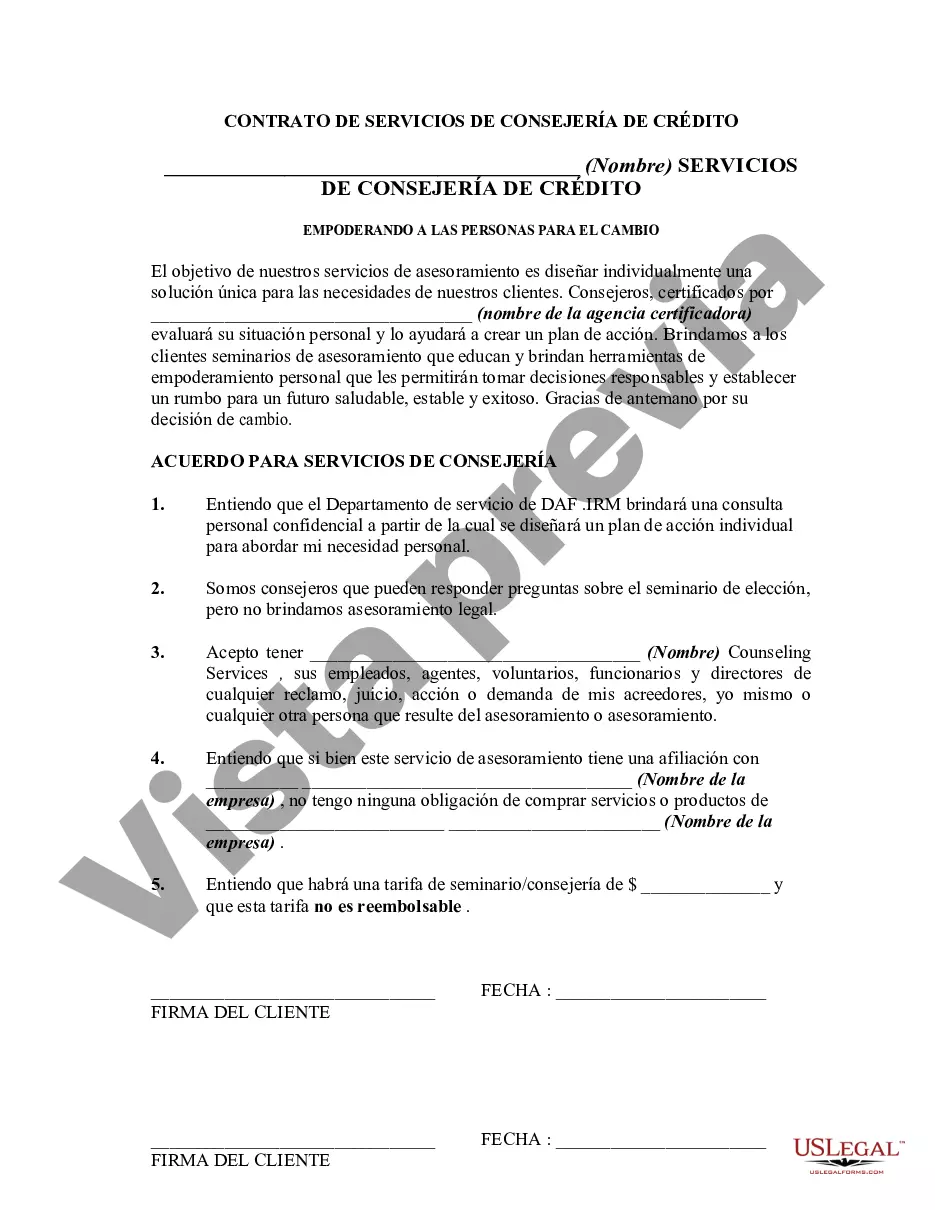

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Harris Texas Agreement for Credit Counseling Services is a comprehensive financial document that outlines the terms and conditions for individuals seeking credit counseling services in the Harris County, Texas area. This legally binding agreement aims to protect both the client and the credit counseling agency, ensuring a fair and transparent relationship. Keywords: Harris Texas, agreement, credit counseling services Under this agreement, the credit counseling agency agrees to provide professional credit counseling services to clients who are overwhelmed by debt or facing financial distress. The agency's goal is to assist clients in managing their finances effectively, improving their credit scores, and ultimately achieving financial stability. The agreement typically includes essential details such as the names and contact information of both parties, the effective date of the agreement, and the duration of the credit counseling services. It also outlines the specific services and assistance the agency will provide, which may include debt management plans, budgeting guidance, education on responsible credit habits, and negotiation with creditors on behalf of the client. Furthermore, the agreement includes the obligations and responsibilities of the client, such as providing accurate and up-to-date financial information, actively participating in the credit counseling process, and making timely payments as per the agreed-upon terms. To ensure transparency, the agreement also covers the fees and payment terms associated with the credit counseling services. This includes any initial setup costs, monthly fees, and charges for additional services. The agreement will specify when and how these fees are to be paid, whether it is through a one-time payment, automatic deductions, or installment plans. In the event of a dispute or disagreement between the client and the credit counseling agency, the agreement may include a clause detailing the process for resolving such issues, such as mediation or arbitration. Types of Harris Texas Agreement for Credit Counseling Services: 1. Basic Credit Counseling Agreement: This type of agreement covers the fundamental credit counseling services provided by the agency, including budgeting assistance and debt management plans. 2. Advanced Credit Counseling Agreement: This agreement offers more comprehensive credit counseling services, such as creditor negotiation and assistance with credit report reviews. 3. Specialized Credit Counseling Agreement: Some agencies may offer specialized credit counseling services tailored to specific situations, such as bankruptcy counseling or foreclosure prevention. These agreements focus on addressing the unique needs of clients in those specific circumstances. In conclusion, the Harris Texas Agreement for Credit Counseling Services is a crucial document that establishes a mutual understanding between clients and credit counseling agencies in Harris County. It provides the necessary framework for a successful and productive credit counseling relationship, helping individuals regain control over their finances and move towards a