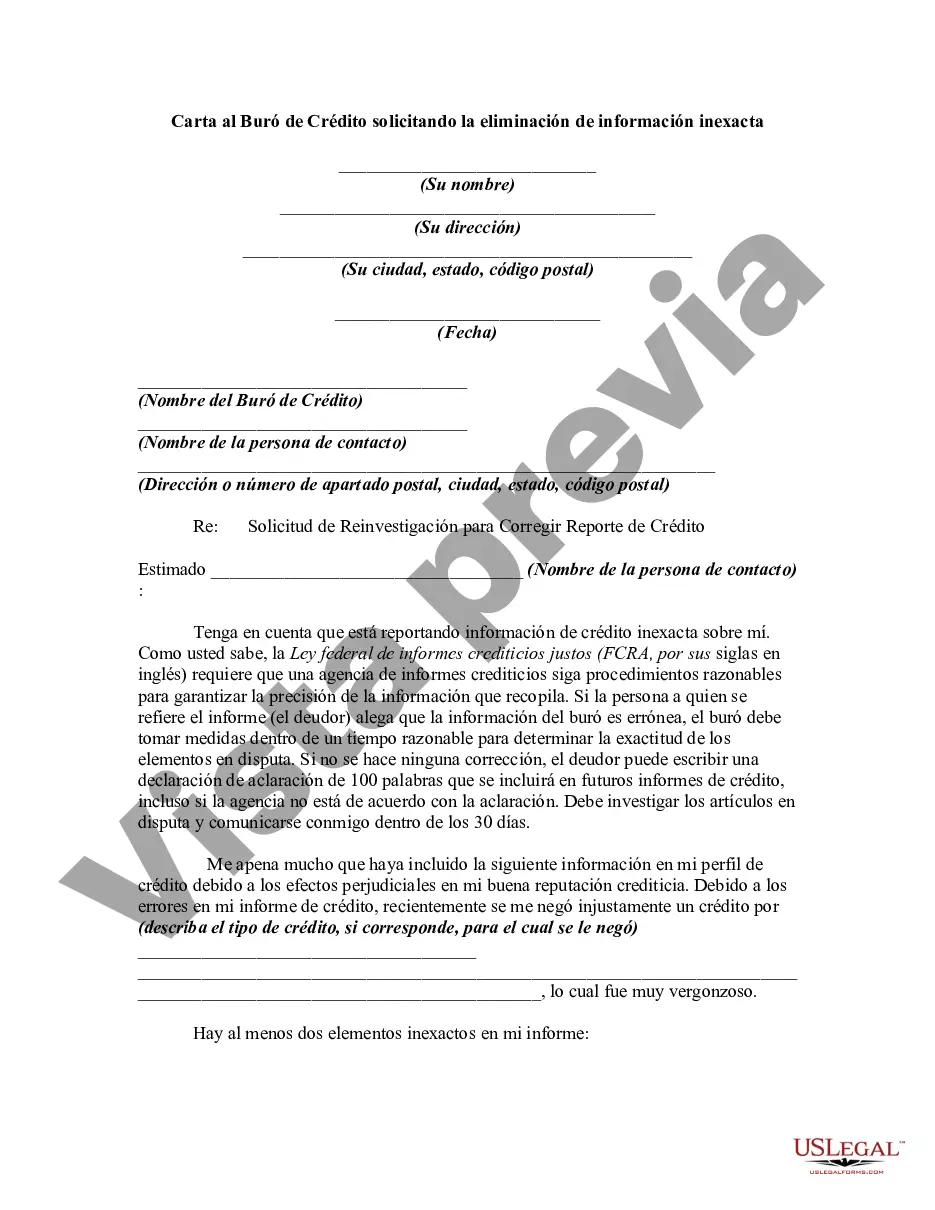

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Montgomery, Maryland, is a vibrant county located just outside the nation's capital, Washington D.C. It is known for its picturesque landscapes, rich history, diverse communities, and thriving economy. Home to over one million residents, Montgomery County offers a unique blend of urban and suburban lifestyles. When it comes to credit reporting, inaccuracies can have a significant impact on an individual's financial wellbeing. In such cases, writing a letter to credit bureaus is a crucial step to request the removal of erroneous information. Below, we will explore different types of Montgomery, Maryland, letters to credit bureaus requesting the removal of inaccurate information: 1. General Inaccuracy Dispute Letter: If you find inaccuracies on your credit report relating to Montgomery, Maryland, this type of letter can be used to address any generic errors. It includes key elements like personal identifying information, specific inaccuracies being disputed, supporting evidence, and requests for correction or removal. 2. Identity Theft Dispute Letter: If you suspect fraudulent activity or identity theft on your credit report in Montgomery, Maryland, you should write a specialized letter to credit bureaus. This letter highlights the unauthorized accounts or transactions associated with your identity, requests their immediate removal, and may include a copy of a police report or other supporting documentation to prove the theft. 3. Employment or Income Discrepancy Dispute Letter: Sometimes, inaccurate reports regarding your employment or income can negatively impact your creditworthiness. To address this, a Montgomery, Maryland, letter to credit bureaus can focus on disputes related to incorrect job titles, wages, or employers. Be sure to provide relevant employment or income verification documentation to strengthen your case. 4. Dispute Letter for Erroneous Public Records: If public records on your credit report from Montgomery, Maryland, contain errors, such as judgments, bankruptcies, or tax liens, this letter type can be utilized. It emphasizes the inaccuracies, requests their removal, and may include supporting documentation to prove the incorrect information. Remember, regardless of the type of letter you write to credit bureaus, it is crucial to follow these best practices: — Clearly state your request for removal or correction of inaccurate information. — Include your full name, address, date, and social security number for identification. — Provide a detailed explanation of the inaccuracies you are disputing, mentioning the relevant accounts or public records. — Enclose any supporting documentation that strengthens your case, such as receipts, account statements, or court documents. — Keep a copy of the letter and all supporting documents for your records. — Send the letter via certified mail with a return receipt to ensure it is properly delivered and received. Writing an effective Montgomery, Maryland, letter to credit bureaus requesting the removal of inaccurate information is crucial for maintaining a healthy credit profile. By addressing any discrepancies promptly and following the correct procedure, you can protect your financial reputation and secure