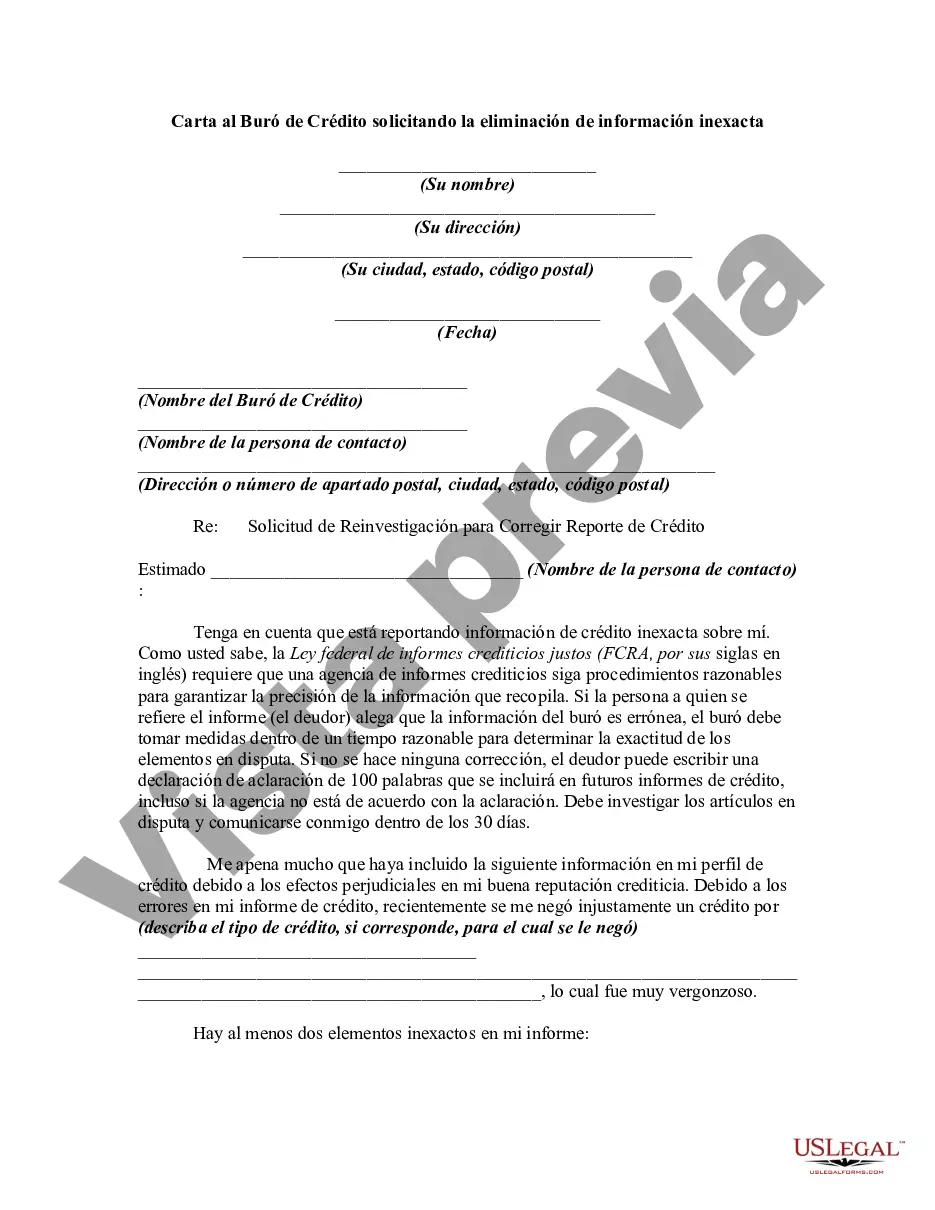

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Title: Suffolk New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information Introduction: A Suffolk New York letter to the credit bureau requesting the removal of inaccurate information is a formal communication addressed to a credit reporting agency. Its purpose is to dispute and seek the correction or complete removal of erroneous data from an individual's credit report. The letter can contain specific information pertaining to the inaccuracies found and should adhere to the guidelines set forth by the Fair Credit Reporting Act (FCRA). Types of Suffolk New York Letters to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Standard Letter: This is the most common type of Suffolk New York letter used for credit bureau disputes. It follows a formal format and clearly outlines the inaccuracies in the credit report, providing supporting evidence or documentation to validate the claim. It also requests the credit reporting agency to conduct a thorough investigation and removes the incorrect information from the individual's credit profile. 2. Identity Theft Letter: In case of identity theft, an individual has the right to submit a Suffolk New York letter to the credit bureau reporting the fraudulent accounts or activities. Besides highlighting the inaccuracies, this type of letter includes specific information regarding the theft, such as police report details, affidavit forms, and any other supporting documents required. It requests the credit bureau to initiate an immediate investigation and remove any associated unauthorized accounts or information. 3. Debt Validation Letter: Sometimes, individuals may doubt the validity of a debt listed on their credit report. A Suffolk New York debt validation letter is sent to the credit bureau, highlighting the disputed debt and requesting the creditor to provide comprehensive and substantiated information about the debt. If the creditor fails to respond adequately within the legally required time frame, the letter requests the credit bureau to remove the debt from the credit report due to lack of validation. 4. Obsolete Information Letter: When an individual finds outdated or expired items on their credit report, such as late payment records or collection accounts that should no longer be listed, a Suffolk New York letter can be customized to address these specific inaccuracies. It requests the credit bureau to remove such obsolete items, providing justifications supported by relevant documentation, like proof of timely payments or legal expiration. Conclusion: Submitting a Suffolk New York letter to the credit bureau requesting the removal of inaccurate information is an essential step in ensuring the accuracy and integrity of one's credit report. By following the specific guidelines and tailoring the letter to address the type of inaccuracy, individuals can effectively dispute and rectify erroneous information, thus positively impacting their creditworthiness