brighter financial future.The Harris Texas Agreement for Credit Counseling Services is a comprehensive financial document that outlines the terms and conditions for individuals seeking credit counseling services in the Harris County, Texas area. This legally binding agreement aims to protect both the client and the credit counseling agency, ensuring a fair and transparent relationship. Keywords: Harris Texas, agreement, credit counseling services Under this agreement, the credit counseling agency agrees to provide professional credit counseling services to clients who are overwhelmed by debt or facing financial distress. The agency's goal is to assist clients in managing their finances effectively, improving their credit scores, and ultimately achieving financial stability. The agreement typically includes essential details such as the names and contact information of both parties, the effective date of the agreement, and the duration of the credit counseling services. It also outlines the specific services and assistance the agency will provide, which may include debt management plans, budgeting guidance, education on responsible credit habits, and negotiation with creditors on behalf of the client. Furthermore, the agreement includes the obligations and responsibilities of the client, such as providing accurate and up-to-date financial information, actively participating in the credit counseling process, and making timely payments as per the agreed-upon terms. To ensure transparency, the agreement also covers the fees and payment terms associated with the credit counseling services. This includes any initial setup costs, monthly fees, and charges for additional services. The agreement will specify when and how these fees are to be paid, whether it is through a one-time payment, automatic deductions, or installment plans. In the event of a dispute or disagreement between the client and the credit counseling agency, the agreement may include a clause detailing the process for resolving such issues, such as mediation or arbitration. Types of Harris Texas Agreement for Credit Counseling Services: 1. Basic Credit Counseling Agreement: This type of agreement covers the fundamental credit counseling services provided by the agency, including budgeting assistance and debt management plans. 2. Advanced Credit Counseling Agreement: This agreement offers more comprehensive credit counseling services, such as creditor negotiation and assistance with credit report reviews. 3. Specialized Credit Counseling Agreement: Some agencies may offer specialized credit counseling services tailored to specific situations, such as bankruptcy counseling or foreclosure prevention. These agreements focus on addressing the unique needs of clients in those specific circumstances. In conclusion, the Harris Texas Agreement for Credit Counseling Services is a crucial document that establishes a mutual understanding between clients and credit counseling agencies in Harris County. It provides the necessary framework for a successful and productive credit counseling relationship, helping individuals regain control over their finances and move towards a brighter financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.