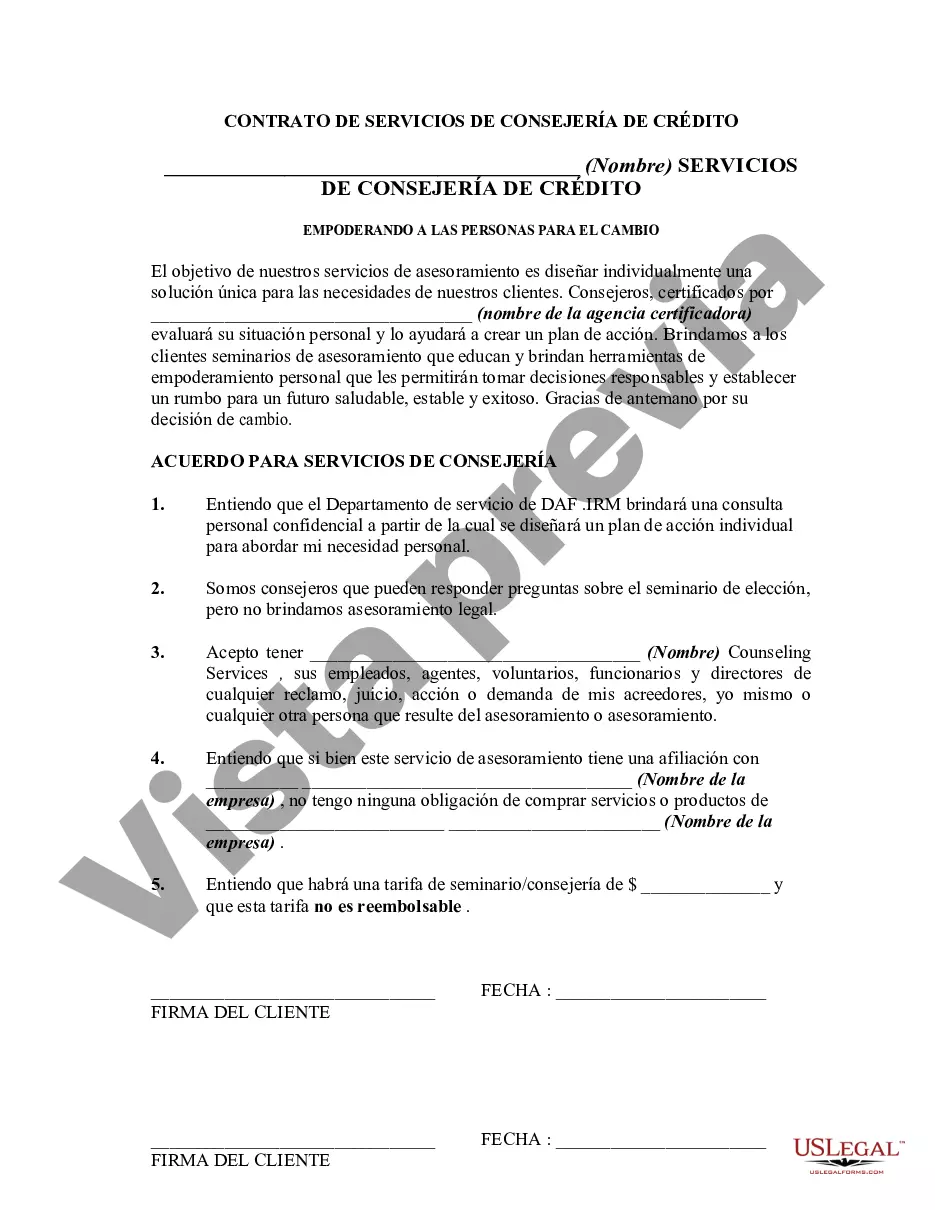

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

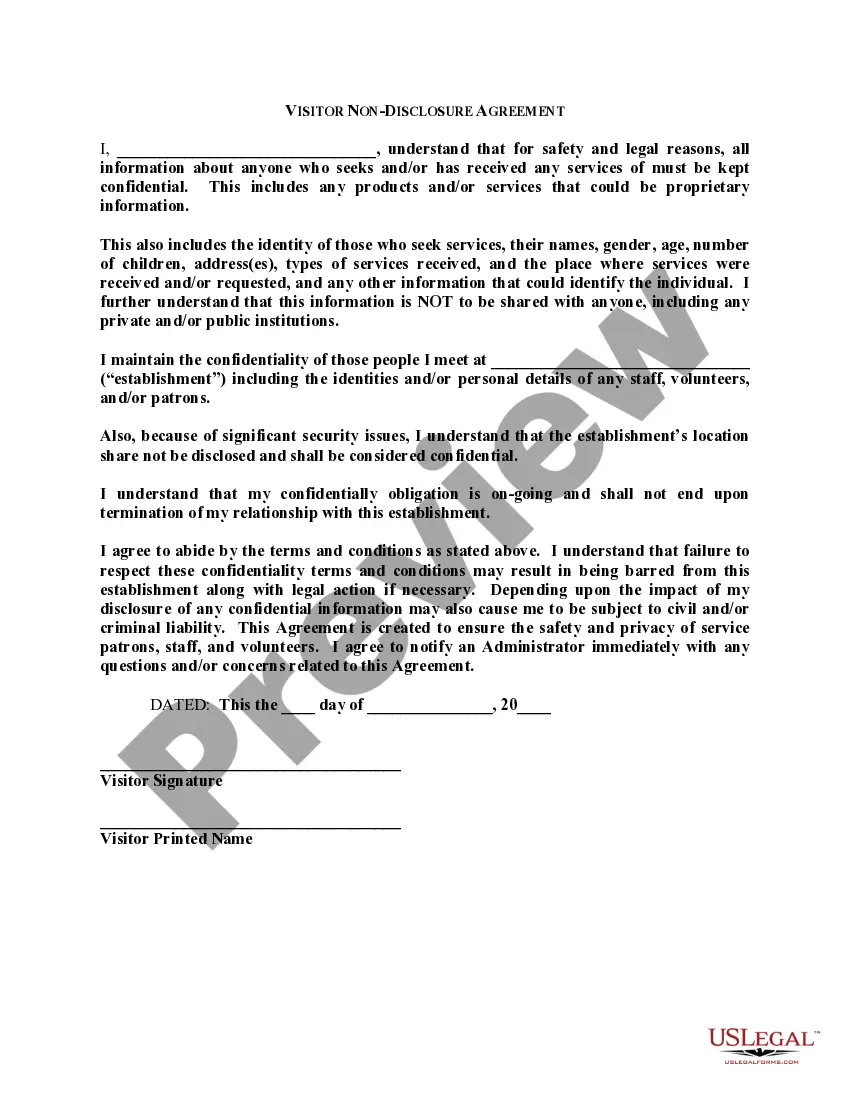

The Montgomery Maryland Agreement for Credit Counseling Services is a legally binding contract entered into by consumers residing in Montgomery County, Maryland, and credit counseling organizations. This agreement outlines the terms and conditions under which the credit counseling services will be provided to the consumer. Credit counseling services aim to assist individuals struggling with debt management and financial difficulties. By entering into the Montgomery Maryland Agreement for Credit Counseling Services, consumers can access professional guidance, budgeting assistance, and debt repayment plans tailored to their specific financial situation. This agreement typically includes key provisions such as: 1. Services Offered: The agreement delineates the range of credit counseling services offered by the organization, which may include financial education, budget counseling, debt management planning, and credit report review. 2. Confidentiality: The agreement emphasizes the confidentiality of all client information, ensuring that personal and financial details are securely protected and not disclosed to any unauthorized parties. 3. Fees and Payment: The agreement details the fees associated with the credit counseling services, including an explanation of how these fees are determined and the acceptable payment methods. Additionally, it may outline any financial assistance options available to economically disadvantaged clients. 4. Rights and Responsibilities: The agreement elucidates the rights and responsibilities of both the consumer and the credit counseling organization. It may specify that the consumer has the right to be informed about alternative options, decline any recommended service, and terminate the agreement at any time. 5. Dispute Resolution: In cases where disputes or disagreements arise between the consumer and the credit counseling organization, the agreement may lay out a process for resolving such issues, which may include mediation or arbitration. Different types of Montgomery Maryland Agreements for Credit Counseling Services may exist depending on the specific services offered by the organization or the target audience they serve. These may include: 1. Personal Credit Counseling Agreement: Tailored to individuals seeking assistance with personal debt management and financial planning. 2. Business Credit Counseling Agreement: Designed for entrepreneurs or business owners requiring credit counseling services to manage debt and improve the financial health of their enterprise. 3. Housing Credit Counseling Agreement: Geared towards individuals facing challenges related to mortgage payments, foreclosure, or rental assistance. In conclusion, the Montgomery Maryland Agreement for Credit Counseling Services provides a framework for the provision of credit counseling services in Montgomery County. It sets forth the obligations, rights, and responsibilities of both the consumer and the credit counseling organization and ensures that the consumer receives professional assistance in managing