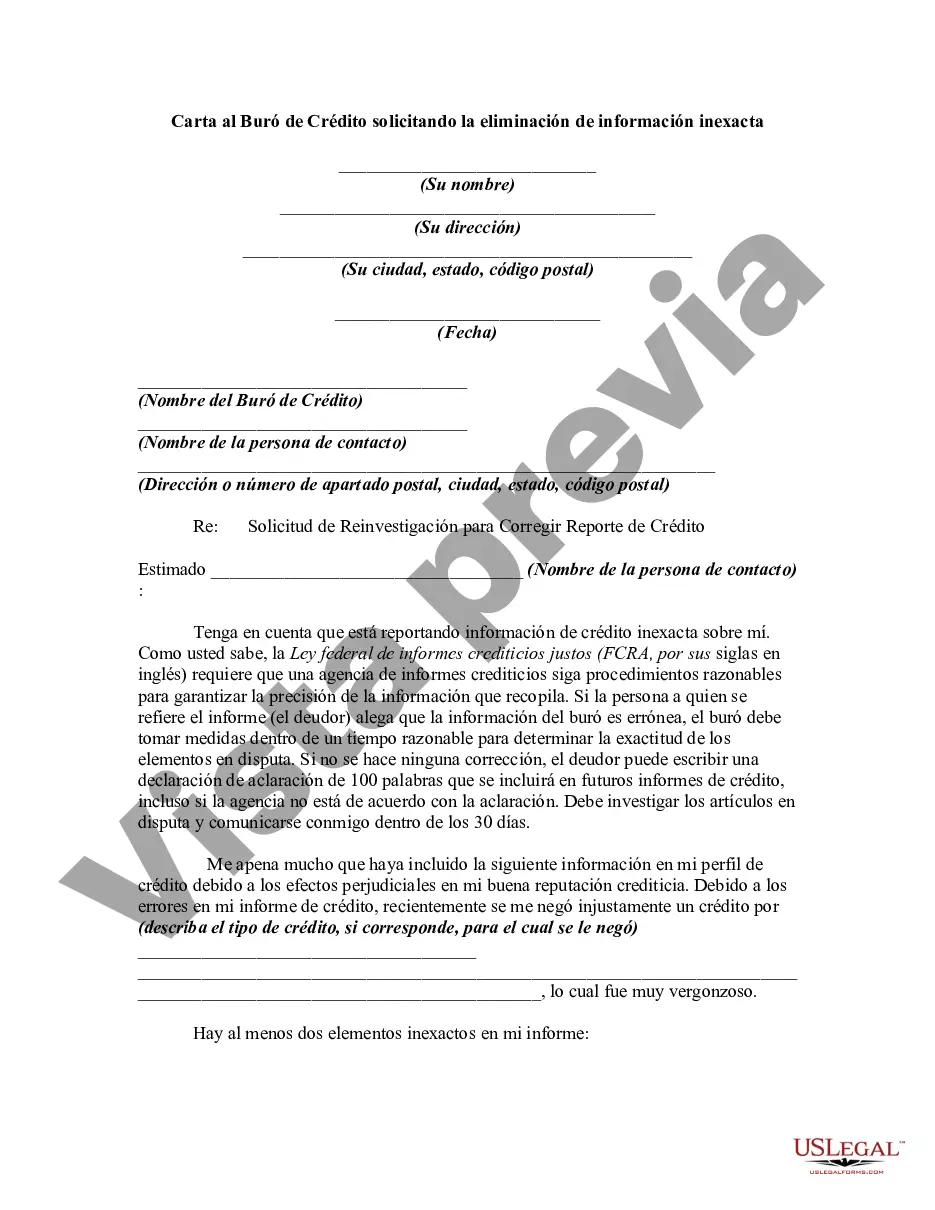

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

When it comes to improving one's credit score and ensuring accurate information, a Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information can be an effective tool. This type of letter is typically written to address any errors or discrepancies found on an individual's credit report and request their correction or removal. The purpose of a Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information is to provide a clear and detailed explanation of the inaccuracies found on the credit report. It is important to include relevant keywords and phrases that highlight the specific issue, such as "credit report errors," "inaccurate information," or "credit reporting discrepancies." These keywords can help grab the attention of the credit bureau and ensure that the request receives the proper attention it deserves. In addition to addressing the inaccuracies, a Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information should include other important details. This may include the individual's personal information, such as full name, address, and social security number, to ensure the accuracy of the request and facilitate the investigation process. It is also essential to provide any supporting documentation that verifies the inaccuracies, such as receipts, statements, or any other relevant proof of the correct information. There may be different types or variations of a Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information, depending on the specific error being addressed. For instance, if there is a case of identity theft, a letter could emphasize the fraudulent accounts or unauthorized transactions that were reported on the credit report. On the other hand, if the inaccuracies pertain to credit limits, late payments, or missed payments, the letter should focus on these specific issues and provide detailed explanations or evidence to support their removal. Overall, a well-crafted Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information is essential in rectifying any credit report errors and improving one's financial standing. It is crucial to use relevant keywords and address the specific inaccuracies with supporting documentation, ensuring that the credit bureau understands the need for their prompt investigation and correction.When it comes to improving one's credit score and ensuring accurate information, a Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information can be an effective tool. This type of letter is typically written to address any errors or discrepancies found on an individual's credit report and request their correction or removal. The purpose of a Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information is to provide a clear and detailed explanation of the inaccuracies found on the credit report. It is important to include relevant keywords and phrases that highlight the specific issue, such as "credit report errors," "inaccurate information," or "credit reporting discrepancies." These keywords can help grab the attention of the credit bureau and ensure that the request receives the proper attention it deserves. In addition to addressing the inaccuracies, a Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information should include other important details. This may include the individual's personal information, such as full name, address, and social security number, to ensure the accuracy of the request and facilitate the investigation process. It is also essential to provide any supporting documentation that verifies the inaccuracies, such as receipts, statements, or any other relevant proof of the correct information. There may be different types or variations of a Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information, depending on the specific error being addressed. For instance, if there is a case of identity theft, a letter could emphasize the fraudulent accounts or unauthorized transactions that were reported on the credit report. On the other hand, if the inaccuracies pertain to credit limits, late payments, or missed payments, the letter should focus on these specific issues and provide detailed explanations or evidence to support their removal. Overall, a well-crafted Kings New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information is essential in rectifying any credit report errors and improving one's financial standing. It is crucial to use relevant keywords and address the specific inaccuracies with supporting documentation, ensuring that the credit bureau understands the need for their prompt investigation and correction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.