This form involves the sale or gift of a small business from one individual to another. The word memorandum is sometimes used when the agreement and transfer has already taken place, but has not yet been reduced to writing. If the transfer is a gift (e.g., on family member to another), the figure of $1.00 could be used or $0.00. Another alternative could be to write the word gift in the blank for the consideration.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

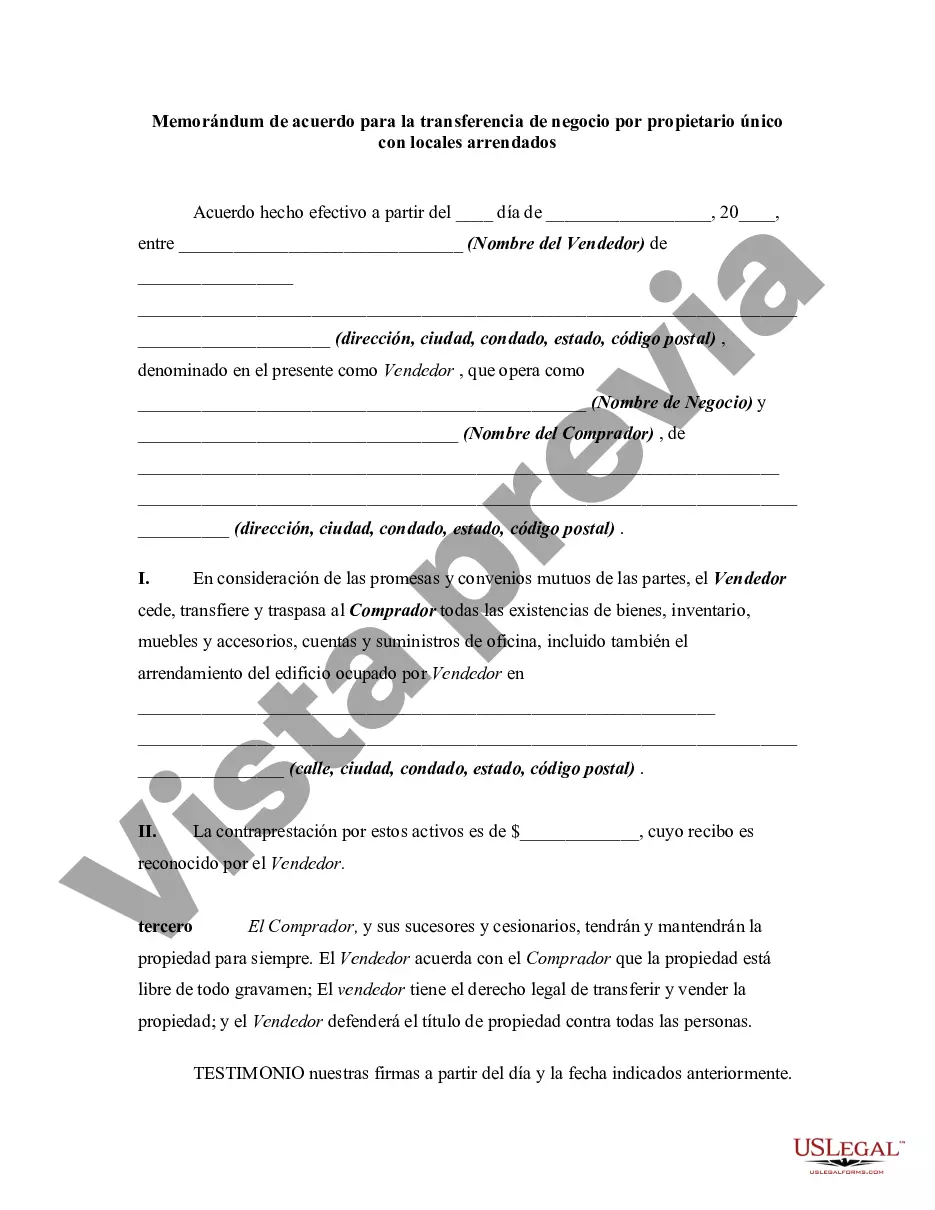

The Franklin Ohio Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions of transferring a sole proprietorship business, which operates in leased premises, in the city of Franklin, Ohio. It serves as a legally binding agreement between the current sole proprietor and the potential buyer or transferee. This memorandum of agreement aims to ensure a smooth and transparent transfer of the business, while protecting the interests of both parties involved. It outlines the rights, obligations, and responsibilities of each party during the transfer process. The document may cover various aspects, including but not limited to: 1. Identification of Parties: The memorandum clearly identifies the current sole proprietor and the potential buyer or transferee of the business. 2. Business Description: A detailed description of the sole proprietorship business is provided, including its name, location, business type, products or services offered, and any relevant licenses or permits. 3. Lease Agreement Details: The terms and conditions of the lease agreement for the premises are specified. This includes the lease start and end dates, rent amount, any security deposits, and other lease-related obligations. 4. Transfer of Assets: The agreement governs the transfer of tangible and intangible assets related to the business. This may include equipment, inventory, customer lists, intellectual property rights, trademarks, licenses, contracts, and any outstanding debts or liabilities. 5. Purchase Price and Payment Terms: The purchase price for the business is negotiated and documented in the memorandum. The document also specifies the payment terms, such as lump sum, down payment, installment payments, or any other agreed-upon method. 6. Transition Period: In some cases, a transition period may be necessary to facilitate a smooth transfer of the business. This period can be outlined in the agreement, along with the responsibilities of both parties during the transition. 7. Non-Compete Clause: If applicable, a non-compete clause may be included to restrict the current sole proprietor from competing with the business being transferred, within a specified geographical area and timeframe. 8. Confidentiality and Disclosure: The agreement may contain provisions to protect the confidentiality of any sensitive business information that is disclosed during the transfer process. 9. Governing Law: The memorandum determines the jurisdiction and governing law that will apply to the agreement. Different types or variations of the Franklin Ohio Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises may exist, depending on the specific circumstances and preferences of the parties involved. These variations could include additional clauses related to specific industry practices, regulatory requirements, or any unique terms agreed upon between the buyer and seller. Ultimately, the Franklin