This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Fairfax Virginia Agreement for Credit Counseling Services is a legally binding contract entered into by a consumer seeking credit counseling assistance and a credit counseling agency operating in the state of Virginia. This agreement outlines the terms and conditions for the provision of credit counseling services to individuals looking to improve their financial situation. The primary objective of the Fairfax Virginia Agreement for Credit Counseling Services is to help consumers manage their debts more effectively, develop a budget, and establish a plan to repay outstanding debts. It ensures that consumers receive professional guidance and support in handling their financial obligations while promoting responsible financial behavior. Key provisions found within this agreement include the disclosure of the credit counseling agency's services, fees, and any applicable charges associated with the credit counseling process. It outlines the responsibilities of both the credit counseling agency and the consumer, establishing a clear understanding of the services to be provided and the expectations for both parties involved. Additionally, the Fairfax Virginia Agreement for Credit Counseling Services highlights the importance of confidentiality and data protection, ensuring that the personal and financial information shared by the consumer remains secure and protected from unauthorized access or disclosure. Potential types of Fairfax Virginia Agreements for Credit Counseling Services might include: 1. Debt Management Agreement: This type of agreement focuses on creating a customized debt management plan for the consumer. It involves negotiating with creditors to reduce interest rates or waive certain fees, allowing the consumer to make affordable monthly payments. 2. Financial Education Agreement: This agreement emphasizes financial literacy and education, providing the consumer with tools and resources to better understand money management, budgeting, and responsible credit usage. It may involve educational workshops, seminars, or one-on-one counseling sessions. 3. Housing Counseling Agreement: Specifically designed for individuals facing challenges with their mortgage or housing payments, this agreement addresses foreclosure prevention, loan modification assistance, and other housing-related financial concerns. 4. Bankruptcy Counseling Agreement: For consumers considering filing for bankruptcy, this type of agreement provides pre-bankruptcy counseling required by law. It aims to evaluate alternatives to bankruptcy, assess the consumer's financial situation, and provide information about the potential consequences of bankruptcy. In summary, the Fairfax Virginia Agreement for Credit Counseling Services is a comprehensive contract that outlines the terms, responsibilities, and mutual understanding between a credit counseling agency and the consumer seeking professional assistance. It ensures transparency, confidentiality, and proper guidance on debt management, financial education, housing concerns, or bankruptcy as per the specific type of agreement chosen.Fairfax Virginia Agreement for Credit Counseling Services is a legally binding contract entered into by a consumer seeking credit counseling assistance and a credit counseling agency operating in the state of Virginia. This agreement outlines the terms and conditions for the provision of credit counseling services to individuals looking to improve their financial situation. The primary objective of the Fairfax Virginia Agreement for Credit Counseling Services is to help consumers manage their debts more effectively, develop a budget, and establish a plan to repay outstanding debts. It ensures that consumers receive professional guidance and support in handling their financial obligations while promoting responsible financial behavior. Key provisions found within this agreement include the disclosure of the credit counseling agency's services, fees, and any applicable charges associated with the credit counseling process. It outlines the responsibilities of both the credit counseling agency and the consumer, establishing a clear understanding of the services to be provided and the expectations for both parties involved. Additionally, the Fairfax Virginia Agreement for Credit Counseling Services highlights the importance of confidentiality and data protection, ensuring that the personal and financial information shared by the consumer remains secure and protected from unauthorized access or disclosure. Potential types of Fairfax Virginia Agreements for Credit Counseling Services might include: 1. Debt Management Agreement: This type of agreement focuses on creating a customized debt management plan for the consumer. It involves negotiating with creditors to reduce interest rates or waive certain fees, allowing the consumer to make affordable monthly payments. 2. Financial Education Agreement: This agreement emphasizes financial literacy and education, providing the consumer with tools and resources to better understand money management, budgeting, and responsible credit usage. It may involve educational workshops, seminars, or one-on-one counseling sessions. 3. Housing Counseling Agreement: Specifically designed for individuals facing challenges with their mortgage or housing payments, this agreement addresses foreclosure prevention, loan modification assistance, and other housing-related financial concerns. 4. Bankruptcy Counseling Agreement: For consumers considering filing for bankruptcy, this type of agreement provides pre-bankruptcy counseling required by law. It aims to evaluate alternatives to bankruptcy, assess the consumer's financial situation, and provide information about the potential consequences of bankruptcy. In summary, the Fairfax Virginia Agreement for Credit Counseling Services is a comprehensive contract that outlines the terms, responsibilities, and mutual understanding between a credit counseling agency and the consumer seeking professional assistance. It ensures transparency, confidentiality, and proper guidance on debt management, financial education, housing concerns, or bankruptcy as per the specific type of agreement chosen.

