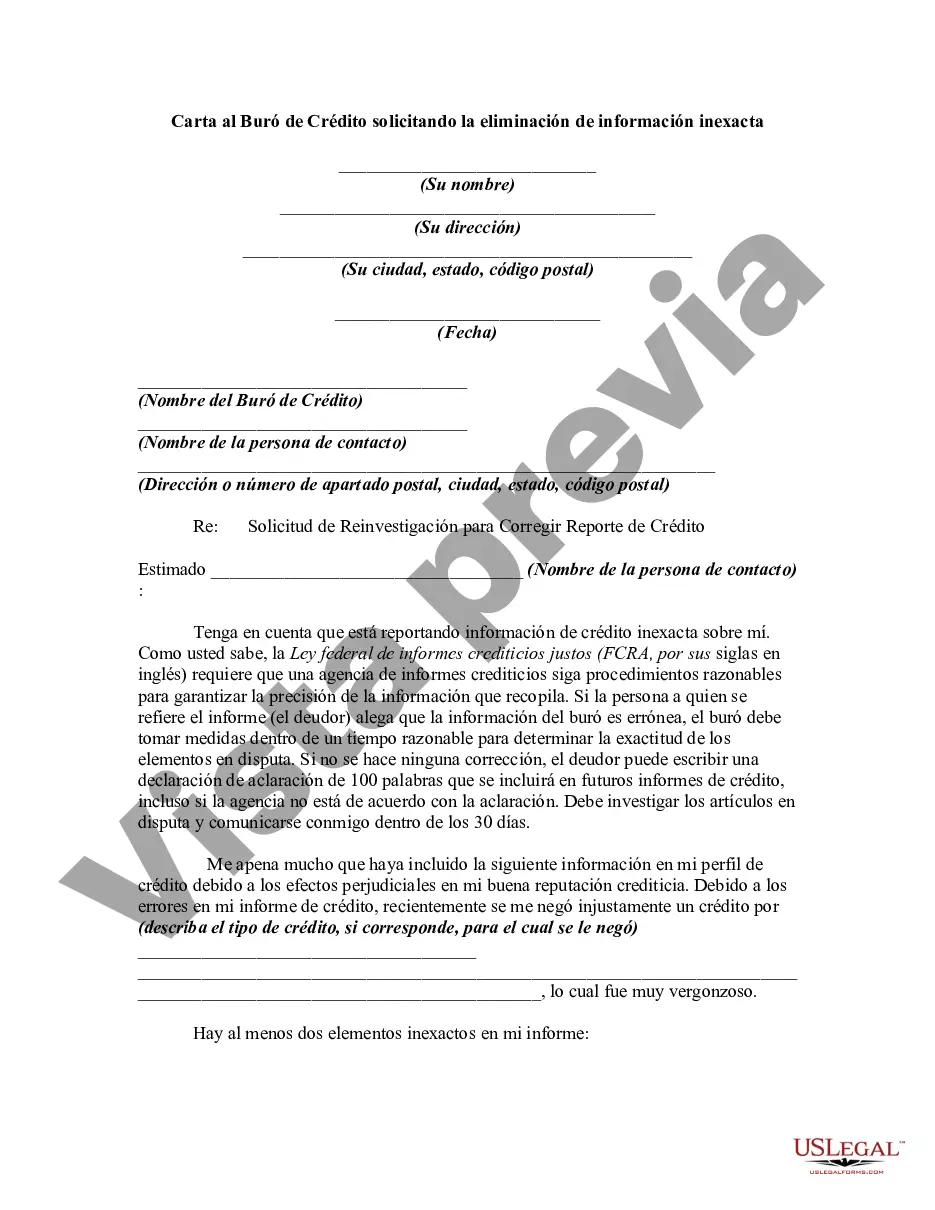

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Title: Lima Arizona Letter to Credit Bureau Requesting Removal of Inaccurate Information: A Comprehensive Guide Introduction: In this detailed description, we will provide a comprehensive guide on writing an effective Lima Arizona letter to credit bureau requesting the removal of inaccurate information. We will explore the importance of addressing inaccuracies on credit reports, outline the essential components of the letter, and provide relevant tips for enhancing its impact. Additionally, we will touch upon different types of Lima Arizona letters that can be utilized based on specific credit report inaccuracies. 1. Importance of Addressing Inaccurate Information: A. Protect your credit score and financial future B. Increase access to loans, credit cards, and favorable interest rates C. Avoid unnecessary obstacles when renting apartments or applying for employment 2. Components of an Effective Lima Arizona Letter: A. Properly formatted sender's information B. Accurate recipient details C. Clear identification of the inaccurate information D. Explanation of the dispute with supporting evidence E. Request for removal or correction of the inaccurate information F. Polite tone and professional language G. Enclosure of supporting documents H. Request for written confirmation after the investigation 3. Tips for Enhancing the Impact of the Letter: A. Understand your rights provided by Fair Credit Reporting Act (FCRA) B. Review your credit report beforehand for accurate identification of inaccuracies C. Keep the letter concise, focused, and error-free D. Include all relevant supporting documents such as receipts, billing statements, or court documents E. Send the letter via certified mail with a return receipt for documentation purposes F. Maintain professionalism and avoid unnecessary emotions G. Follow up on the dispute after a reasonable time has passed Types of Lima Arizona Letters to Credit Bureau Requesting Removal of Inaccurate Information: 1. Generic Inaccuracy Dispute Letter: A letter addressing various inaccurate items present on your credit report, such as incorrect personal information, closed accounts still marked as open, or accounts wrongly attributed to you. 2. Identity Theft Dispute Letter: A letter specifically addressing fraudulent activities, unauthorized accounts, or incorrect personal information resulting from identity theft. 3. Late Payment Inaccuracy Dispute Letter: A letter challenging late payments inaccurately reported by creditors, aiming to correct the payment history and maintain a positive credit rating. 4. Account Status Dispute Letter: A letter focusing on challenging the current status of an account, such as an account marked as delinquent or in collections even though it has been settled or paid in full. Conclusion: By using the appropriate Lima Arizona letter to credit bureau requesting removal of inaccurate information, individuals can protect their credit score, financial standing, and future opportunities. With thorough knowledge of the components, tips, and various types of letters, you can ensure a well-crafted, persuasive dispute that increases the chances of credit report