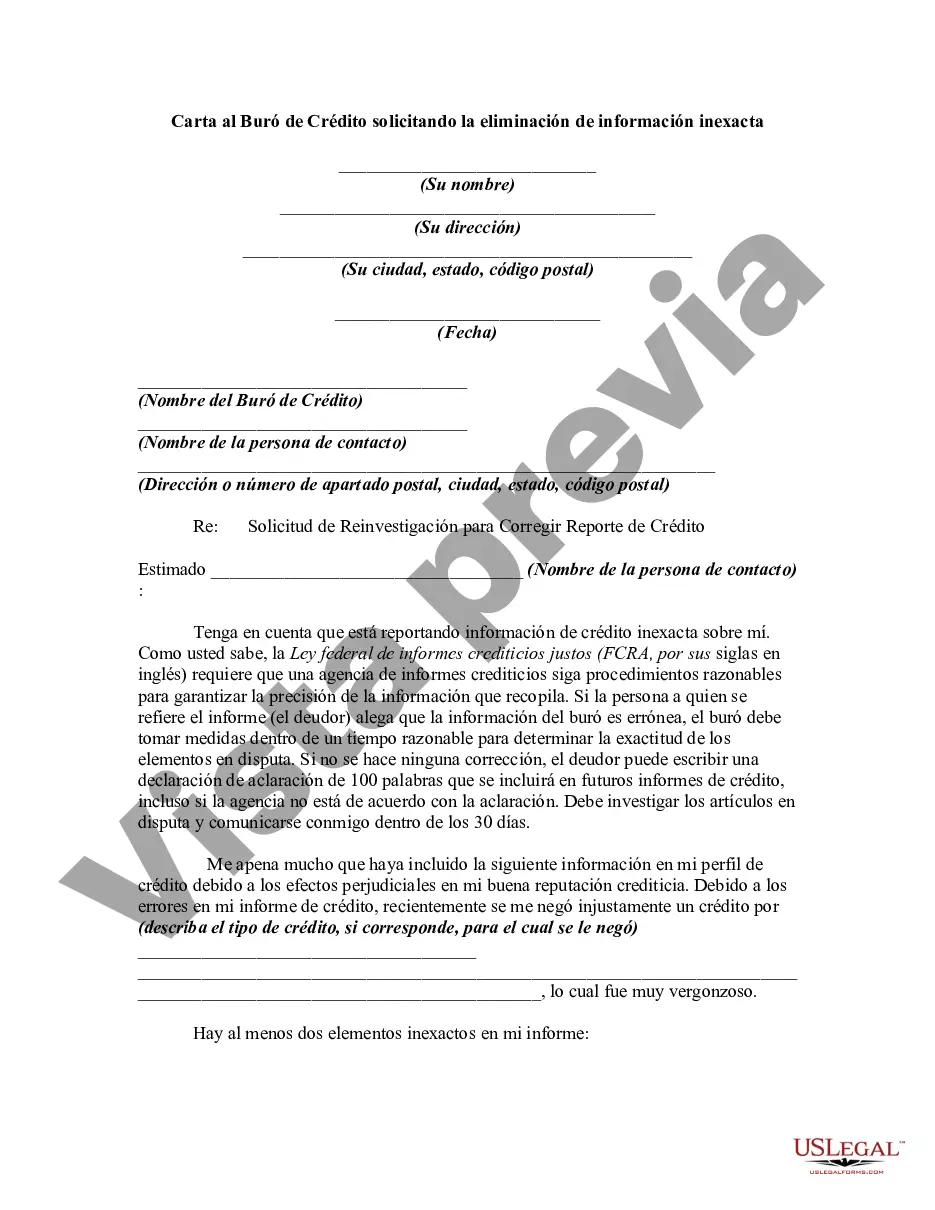

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Miami-Dade County, located in the southern part of the state of Florida, is the most populous county in Florida and the seventh-most populous county in the United States. Known for its vibrant culture, beautiful beaches, and diverse communities, Miami-Dade County attracts millions of visitors every year. When it comes to financial matters, maintaining a good credit rating is crucial. Unfortunately, inaccuracies can sometimes appear on credit reports, potentially damaging an individual's creditworthiness. In such cases, writing a Letter to Credit Bureau Requesting the Removal of Inaccurate Information becomes essential. This type of letter is typically addressed to one of the major credit bureaus, such as Experian, Equifax, or TransUnion, and it aims to dispute and rectify any inaccurate or outdated information present on the individual's credit report. These inaccuracies may include accounts that don't belong to the individual, incorrect personal information, or late payment records that are not accurate. The letter should contain various key elements to ensure its effectiveness. Firstly, it should include the sender's personal information, such as their full name, address, and Social Security number, to help the credit bureau identify and locate their credit file accurately. Secondly, a clear and concise explanation of the inaccuracies found on the credit report should be included, specifying the incorrect information, its source, and the reasons it should be removed. Moreover, it's crucial to include any supporting documentation that evidences the inaccuracies, such as receipts, canceled checks, or letters from creditors that acknowledge errors. This documentation strengthens the request and provides substantial evidence to credit bureaus for prompt resolution. The tone of the letter should remain formal, courteous, and concise. It's helpful to request a response within a reasonable timeframe, urging the credit bureau to investigate and correct the inaccuracies promptly. The sender should keep a copy of the letter for future reference and send it via certified mail with a return receipt requested to ensure its delivery and maintain proof of receipt. In summary, a Miami-Dade Florida Letter to Credit Bureau Requesting the Removal of Inaccurate Information is an important document for individuals seeking to rectify any inaccuracies present on their credit reports. By following the guidelines provided and using the relevant keywords, individuals can increase their chances of achieving a favorable outcome in resolving credit