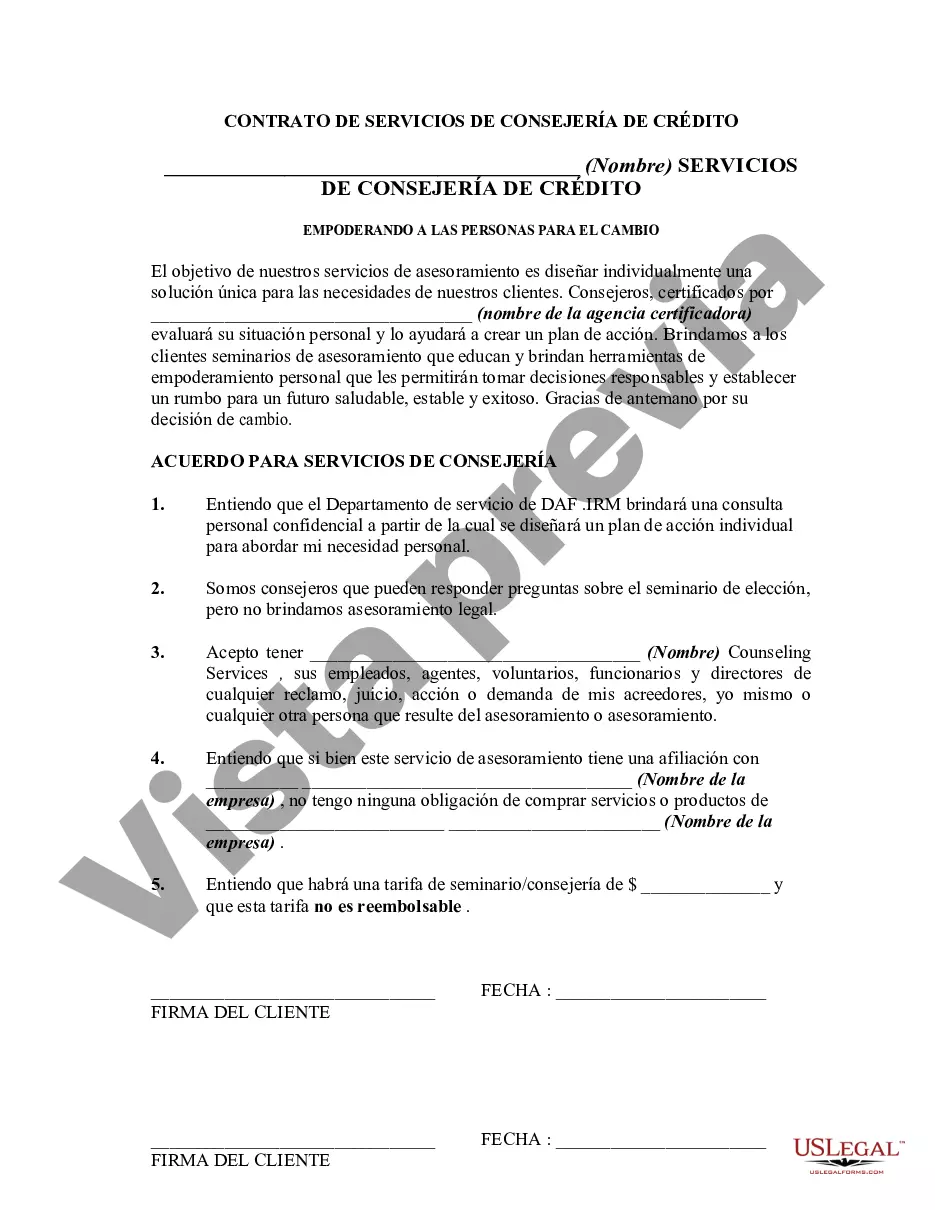

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Houston Texas Agreement for Credit Counseling Services is a legally binding contract that governs the provision of credit counseling services in the city of Houston, Texas. This agreement outlines the terms and conditions under which the credit counseling services will be provided to individuals seeking assistance with managing their debt and improving their financial situation. Keywords: Houston Texas, agreement, credit counseling services, contract, debt management, financial situation. The Houston Texas Agreement for Credit Counseling Services may encompass various types of credit counseling services, such as: 1. Debt Management Plan (DMP) Agreement: This type of agreement focuses on helping individuals develop a personalized plan to repay their debts through negotiated terms with creditors. The agreement specifies the responsibilities of both the credit counseling agency and the individual seeking assistance. 2. Financial Education Agreement: This agreement aims to educate individuals on various aspects of personal finance, including budgeting, money management, credit scores, and debt management strategies. It outlines the topics covered and the methods through which the educational services will be provided. 3. Counseling and Consultation Agreement: This type of agreement focuses on providing one-on-one counseling sessions to individuals seeking assistance with their financial matters. It may include budget analysis, credit report reviews, financial goal-setting, and personalized recommendations. 4. Pre-Bankruptcy Counseling Agreement: This agreement is specifically tailored for individuals considering filing for bankruptcy. It provides counseling services aimed at evaluating possible alternatives to bankruptcy, discussing the implications of bankruptcy filings, and offering guidance on financial management during and after the process. Regardless of the specific type of credit counseling service, the Houston Texas Agreement for Credit Counseling Services typically includes the following key elements: 1. Parties involved: Identifies the credit counseling agency and the individual(s) seeking assistance. 2. Services provided: Specifies the nature and extent of the credit counseling services to be provided, such as debt management, financial education, or consultation. 3. Payment terms: Outlines the fees, if any, associated with the credit counseling services, including any upfront costs, ongoing fees, or payment schedule. 4. Confidentiality: Ensures the confidentiality of all information shared during the credit counseling sessions, adhering to applicable privacy laws and regulations. 5. Termination and cancellation: Defines the procedures and grounds for terminating or canceling the agreement, for example, if the client fails to fulfill their obligations or if the credit counseling agency does not meet the agreed-upon standards. 