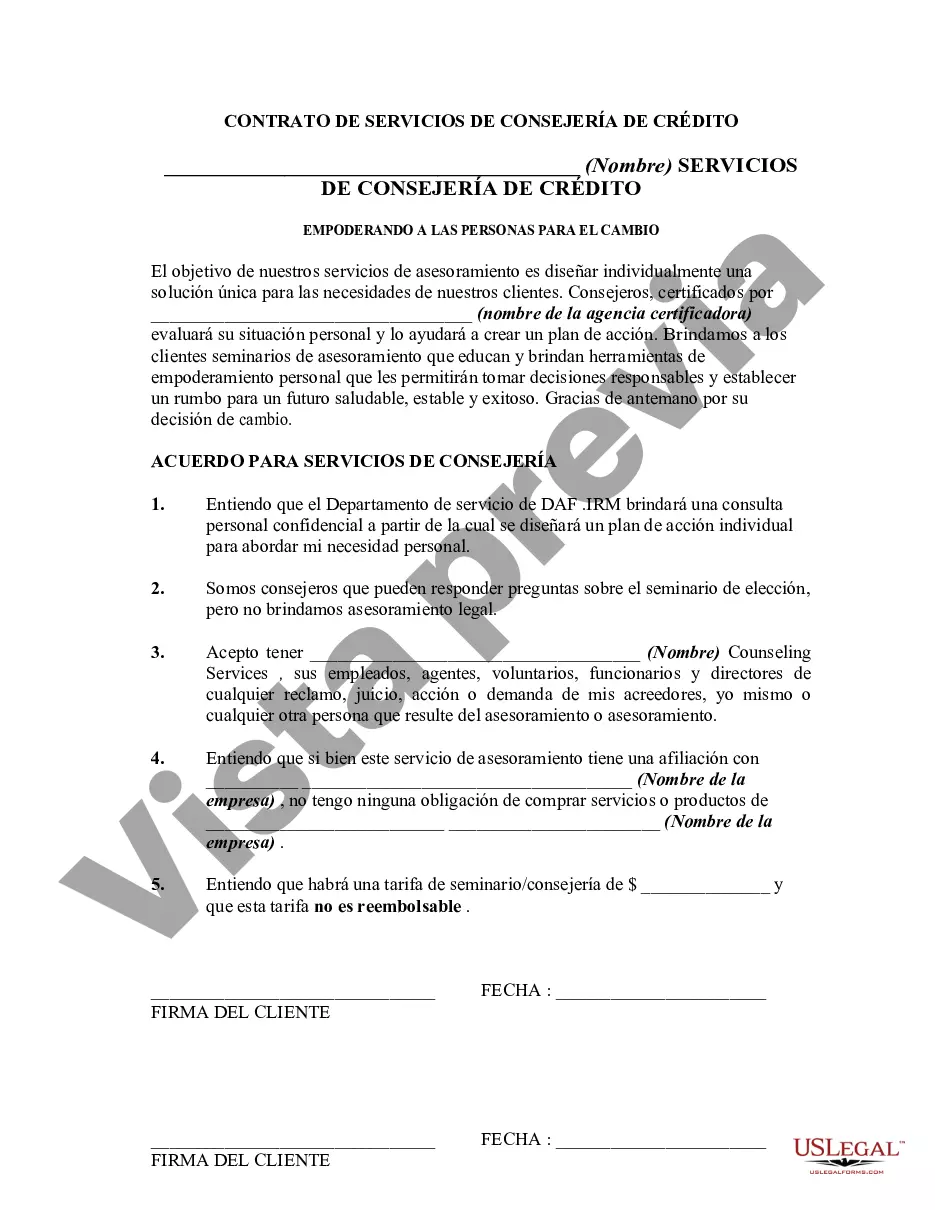

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Allegheny Pennsylvania Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between a credit counseling agency and an individual seeking financial guidance and assistance in Allegheny, Pennsylvania. This agreement serves as a comprehensive contract that defines the responsibilities, rights, and obligations of both parties involved. It ensures transparency and clarity in the provision of credit counseling services and helps establish a framework for cooperation. Keywords: Allegheny Pennsylvania, agreement, credit counseling services, financial guidance, assistance, responsibilities, rights, obligations, transparency, clarity, provision, cooperation. Types of Allegheny Pennsylvania Agreement for Credit Counseling Services: 1. Debt Management Plan Agreement A Debt Management Plan Agreement is a specific type of Allegheny Pennsylvania Agreement for Credit Counseling Services that focuses on managing and repaying the individual's debts effectively. It includes a detailed assessment of the individual's financial situation, budgeting advice, and negotiation with creditors to reduce interest rates and monthly payments. This agreement provides a roadmap for the individual to achieve financial stability and eliminate debt over time. 2. Budgeting and Financial Education Agreement This type of Allegheny Pennsylvania Agreement for Credit Counseling Services concentrates on educating individuals about effective budgeting techniques, financial planning, and money management skills. The agreement includes personalized financial coaching, assisting the individual in understanding their income, expenses, and developing a realistic budget. It also provides resources and guidance to help the individual make sound financial decisions and improve their overall financial well-being. 3. Pre-Bankruptcy Counseling Agreement Before filing for bankruptcy, individuals in Allegheny, Pennsylvania, are required to undergo pre-bankruptcy counseling. This agreement focuses on assessing the individual's financial situation, exploring alternative options to bankruptcy, and providing guidance on the potential consequences of filing for bankruptcy. The credit counseling agency helps the individual understand the legal requirements and procedures involved in the bankruptcy process, enabling them to make an informed decision regarding their financial future. 4. Financial Review and Credit Report Analysis Agreement This type of Allegheny Pennsylvania Agreement for Credit Counseling Services is centered on conducting a comprehensive financial review and credit report analysis for the individual. The agreement involves a detailed examination of the individual's credit history, debts, income, and expenses. The credit counseling agency then provides a thorough analysis, highlighting areas where improvements can be made to enhance the individual's creditworthiness and financial situation. By catering to various aspects of financial counseling, these different types of Allegheny Pennsylvania Agreements for Credit Counseling Services enable individuals to receive tailored guidance and support based on their specific