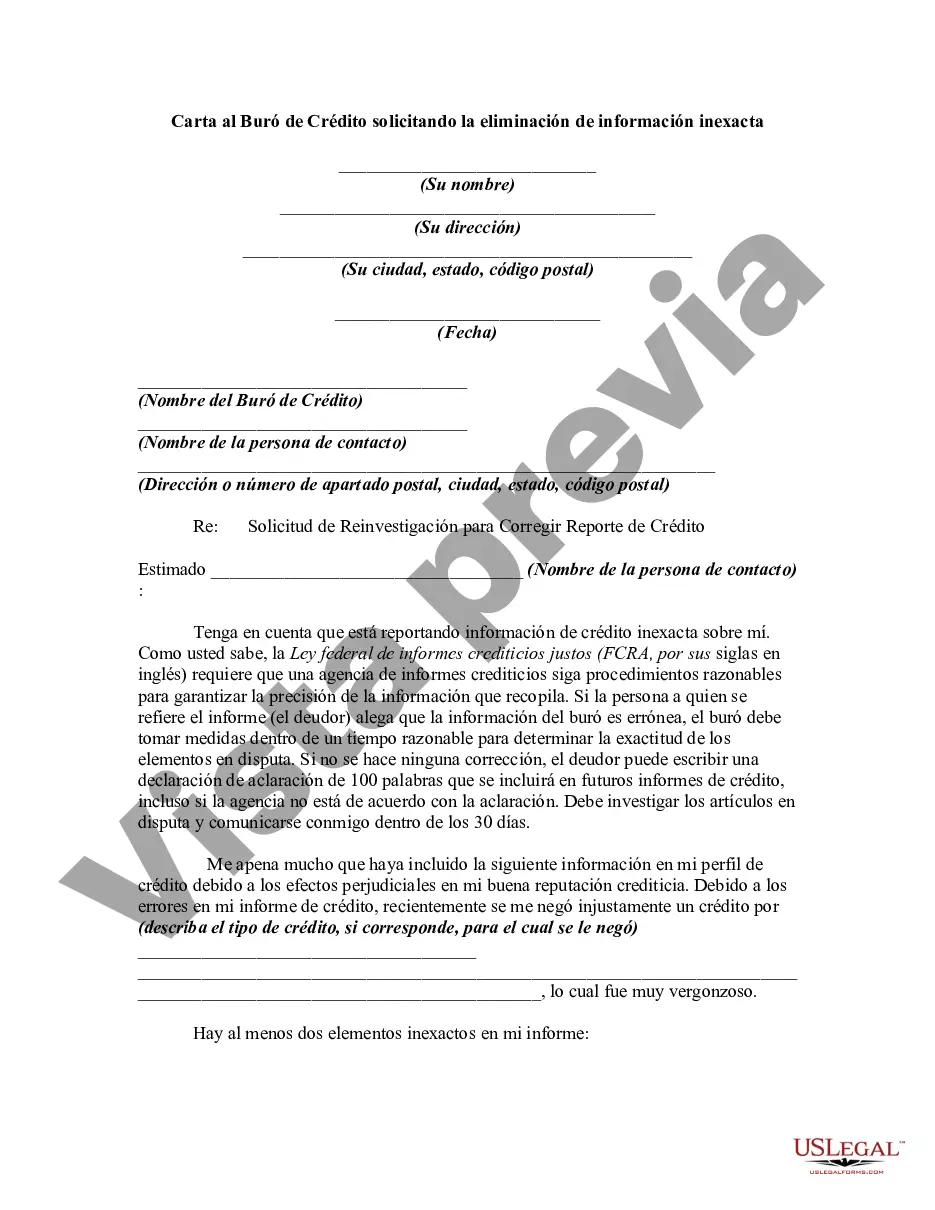

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

San Bernardino, California is a vibrant city nestled in the heart of the Inland Empire region. Known for its diverse population and rich cultural heritage, San Bernardino offers a plethora of attractions and opportunities for residents and visitors alike. With its captivating landscapes, including the awe-inspiring San Bernardino Mountains, and its thriving economy, the city is truly a gem in Southern California. When it comes to credit management and maintaining a good credit score, accuracy is crucial. Occasionally, individuals may come across inaccuracies in their credit reports that can negatively impact their financial health. One effective way to rectify these inaccuracies is by drafting a letter to the credit bureau, requesting the removal of erroneous information. In a San Bernardino California letter to a credit bureau requesting the removal of inaccurate information, it is essential to include specific details and use appropriate language to ensure its effectiveness. The letter should begin with a respectful salutation, followed by a clear and concise explanation of the inaccuracies identified in the credit report. Providing specific account names, numbers, and dates will strengthen your case. When drafting the letter, it is crucial to highlight why the inaccurate information should be removed. This could include reasons such as identity theft, incorrect payment records, or other errors that you have evidence to dispute. Adding any supporting documentation, such as receipts, correspondence, or official statements, can bolster your argument. Moreover, it's essential to state your desired outcome clearly. Whether you request the complete removal of the inaccurate information or simply ask for a correction, make sure to articulate your expectations. It is advisable to provide contact information, including your phone number and address, so the credit bureau can easily reach out to you if necessary. Different types of San Bernardino California letters to credit bureaus requesting the removal of inaccurate information may include letters addressing specific issues like wrong personal information, incorrect payment history, or fraudulent accounts. Each type requires tailored details and documentation, but the general structure and purpose of the letter remain the same. In summary, a San Bernardino California letter to a credit bureau requesting the removal of inaccurate information is a formal communication seeking to rectify errors in one's credit report. By clearly explaining the inaccuracies, providing evidence, and stating the desired outcome, individuals can take proactive steps towards improving their credit scores and ensuring financial stability.San Bernardino, California is a vibrant city nestled in the heart of the Inland Empire region. Known for its diverse population and rich cultural heritage, San Bernardino offers a plethora of attractions and opportunities for residents and visitors alike. With its captivating landscapes, including the awe-inspiring San Bernardino Mountains, and its thriving economy, the city is truly a gem in Southern California. When it comes to credit management and maintaining a good credit score, accuracy is crucial. Occasionally, individuals may come across inaccuracies in their credit reports that can negatively impact their financial health. One effective way to rectify these inaccuracies is by drafting a letter to the credit bureau, requesting the removal of erroneous information. In a San Bernardino California letter to a credit bureau requesting the removal of inaccurate information, it is essential to include specific details and use appropriate language to ensure its effectiveness. The letter should begin with a respectful salutation, followed by a clear and concise explanation of the inaccuracies identified in the credit report. Providing specific account names, numbers, and dates will strengthen your case. When drafting the letter, it is crucial to highlight why the inaccurate information should be removed. This could include reasons such as identity theft, incorrect payment records, or other errors that you have evidence to dispute. Adding any supporting documentation, such as receipts, correspondence, or official statements, can bolster your argument. Moreover, it's essential to state your desired outcome clearly. Whether you request the complete removal of the inaccurate information or simply ask for a correction, make sure to articulate your expectations. It is advisable to provide contact information, including your phone number and address, so the credit bureau can easily reach out to you if necessary. Different types of San Bernardino California letters to credit bureaus requesting the removal of inaccurate information may include letters addressing specific issues like wrong personal information, incorrect payment history, or fraudulent accounts. Each type requires tailored details and documentation, but the general structure and purpose of the letter remain the same. In summary, a San Bernardino California letter to a credit bureau requesting the removal of inaccurate information is a formal communication seeking to rectify errors in one's credit report. By clearly explaining the inaccuracies, providing evidence, and stating the desired outcome, individuals can take proactive steps towards improving their credit scores and ensuring financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.