and financial future.Title: Suffolk New York Letter to Credit Bureau Requesting the Removal of Inaccurate Information Introduction: A Suffolk New York letter to the credit bureau requesting the removal of inaccurate information is a formal communication addressed to a credit reporting agency. Its purpose is to dispute and seek the correction or complete removal of erroneous data from an individual's credit report. The letter can contain specific information pertaining to the inaccuracies found and should adhere to the guidelines set forth by the Fair Credit Reporting Act (FCRA). Types of Suffolk New York Letters to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Standard Letter: This is the most common type of Suffolk New York letter used for credit bureau disputes. It follows a formal format and clearly outlines the inaccuracies in the credit report, providing supporting evidence or documentation to validate the claim. It also requests the credit reporting agency to conduct a thorough investigation and removes the incorrect information from the individual's credit profile. 2. Identity Theft Letter: In case of identity theft, an individual has the right to submit a Suffolk New York letter to the credit bureau reporting the fraudulent accounts or activities. Besides highlighting the inaccuracies, this type of letter includes specific information regarding the theft, such as police report details, affidavit forms, and any other supporting documents required. It requests the credit bureau to initiate an immediate investigation and remove any associated unauthorized accounts or information. 3. Debt Validation Letter: Sometimes, individuals may doubt the validity of a debt listed on their credit report. A Suffolk New York debt validation letter is sent to the credit bureau, highlighting the disputed debt and requesting the creditor to provide comprehensive and substantiated information about the debt. If the creditor fails to respond adequately within the legally required time frame, the letter requests the credit bureau to remove the debt from the credit report due to lack of validation. 4. Obsolete Information Letter: When an individual finds outdated or expired items on their credit report, such as late payment records or collection accounts that should no longer be listed, a Suffolk New York letter can be customized to address these specific inaccuracies. It requests the credit bureau to remove such obsolete items, providing justifications supported by relevant documentation, like proof of timely payments or legal expiration. Conclusion: Submitting a Suffolk New York letter to the credit bureau requesting the removal of inaccurate information is an essential step in ensuring the accuracy and integrity of one's credit report. By following the specific guidelines and tailoring the letter to address the type of inaccuracy, individuals can effectively dispute and rectify erroneous information, thus positively impacting their creditworthiness and financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.