report discrepancies.Miami-Dade County, located in the southern part of the state of Florida, is the most populous county in Florida and the seventh-most populous county in the United States. Known for its vibrant culture, beautiful beaches, and diverse communities, Miami-Dade County attracts millions of visitors every year. When it comes to financial matters, maintaining a good credit rating is crucial. Unfortunately, inaccuracies can sometimes appear on credit reports, potentially damaging an individual's creditworthiness. In such cases, writing a Letter to Credit Bureau Requesting the Removal of Inaccurate Information becomes essential. This type of letter is typically addressed to one of the major credit bureaus, such as Experian, Equifax, or TransUnion, and it aims to dispute and rectify any inaccurate or outdated information present on the individual's credit report. These inaccuracies may include accounts that don't belong to the individual, incorrect personal information, or late payment records that are not accurate. The letter should contain various key elements to ensure its effectiveness. Firstly, it should include the sender's personal information, such as their full name, address, and Social Security number, to help the credit bureau identify and locate their credit file accurately. Secondly, a clear and concise explanation of the inaccuracies found on the credit report should be included, specifying the incorrect information, its source, and the reasons it should be removed. Moreover, it's crucial to include any supporting documentation that evidences the inaccuracies, such as receipts, canceled checks, or letters from creditors that acknowledge errors. This documentation strengthens the request and provides substantial evidence to credit bureaus for prompt resolution. The tone of the letter should remain formal, courteous, and concise. It's helpful to request a response within a reasonable timeframe, urging the credit bureau to investigate and correct the inaccuracies promptly. The sender should keep a copy of the letter for future reference and send it via certified mail with a return receipt requested to ensure its delivery and maintain proof of receipt. In summary, a Miami-Dade Florida Letter to Credit Bureau Requesting the Removal of Inaccurate Information is an important document for individuals seeking to rectify any inaccuracies present on their credit reports. By following the guidelines provided and using the relevant keywords, individuals can increase their chances of achieving a favorable outcome in resolving credit report discrepancies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.