A notary public has the power and is authorized to administer oaths and affirmations, receive proof and acknowledgment of writings, and present and protest any type of negotiable paper, in addition to any other acts to be done by notaries public as provided by law.

Source: YSL 2-21 ?§12, modified.

Nothing in this section shall preclude acknowledgment by a notary public duly authorized to acknowledge instruments in any state or territory of the United States or other foreign jurisdiction; provided, however, that said notary public complies with the laws of that jurisdiction.

Source: TSL 4-91, ?§ 10, modified.

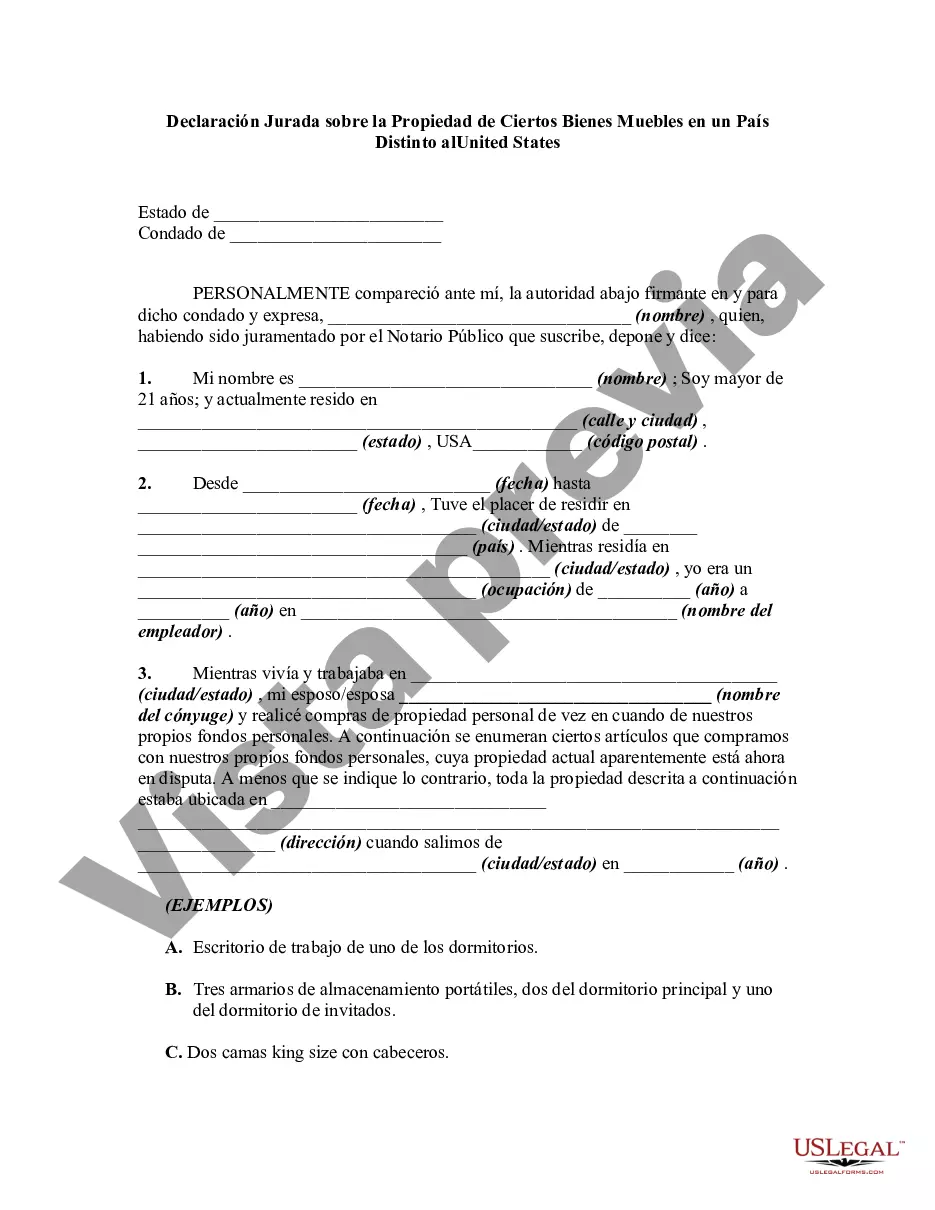

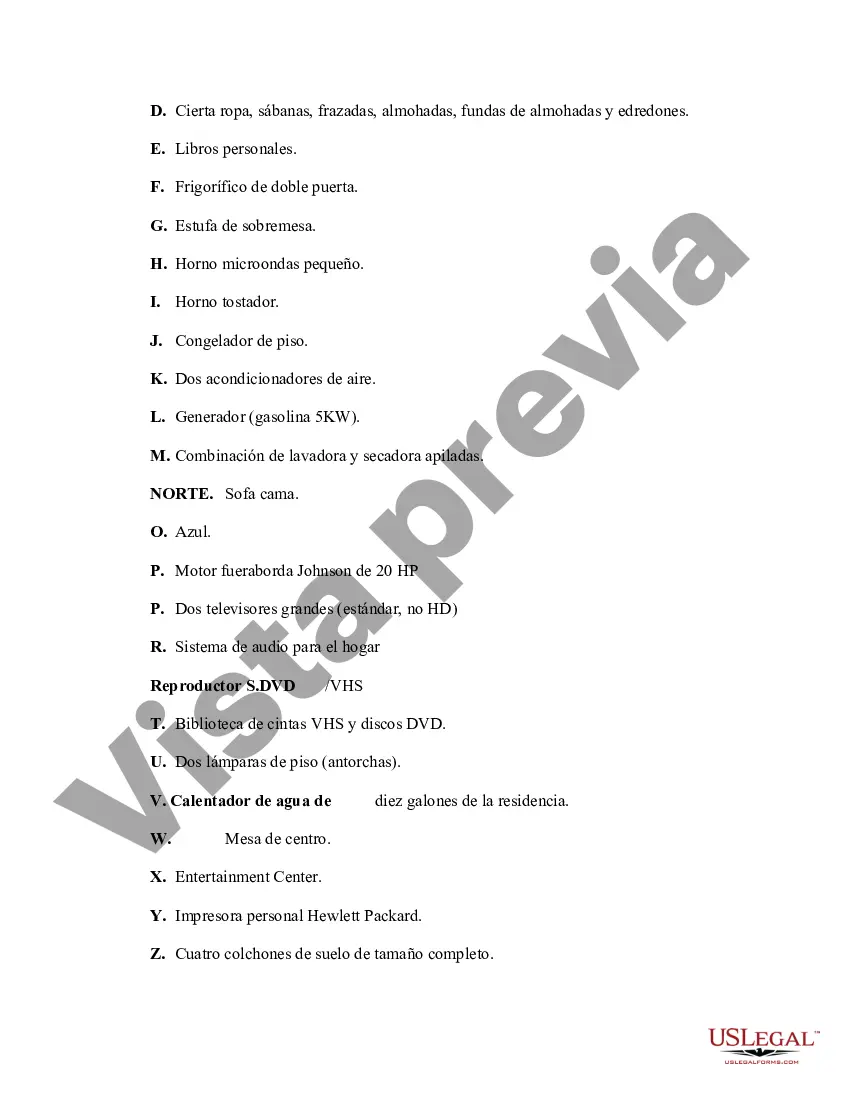

Cook Illinois Affidavit as to Ownership of Certain Personal Property in a Country Other than the United States is a legal document that verifies an individual's ownership and possession of personal property located in a foreign country. This affidavit is commonly used in various situations where individuals need to declare their ownership of assets in another country, such as during estate planning, immigration processes, or international business transactions. When preparing a Cook Illinois Affidavit as to Ownership of Certain Personal Property, it is crucial to include all relevant details and keywords for clarity and accuracy. Here is a detailed description of the document and its different types: 1. Cook Illinois Affidavit as to Ownership of Real Property in a Country Other than the United States: This type of affidavit is specifically used to declare ownership and possession of real estate or immovable property situated in a foreign country. It can encompass properties like houses, buildings, land, or any other form of real estate. 