6. Dispute resolution: Specifies the mechanism for resolving any disputes or disagreements that may arise between the parties, such as mediation or arbitration. In conclusion, the Houston Texas Agreement for Credit Counseling Services is a comprehensive document that sets forth the terms, responsibilities, and financial aspects of credit counseling services in Houston, Texas. The agreement protects the rights of both the credit counseling agency and the individuals seeking assistance, ensuring a transparent and mutually beneficial relationship.Houston Texas Agreement for Credit Counseling Services is a legally binding contract that governs the provision of credit counseling services in the city of Houston, Texas. This agreement outlines the terms and conditions under which the credit counseling services will be provided to individuals seeking assistance with managing their debt and improving their financial situation. Keywords: Houston Texas, agreement, credit counseling services, contract, debt management, financial situation. The Houston Texas Agreement for Credit Counseling Services may encompass various types of credit counseling services, such as: 1. Debt Management Plan (DMP) Agreement: This type of agreement focuses on helping individuals develop a personalized plan to repay their debts through negotiated terms with creditors. The agreement specifies the responsibilities of both the credit counseling agency and the individual seeking assistance. 2. Financial Education Agreement: This agreement aims to educate individuals on various aspects of personal finance, including budgeting, money management, credit scores, and debt management strategies. It outlines the topics covered and the methods through which the educational services will be provided. 3. Counseling and Consultation Agreement: This type of agreement focuses on providing one-on-one counseling sessions to individuals seeking assistance with their financial matters. It may include budget analysis, credit report reviews, financial goal-setting, and personalized recommendations. 4. Pre-Bankruptcy Counseling Agreement: This agreement is specifically tailored for individuals considering filing for bankruptcy. It provides counseling services aimed at evaluating possible alternatives to bankruptcy, discussing the implications of bankruptcy filings, and offering guidance on financial management during and after the process. Regardless of the specific type of credit counseling service, the Houston Texas Agreement for Credit Counseling Services typically includes the following key elements: 1. Parties involved: Identifies the credit counseling agency and the individual(s) seeking assistance. 2. Services provided: Specifies the nature and extent of the credit counseling services to be provided, such as debt management, financial education, or consultation. 3. Payment terms: Outlines the fees, if any, associated with the credit counseling services, including any upfront costs, ongoing fees, or payment schedule. 4. Confidentiality: Ensures the confidentiality of all information shared during the credit counseling sessions, adhering to applicable privacy laws and regulations. 5. Termination and cancellation: Defines the procedures and grounds for terminating or canceling the agreement, for example, if the client fails to fulfill their obligations or if the credit counseling agency does not meet the agreed-upon standards. 6. Dispute resolution: Specifies the mechanism for resolving any disputes or disagreements that may arise between the parties, such as mediation or arbitration. In conclusion, the Houston Texas Agreement for Credit Counseling Services is a comprehensive document that sets forth the terms, responsibilities, and financial aspects of credit counseling services in Houston, Texas. The agreement protects the rights of both the credit counseling agency and the individuals seeking assistance, ensuring a transparent and mutually beneficial relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.