This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cook Illinois Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between Cook Illinois, a leading credit counseling service provider, and individuals seeking professional guidance in managing their finances. This agreement aims to provide a clear framework for credit counseling services and the responsibilities and expectations of both parties involved. The Cook Illinois Agreement for Credit Counseling Services can vary depending on the specific type of credit counseling sought. Some different types of credit counseling services offered by Cook Illinois include: 1. Personal budget counseling: This type of credit counseling focuses on assisting individuals in creating a comprehensive budget that aligns with their financial goals. Cook Illinois professionals will help clients assess their income, expenses, and debts to develop a personalized budget plan. 2. Debt management plans (DMP): Cook Illinois offers Dumps aimed at individuals struggling with overwhelming debt. These plans involve negotiating with creditors to potentially lower interest rates, waive fees, or extend payment terms. The agreement establishes the terms of the DMP and the responsibilities of both Cook Illinois and the client in adhering to the agreed-upon payment schedule. 3. Financial education and counseling: Cook Illinois provides educational resources and counseling sessions to enhance clients' financial literacy and understanding of credit management. This type of credit counseling may cover topics such as budgeting, saving, credit scoring, and responsible borrowing. 4. Housing counseling: Cook Illinois may offer specialized credit counseling services for individuals facing difficulties with their mortgage, rental payments, or homeownership-related financial concerns. This agreement would outline the terms and services specific to housing counseling. The Cook Illinois Agreement for Credit Counseling Services typically includes relevant keywords such as credit counseling, financial management, debt management, Dumps, budgeting, housing counseling, education, responsible borrowing, credit score improvement, and financial literacy. By clearly defining the terms, responsibilities, and specifics of each credit counseling service, Cook Illinois aims to guide individuals in achieving financial stability and long-term success.Cook Illinois Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between Cook Illinois, a leading credit counseling service provider, and individuals seeking professional guidance in managing their finances. This agreement aims to provide a clear framework for credit counseling services and the responsibilities and expectations of both parties involved. The Cook Illinois Agreement for Credit Counseling Services can vary depending on the specific type of credit counseling sought. Some different types of credit counseling services offered by Cook Illinois include: 1. Personal budget counseling: This type of credit counseling focuses on assisting individuals in creating a comprehensive budget that aligns with their financial goals. Cook Illinois professionals will help clients assess their income, expenses, and debts to develop a personalized budget plan. 2. Debt management plans (DMP): Cook Illinois offers Dumps aimed at individuals struggling with overwhelming debt. These plans involve negotiating with creditors to potentially lower interest rates, waive fees, or extend payment terms. The agreement establishes the terms of the DMP and the responsibilities of both Cook Illinois and the client in adhering to the agreed-upon payment schedule. 3. Financial education and counseling: Cook Illinois provides educational resources and counseling sessions to enhance clients' financial literacy and understanding of credit management. This type of credit counseling may cover topics such as budgeting, saving, credit scoring, and responsible borrowing. 4. Housing counseling: Cook Illinois may offer specialized credit counseling services for individuals facing difficulties with their mortgage, rental payments, or homeownership-related financial concerns. This agreement would outline the terms and services specific to housing counseling. The Cook Illinois Agreement for Credit Counseling Services typically includes relevant keywords such as credit counseling, financial management, debt management, Dumps, budgeting, housing counseling, education, responsible borrowing, credit score improvement, and financial literacy. By clearly defining the terms, responsibilities, and specifics of each credit counseling service, Cook Illinois aims to guide individuals in achieving financial stability and long-term success.

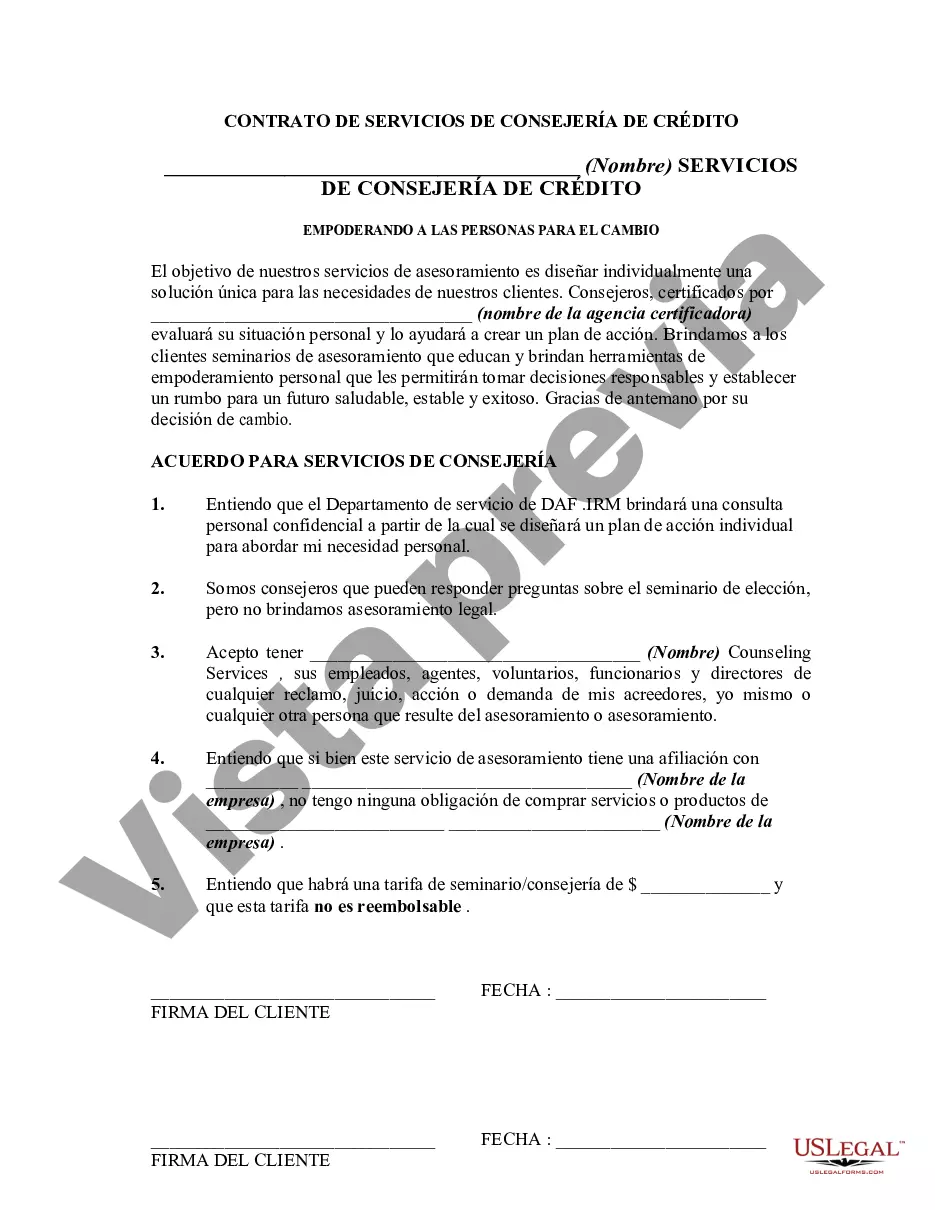

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.