Ohio Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is an important legal document that protects the rights and interests of both parties and facilitates a successful transfer of a sole proprietorship business operating in leased premises in Franklin, Ohio.The Franklin Ohio Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions of transferring a sole proprietorship business, which operates in leased premises, in the city of Franklin, Ohio. It serves as a legally binding agreement between the current sole proprietor and the potential buyer or transferee. This memorandum of agreement aims to ensure a smooth and transparent transfer of the business, while protecting the interests of both parties involved. It outlines the rights, obligations, and responsibilities of each party during the transfer process. The document may cover various aspects, including but not limited to: 1. Identification of Parties: The memorandum clearly identifies the current sole proprietor and the potential buyer or transferee of the business. 2. Business Description: A detailed description of the sole proprietorship business is provided, including its name, location, business type, products or services offered, and any relevant licenses or permits. 3. Lease Agreement Details: The terms and conditions of the lease agreement for the premises are specified. This includes the lease start and end dates, rent amount, any security deposits, and other lease-related obligations. 4. Transfer of Assets: The agreement governs the transfer of tangible and intangible assets related to the business. This may include equipment, inventory, customer lists, intellectual property rights, trademarks, licenses, contracts, and any outstanding debts or liabilities. 5. Purchase Price and Payment Terms: The purchase price for the business is negotiated and documented in the memorandum. The document also specifies the payment terms, such as lump sum, down payment, installment payments, or any other agreed-upon method. 6. Transition Period: In some cases, a transition period may be necessary to facilitate a smooth transfer of the business. This period can be outlined in the agreement, along with the responsibilities of both parties during the transition. 7. Non-Compete Clause: If applicable, a non-compete clause may be included to restrict the current sole proprietor from competing with the business being transferred, within a specified geographical area and timeframe. 8. Confidentiality and Disclosure: The agreement may contain provisions to protect the confidentiality of any sensitive business information that is disclosed during the transfer process. 9. Governing Law: The memorandum determines the jurisdiction and governing law that will apply to the agreement. Different types or variations of the Franklin Ohio Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises may exist, depending on the specific circumstances and preferences of the parties involved. These variations could include additional clauses related to specific industry practices, regulatory requirements, or any unique terms agreed upon between the buyer and seller. Ultimately, the Franklin Ohio Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is an important legal document that protects the rights and interests of both parties and facilitates a successful transfer of a sole proprietorship business operating in leased premises in Franklin, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.