their debt and improving their financial well-being.The Montgomery Maryland Agreement for Credit Counseling Services is a legally binding contract entered into by consumers residing in Montgomery County, Maryland, and credit counseling organizations. This agreement outlines the terms and conditions under which the credit counseling services will be provided to the consumer. Credit counseling services aim to assist individuals struggling with debt management and financial difficulties. By entering into the Montgomery Maryland Agreement for Credit Counseling Services, consumers can access professional guidance, budgeting assistance, and debt repayment plans tailored to their specific financial situation. This agreement typically includes key provisions such as: 1. Services Offered: The agreement delineates the range of credit counseling services offered by the organization, which may include financial education, budget counseling, debt management planning, and credit report review. 2. Confidentiality: The agreement emphasizes the confidentiality of all client information, ensuring that personal and financial details are securely protected and not disclosed to any unauthorized parties. 3. Fees and Payment: The agreement details the fees associated with the credit counseling services, including an explanation of how these fees are determined and the acceptable payment methods. Additionally, it may outline any financial assistance options available to economically disadvantaged clients. 4. Rights and Responsibilities: The agreement elucidates the rights and responsibilities of both the consumer and the credit counseling organization. It may specify that the consumer has the right to be informed about alternative options, decline any recommended service, and terminate the agreement at any time. 5. Dispute Resolution: In cases where disputes or disagreements arise between the consumer and the credit counseling organization, the agreement may lay out a process for resolving such issues, which may include mediation or arbitration. Different types of Montgomery Maryland Agreements for Credit Counseling Services may exist depending on the specific services offered by the organization or the target audience they serve. These may include: 1. Personal Credit Counseling Agreement: Tailored to individuals seeking assistance with personal debt management and financial planning. 2. Business Credit Counseling Agreement: Designed for entrepreneurs or business owners requiring credit counseling services to manage debt and improve the financial health of their enterprise. 3. Housing Credit Counseling Agreement: Geared towards individuals facing challenges related to mortgage payments, foreclosure, or rental assistance. In conclusion, the Montgomery Maryland Agreement for Credit Counseling Services provides a framework for the provision of credit counseling services in Montgomery County. It sets forth the obligations, rights, and responsibilities of both the consumer and the credit counseling organization and ensures that the consumer receives professional assistance in managing their debt and improving their financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.