needs and financial goals.Allegheny Pennsylvania Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between a credit counseling agency and an individual seeking financial guidance and assistance in Allegheny, Pennsylvania. This agreement serves as a comprehensive contract that defines the responsibilities, rights, and obligations of both parties involved. It ensures transparency and clarity in the provision of credit counseling services and helps establish a framework for cooperation. Keywords: Allegheny Pennsylvania, agreement, credit counseling services, financial guidance, assistance, responsibilities, rights, obligations, transparency, clarity, provision, cooperation. Types of Allegheny Pennsylvania Agreement for Credit Counseling Services: 1. Debt Management Plan Agreement A Debt Management Plan Agreement is a specific type of Allegheny Pennsylvania Agreement for Credit Counseling Services that focuses on managing and repaying the individual's debts effectively. It includes a detailed assessment of the individual's financial situation, budgeting advice, and negotiation with creditors to reduce interest rates and monthly payments. This agreement provides a roadmap for the individual to achieve financial stability and eliminate debt over time. 2. Budgeting and Financial Education Agreement This type of Allegheny Pennsylvania Agreement for Credit Counseling Services concentrates on educating individuals about effective budgeting techniques, financial planning, and money management skills. The agreement includes personalized financial coaching, assisting the individual in understanding their income, expenses, and developing a realistic budget. It also provides resources and guidance to help the individual make sound financial decisions and improve their overall financial well-being. 3. Pre-Bankruptcy Counseling Agreement Before filing for bankruptcy, individuals in Allegheny, Pennsylvania, are required to undergo pre-bankruptcy counseling. This agreement focuses on assessing the individual's financial situation, exploring alternative options to bankruptcy, and providing guidance on the potential consequences of filing for bankruptcy. The credit counseling agency helps the individual understand the legal requirements and procedures involved in the bankruptcy process, enabling them to make an informed decision regarding their financial future. 4. Financial Review and Credit Report Analysis Agreement This type of Allegheny Pennsylvania Agreement for Credit Counseling Services is centered on conducting a comprehensive financial review and credit report analysis for the individual. The agreement involves a detailed examination of the individual's credit history, debts, income, and expenses. The credit counseling agency then provides a thorough analysis, highlighting areas where improvements can be made to enhance the individual's creditworthiness and financial situation. By catering to various aspects of financial counseling, these different types of Allegheny Pennsylvania Agreements for Credit Counseling Services enable individuals to receive tailored guidance and support based on their specific needs and financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.