This form involves the sale or gift of a small business from one individual to another. The word memorandum is sometimes used when the agreement and transfer has already taken place, but has not yet been reduced to writing. If the transfer is a gift (e.g., on family member to another), the figure of $1.00 could be used or $0.00. Another alternative could be to write the word gift in the blank for the consideration.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

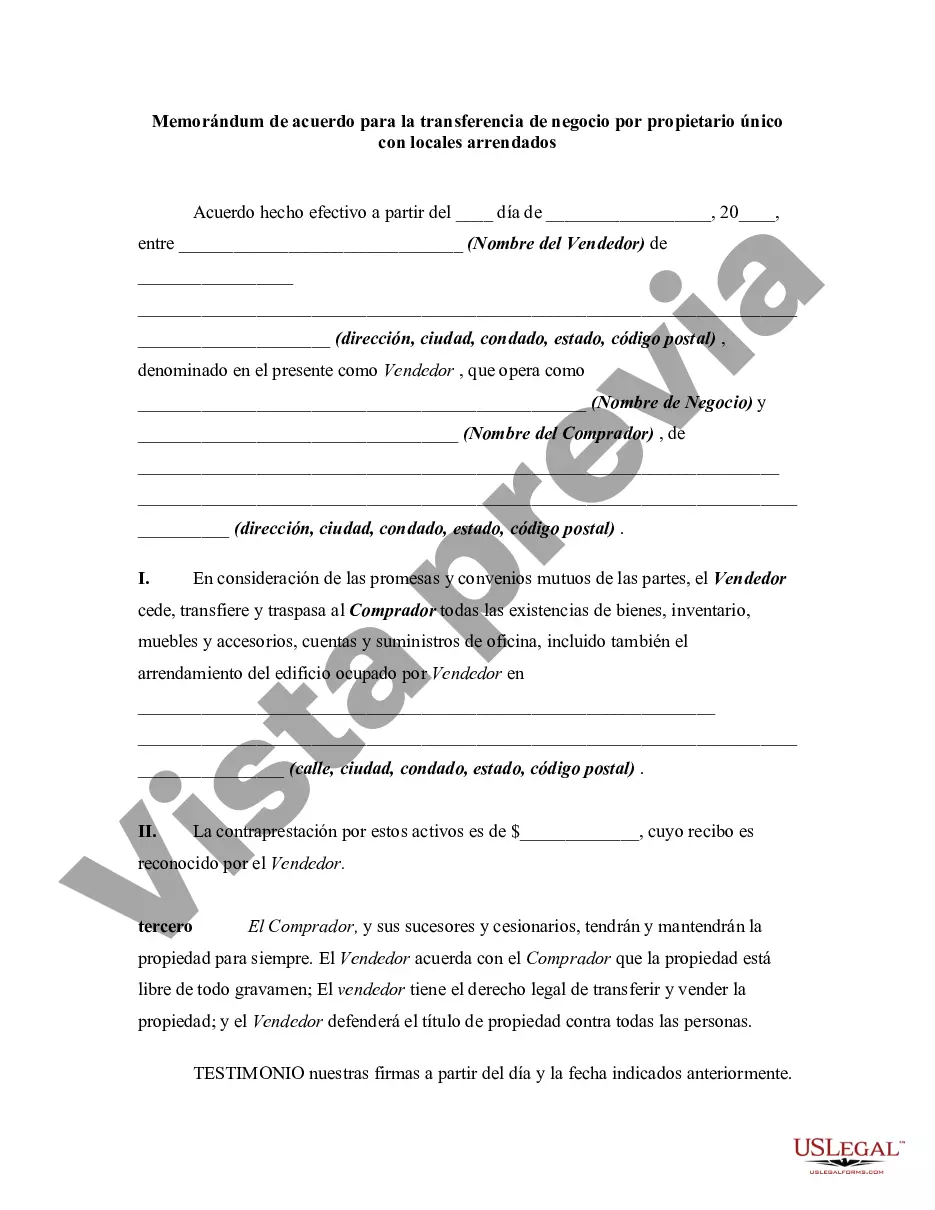

Chicago, Illinois Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions for the transfer of a business that operates as a sole proprietorship and is located in leased premises in Chicago, Illinois. This agreement serves as a binding contract between the current sole proprietor, the new proprietor, and the lessor of the premises. The agreement typically includes various key elements such as: 1. Parties involved: The memorandum of agreement identifies the current sole proprietor, the new proprietor, and the lessor of the premises. 2. Business details: It includes a detailed description of the business being transferred, including its name, location, assets, inventory, customer base, and any other relevant information. 3. Lease terms: The agreement addresses the terms and conditions of the lease for the premises, including lease duration, rental amount, renew ability, any existing obligations, and the consent of the lessor to transfer the lease to the new proprietor. 4. Sale consideration: The document outlines the agreed-upon purchase price or consideration for the transfer of the business, including any down payments, payment schedules, and methods of payment. 5. Liabilities and indemnification: It specifies the allocation of existing liabilities, debts, obligations, and any indemnification clauses related to legal claims or disputes arising from the sale and transfer of the business. 6. Liabilities disclosure: The agreement may require the current sole proprietor to disclose any known liabilities, pending litigation, or other potential business risks to the new proprietor. 7. Intellectual property and licenses: If applicable, the agreement addresses the transfer or renewal of any intellectual property rights, licenses, permits, or registrations necessary for the operation of the business. 8. Non-compete clause: It may include a non-compete clause, which restricts the current sole proprietor from engaging in a similar business within a specified geographic area for a defined period of time after the transfer. Other types of Chicago, Illinois Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises may include variations based on specific industries, unique assets, or additional provisions required by the parties involved. It is advisable to consult an attorney or legal professional to draft a customized agreement that suits the specific needs of the business transfer.Chicago, Illinois Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions for the transfer of a business that operates as a sole proprietorship and is located in leased premises in Chicago, Illinois. This agreement serves as a binding contract between the current sole proprietor, the new proprietor, and the lessor of the premises. The agreement typically includes various key elements such as: 1. Parties involved: The memorandum of agreement identifies the current sole proprietor, the new proprietor, and the lessor of the premises. 2. Business details: It includes a detailed description of the business being transferred, including its name, location, assets, inventory, customer base, and any other relevant information. 3. Lease terms: The agreement addresses the terms and conditions of the lease for the premises, including lease duration, rental amount, renew ability, any existing obligations, and the consent of the lessor to transfer the lease to the new proprietor. 4. Sale consideration: The document outlines the agreed-upon purchase price or consideration for the transfer of the business, including any down payments, payment schedules, and methods of payment. 5. Liabilities and indemnification: It specifies the allocation of existing liabilities, debts, obligations, and any indemnification clauses related to legal claims or disputes arising from the sale and transfer of the business. 6. Liabilities disclosure: The agreement may require the current sole proprietor to disclose any known liabilities, pending litigation, or other potential business risks to the new proprietor. 7. Intellectual property and licenses: If applicable, the agreement addresses the transfer or renewal of any intellectual property rights, licenses, permits, or registrations necessary for the operation of the business. 8. Non-compete clause: It may include a non-compete clause, which restricts the current sole proprietor from engaging in a similar business within a specified geographic area for a defined period of time after the transfer. Other types of Chicago, Illinois Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises may include variations based on specific industries, unique assets, or additional provisions required by the parties involved. It is advisable to consult an attorney or legal professional to draft a customized agreement that suits the specific needs of the business transfer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.