2. Cook Illinois Affidavit as to Ownership of Financial Accounts in a Country Other than the United States: This variant of the affidavit focuses on the ownership and control of financial accounts held in a foreign country. It can include bank accounts, investment accounts, retirement accounts, or any other financial instruments located in another jurisdiction. 3. Cook Illinois Affidavit as to Ownership of Intellectual Property in a Country Other than the United States: This type of affidavit pertains to individuals who claim ownership of intellectual property (IP) assets in a country other than the United States. It covers patents, trademarks, copyrights, trade secrets, or any other form of IP rights held in a foreign jurisdiction. 4. Cook Illinois Affidavit as to Ownership of Tangible Personal Property in a Country Other than the United States: This variant of the affidavit is used for stating the ownership of physical, movable personal property situated in a foreign country. It can include items such as vehicles, jewelry, artwork, furniture, or any other valuable possessions. When drafting the Cook Illinois Affidavit as to Ownership of Certain Personal Property in a Country Other than the United States, individuals should include essential information. This typically consists of the affine's full legal name, contact details, details about the property, such as location, description, value, and any relevant supporting documents or evidence of ownership. To ensure compliance with legal standards, it is advisable to consult an attorney or legal professional experienced in international matters when preparing a Cook Illinois Affidavit as to Ownership of Certain Personal Property. Proper execution and notarization of the affidavit may be required for it to be deemed valid and admissible in legal proceedings or administrative processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.