a brighter future.Montgomery, Maryland, is a vibrant county located just outside the nation's capital, Washington D.C. It is known for its picturesque landscapes, rich history, diverse communities, and thriving economy. Home to over one million residents, Montgomery County offers a unique blend of urban and suburban lifestyles. When it comes to credit reporting, inaccuracies can have a significant impact on an individual's financial wellbeing. In such cases, writing a letter to credit bureaus is a crucial step to request the removal of erroneous information. Below, we will explore different types of Montgomery, Maryland, letters to credit bureaus requesting the removal of inaccurate information: 1. General Inaccuracy Dispute Letter: If you find inaccuracies on your credit report relating to Montgomery, Maryland, this type of letter can be used to address any generic errors. It includes key elements like personal identifying information, specific inaccuracies being disputed, supporting evidence, and requests for correction or removal. 2. Identity Theft Dispute Letter: If you suspect fraudulent activity or identity theft on your credit report in Montgomery, Maryland, you should write a specialized letter to credit bureaus. This letter highlights the unauthorized accounts or transactions associated with your identity, requests their immediate removal, and may include a copy of a police report or other supporting documentation to prove the theft. 3. Employment or Income Discrepancy Dispute Letter: Sometimes, inaccurate reports regarding your employment or income can negatively impact your creditworthiness. To address this, a Montgomery, Maryland, letter to credit bureaus can focus on disputes related to incorrect job titles, wages, or employers. Be sure to provide relevant employment or income verification documentation to strengthen your case. 4. Dispute Letter for Erroneous Public Records: If public records on your credit report from Montgomery, Maryland, contain errors, such as judgments, bankruptcies, or tax liens, this letter type can be utilized. It emphasizes the inaccuracies, requests their removal, and may include supporting documentation to prove the incorrect information. Remember, regardless of the type of letter you write to credit bureaus, it is crucial to follow these best practices: — Clearly state your request for removal or correction of inaccurate information. — Include your full name, address, date, and social security number for identification. — Provide a detailed explanation of the inaccuracies you are disputing, mentioning the relevant accounts or public records. — Enclose any supporting documentation that strengthens your case, such as receipts, account statements, or court documents. — Keep a copy of the letter and all supporting documents for your records. — Send the letter via certified mail with a return receipt to ensure it is properly delivered and received. Writing an effective Montgomery, Maryland, letter to credit bureaus requesting the removal of inaccurate information is crucial for maintaining a healthy credit profile. By addressing any discrepancies promptly and following the correct procedure, you can protect your financial reputation and secure a brighter future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.