This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Maricopa Arizona Agreement for Credit Counseling Services, also known as the Maricopa Agreement, is a legal document that outlines the terms and conditions between a consumer and a credit counseling agency based in Maricopa, Arizona. This agreement is designed to provide individuals with professional financial guidance and support to help manage their debt and improve their overall financial situation. The Maricopa Agreement for Credit Counseling Services is an essential tool for individuals seeking assistance in dealing with their financial challenges. By entering into this agreement, consumers can access valuable services and resources to address their credit issues, develop effective budgeting strategies, and gain the necessary knowledge to make informed financial decisions. The agreement typically covers various areas, including the scope of services, fees, confidentiality, and termination clauses. In the document, specific keywords are used to ensure clarity and mutual understanding between the consumer and the credit counseling agency. These keywords include: 1. Credit counseling: The agency will provide personalized guidance and advice to help individuals manage their debts, create an effective budget, and achieve long-term financial stability. 2. Debt management plan (DMP): The agreement may outline the specifics of a DMP, a structured repayment plan negotiated between the consumer and their creditors to reduce interest rates, waive fees, and establish a manageable payment schedule. 3. Budgeting assistance: The agency will assist the consumer in creating a personalized budget that reflects their income, expenses, and financial goals. 4. Credit education: The agreement may include provisions for educational resources and workshops aimed at improving the consumer's financial literacy and teaching them techniques to avoid future financial problems. 5. Confidentiality: The agreement will include clauses ensuring the privacy and confidentiality of the consumer's personal and financial information. It is important to note that there may be different types of Maricopa Arizona Agreements for Credit Counseling Services, depending on the specific credit counseling agency. However, the purpose of each type remains the same — to provide individuals with financial guidance and support for dealing with their credit and debt issues. For individuals in Maricopa, Arizona, seeking assistance with credit and debt management, understanding the specifics and keywords associated with the Maricopa Arizona Agreement for Credit Counseling Services is crucial. By familiarizing themselves with this agreement, consumers can make well-informed decisions about seeking the help they need to regain control of their finances.

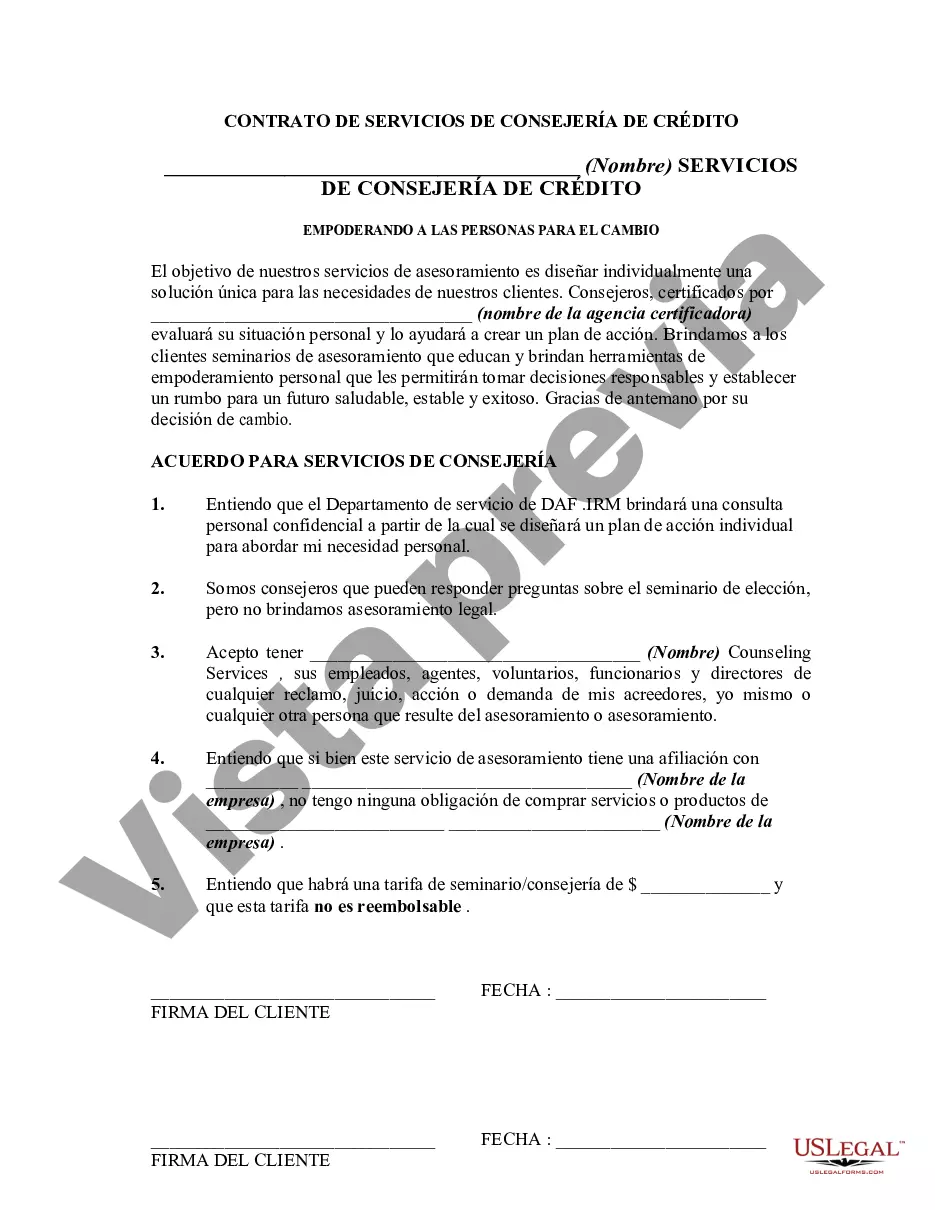

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.