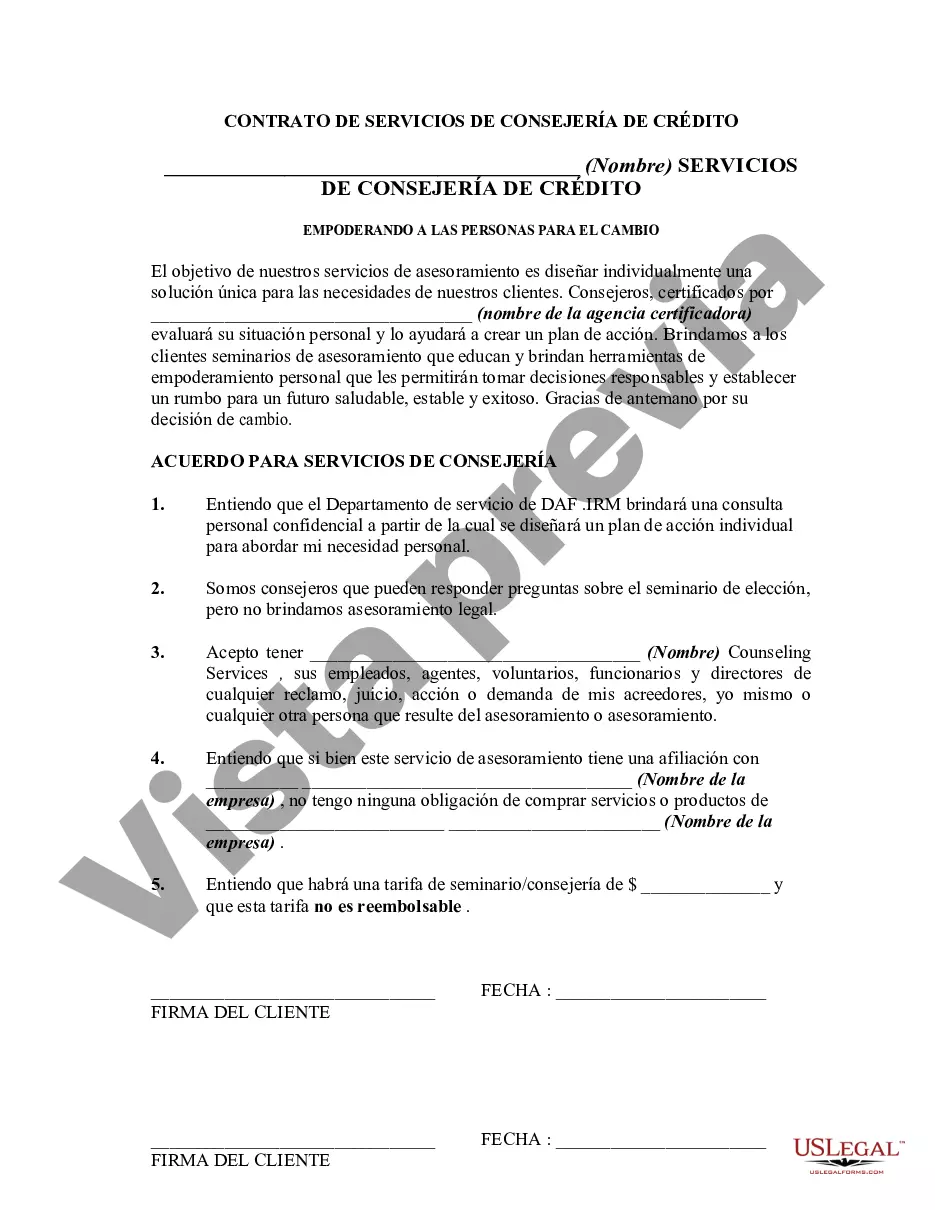

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.