accuracy restoration.Title: Lima Arizona Letter to Credit Bureau Requesting Removal of Inaccurate Information: A Comprehensive Guide Introduction: In this detailed description, we will provide a comprehensive guide on writing an effective Lima Arizona letter to credit bureau requesting the removal of inaccurate information. We will explore the importance of addressing inaccuracies on credit reports, outline the essential components of the letter, and provide relevant tips for enhancing its impact. Additionally, we will touch upon different types of Lima Arizona letters that can be utilized based on specific credit report inaccuracies. 1. Importance of Addressing Inaccurate Information: A. Protect your credit score and financial future B. Increase access to loans, credit cards, and favorable interest rates C. Avoid unnecessary obstacles when renting apartments or applying for employment 2. Components of an Effective Lima Arizona Letter: A. Properly formatted sender's information B. Accurate recipient details C. Clear identification of the inaccurate information D. Explanation of the dispute with supporting evidence E. Request for removal or correction of the inaccurate information F. Polite tone and professional language G. Enclosure of supporting documents H. Request for written confirmation after the investigation 3. Tips for Enhancing the Impact of the Letter: A. Understand your rights provided by Fair Credit Reporting Act (FCRA) B. Review your credit report beforehand for accurate identification of inaccuracies C. Keep the letter concise, focused, and error-free D. Include all relevant supporting documents such as receipts, billing statements, or court documents E. Send the letter via certified mail with a return receipt for documentation purposes F. Maintain professionalism and avoid unnecessary emotions G. Follow up on the dispute after a reasonable time has passed Types of Lima Arizona Letters to Credit Bureau Requesting Removal of Inaccurate Information: 1. Generic Inaccuracy Dispute Letter: A letter addressing various inaccurate items present on your credit report, such as incorrect personal information, closed accounts still marked as open, or accounts wrongly attributed to you. 2. Identity Theft Dispute Letter: A letter specifically addressing fraudulent activities, unauthorized accounts, or incorrect personal information resulting from identity theft. 3. Late Payment Inaccuracy Dispute Letter: A letter challenging late payments inaccurately reported by creditors, aiming to correct the payment history and maintain a positive credit rating. 4. Account Status Dispute Letter: A letter focusing on challenging the current status of an account, such as an account marked as delinquent or in collections even though it has been settled or paid in full. Conclusion: By using the appropriate Lima Arizona letter to credit bureau requesting removal of inaccurate information, individuals can protect their credit score, financial standing, and future opportunities. With thorough knowledge of the components, tips, and various types of letters, you can ensure a well-crafted, persuasive dispute that increases the chances of credit report accuracy restoration.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.