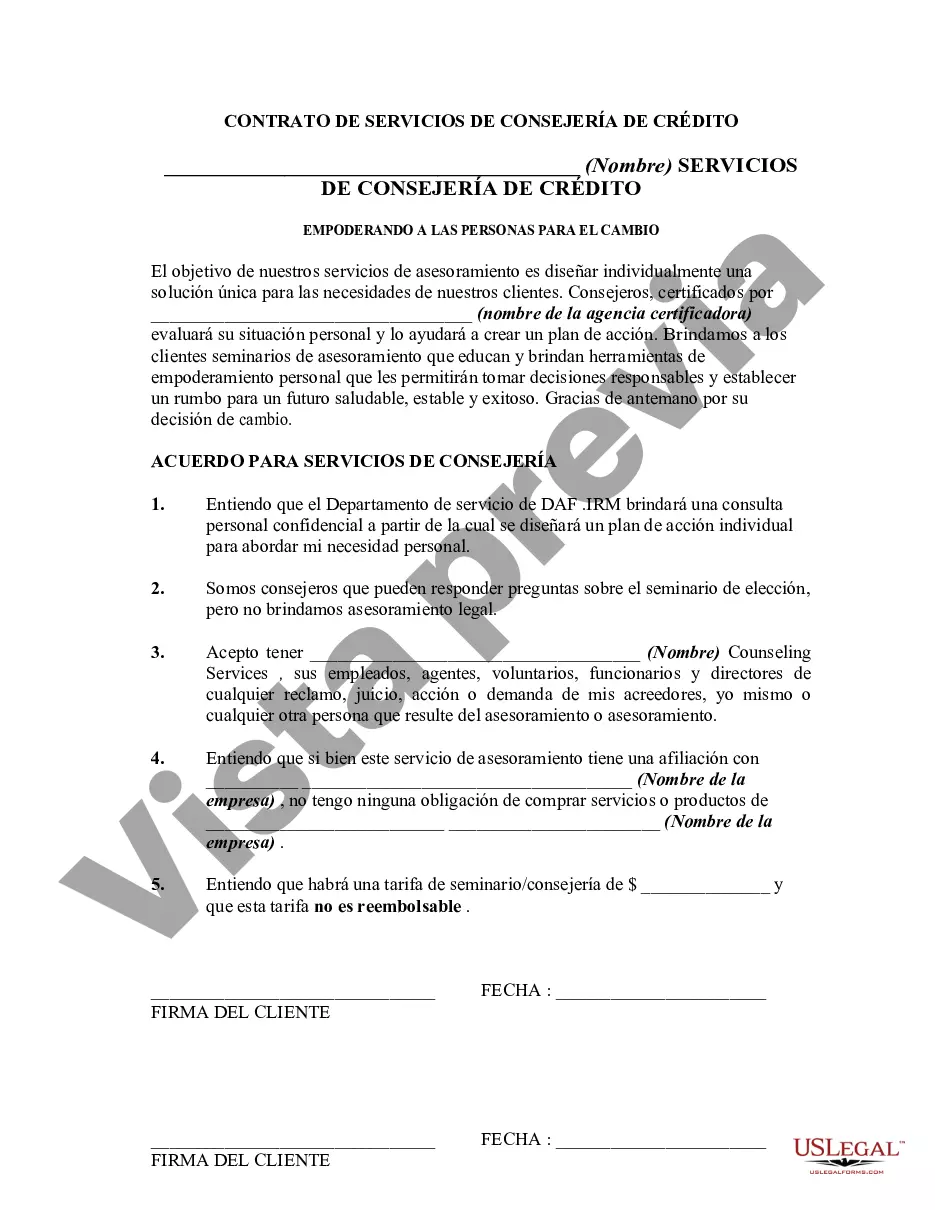

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Miami-Dade Florida Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions between a credit counseling agency and an individual seeking assistance with their financial situation. This agreement is designed to protect both parties involved and ensure that the credit counseling services provided are fair, transparent, and effective. Keywords: Miami-Dade Florida, agreement, credit counseling services, legal document, terms and conditions, financial situation, credit counseling agency, individual, assistance, protect, fair, transparent, effective. There are multiple types of Miami-Dade Florida Agreement for Credit Counseling Services, each catering to different individuals' needs and financial circumstances. Some common types include: 1. Debt management plan (DMP) agreement: This type of agreement is created when an individual with substantial unsecured debt seeks assistance from a credit counseling agency to develop a structured repayment plan. The agreement will outline the terms of the DMP, such as the monthly payment amount, interest rates, and creditor negotiations facilitated by the credit counseling agency. 2. Credit counseling education agreement: This agreement is designed for individuals who want to gain knowledge about managing their finances, budgeting, and improving their credit score. It may include participation in workshops, classes, or one-on-one counseling sessions to educate individuals on responsible financial practices. 3. Housing counseling agreement: Individuals seeking assistance with housing-related financial issues, such as foreclosure prevention, rental advice, or homebuyer education, may enter into a housing counseling agreement. This type of agreement will specify the services provided, including counseling sessions, information resources, or referrals to relevant organizations. 4. Bankruptcy counseling agreement: For individuals considering filing for bankruptcy, a credit counseling agency can provide mandatory pre-bankruptcy counseling. This agreement will identify the specific counseling services offered, such as assessment of financial circumstances, budgeting advice, and understanding the consequences of bankruptcy. It is important for individuals considering credit counseling services in Miami-Dade Florida to carefully review the agreement proposed by the credit counseling agency. Key aspects to consider include the fees, cancellation policies, confidentiality of personal information, dispute resolution mechanisms, and any guarantees or warranties provided by the agency. Seeking legal advice before signing the agreement is advisable to fully understand the rights and obligations of both parties involved. In conclusion, the Miami-Dade Florida Agreement for Credit Counseling Services plays a crucial role in safeguarding the interests of both the individual seeking assistance and the credit counseling agency. By clearly defining the terms and conditions, this agreement ensures a fair and effective provision of credit counseling services, ultimately helping individuals regain control of their financial situation.The Miami-Dade Florida Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions between a credit counseling agency and an individual seeking assistance with their financial situation. This agreement is designed to protect both parties involved and ensure that the credit counseling services provided are fair, transparent, and effective. Keywords: Miami-Dade Florida, agreement, credit counseling services, legal document, terms and conditions, financial situation, credit counseling agency, individual, assistance, protect, fair, transparent, effective. There are multiple types of Miami-Dade Florida Agreement for Credit Counseling Services, each catering to different individuals' needs and financial circumstances. Some common types include: 1. Debt management plan (DMP) agreement: This type of agreement is created when an individual with substantial unsecured debt seeks assistance from a credit counseling agency to develop a structured repayment plan. The agreement will outline the terms of the DMP, such as the monthly payment amount, interest rates, and creditor negotiations facilitated by the credit counseling agency. 2. Credit counseling education agreement: This agreement is designed for individuals who want to gain knowledge about managing their finances, budgeting, and improving their credit score. It may include participation in workshops, classes, or one-on-one counseling sessions to educate individuals on responsible financial practices. 3. Housing counseling agreement: Individuals seeking assistance with housing-related financial issues, such as foreclosure prevention, rental advice, or homebuyer education, may enter into a housing counseling agreement. This type of agreement will specify the services provided, including counseling sessions, information resources, or referrals to relevant organizations. 4. Bankruptcy counseling agreement: For individuals considering filing for bankruptcy, a credit counseling agency can provide mandatory pre-bankruptcy counseling. This agreement will identify the specific counseling services offered, such as assessment of financial circumstances, budgeting advice, and understanding the consequences of bankruptcy. It is important for individuals considering credit counseling services in Miami-Dade Florida to carefully review the agreement proposed by the credit counseling agency. Key aspects to consider include the fees, cancellation policies, confidentiality of personal information, dispute resolution mechanisms, and any guarantees or warranties provided by the agency. Seeking legal advice before signing the agreement is advisable to fully understand the rights and obligations of both parties involved. In conclusion, the Miami-Dade Florida Agreement for Credit Counseling Services plays a crucial role in safeguarding the interests of both the individual seeking assistance and the credit counseling agency. By clearly defining the terms and conditions, this agreement ensures a fair and effective provision of credit counseling services, ultimately helping individuals regain control of their financial situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.