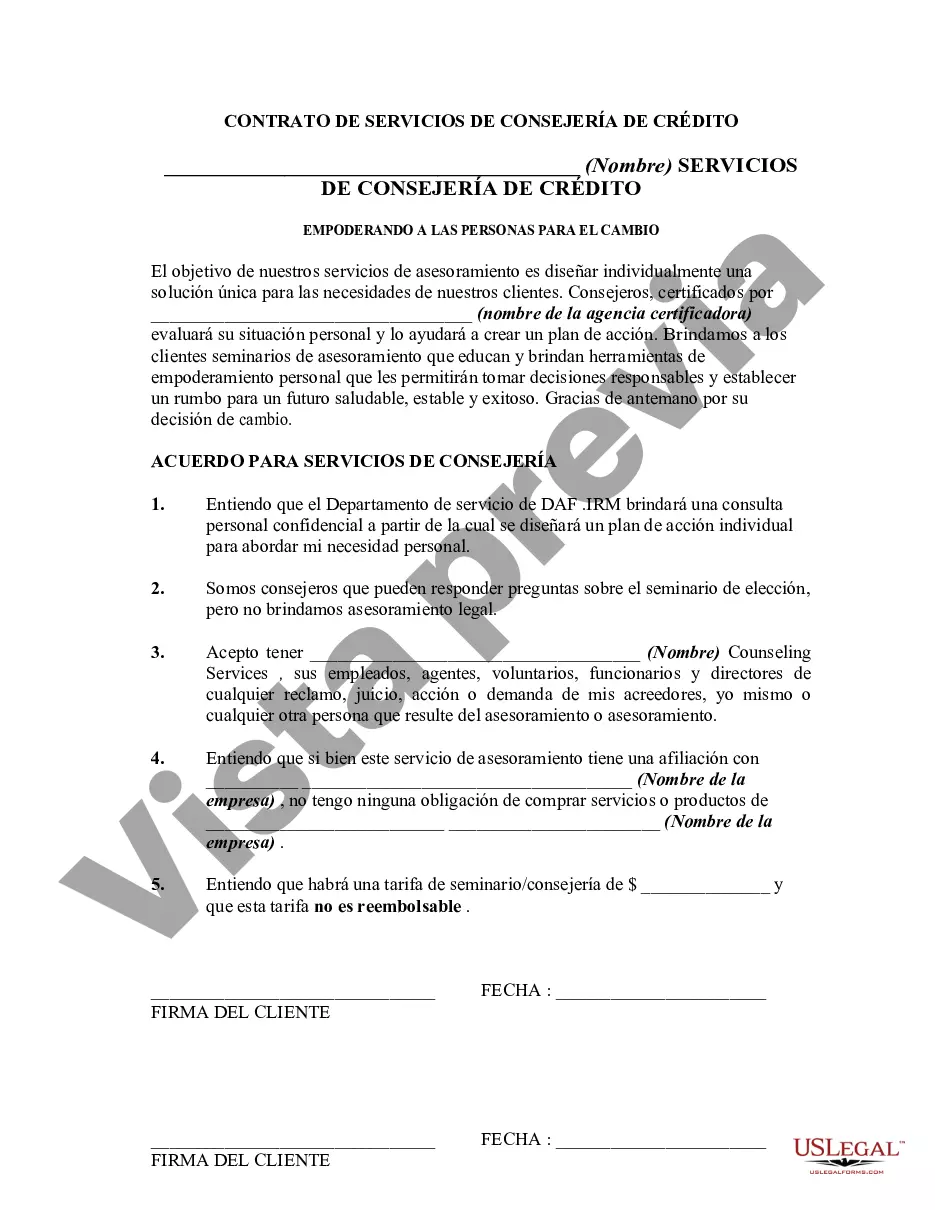

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Orange California Agreement for Credit Counseling Services is a legal document that establishes a formal arrangement between a credit counseling agency and an individual seeking assistance with their credit and financial situation. This agreement outlines the terms and conditions under which the services will be provided and the responsibilities of both parties involved. Keywords: Orange California, Agreement, Credit Counseling Services, credit counseling agency, credit and financial situation, terms and conditions, responsibilities. There are different types of Orange California Agreement for Credit Counseling Services, namely: 1. Debt Management Plan (DMP) Agreement: This type of agreement focuses on developing a personalized plan to manage and repay debts effectively. It involves the credit counseling agency negotiating with creditors to establish revised payment terms and lower interest rates for the individual. 2. Financial Education Agreement: This agreement emphasizes the educational aspect of credit counseling services. It involves providing the individual with resources, tools, and guidance to improve their financial literacy, budgeting skills, and money management practices. 3. Budget Counseling Agreement: This type of agreement primarily focuses on assisting individuals in creating a personalized budget plan to better manage their finances. The credit counseling agency will work with the individual to understand their income, expenses, debts, and financial goals to establish a comprehensive budgeting strategy. 4. Credit Report Review Agreement: This agreement is designed to help individuals understand and analyze their credit reports. The credit counseling agency will review the individual's credit report, identify any errors or discrepancies, and offer guidance on improving their credit score and overall creditworthiness. 5. Foreclosure Prevention Agreement: This particular agreement is intended for individuals facing the risk of foreclosure on their homes. The credit counseling agency will assist the individual in exploring options to avoid foreclosure, such as loan modification, refinancing, or other alternatives. Overall, the Orange California Agreement for Credit Counseling Services aims to provide individuals with the necessary tools, knowledge, and support to develop sound financial habits, effectively manage their credit, and ultimately achieve long-term financial stability.The Orange California Agreement for Credit Counseling Services is a legal document that establishes a formal arrangement between a credit counseling agency and an individual seeking assistance with their credit and financial situation. This agreement outlines the terms and conditions under which the services will be provided and the responsibilities of both parties involved. Keywords: Orange California, Agreement, Credit Counseling Services, credit counseling agency, credit and financial situation, terms and conditions, responsibilities. There are different types of Orange California Agreement for Credit Counseling Services, namely: 1. Debt Management Plan (DMP) Agreement: This type of agreement focuses on developing a personalized plan to manage and repay debts effectively. It involves the credit counseling agency negotiating with creditors to establish revised payment terms and lower interest rates for the individual. 2. Financial Education Agreement: This agreement emphasizes the educational aspect of credit counseling services. It involves providing the individual with resources, tools, and guidance to improve their financial literacy, budgeting skills, and money management practices. 3. Budget Counseling Agreement: This type of agreement primarily focuses on assisting individuals in creating a personalized budget plan to better manage their finances. The credit counseling agency will work with the individual to understand their income, expenses, debts, and financial goals to establish a comprehensive budgeting strategy. 4. Credit Report Review Agreement: This agreement is designed to help individuals understand and analyze their credit reports. The credit counseling agency will review the individual's credit report, identify any errors or discrepancies, and offer guidance on improving their credit score and overall creditworthiness. 5. Foreclosure Prevention Agreement: This particular agreement is intended for individuals facing the risk of foreclosure on their homes. The credit counseling agency will assist the individual in exploring options to avoid foreclosure, such as loan modification, refinancing, or other alternatives. Overall, the Orange California Agreement for Credit Counseling Services aims to provide individuals with the necessary tools, knowledge, and support to develop sound financial habits, effectively manage their credit, and ultimately achieve long-term financial stability.

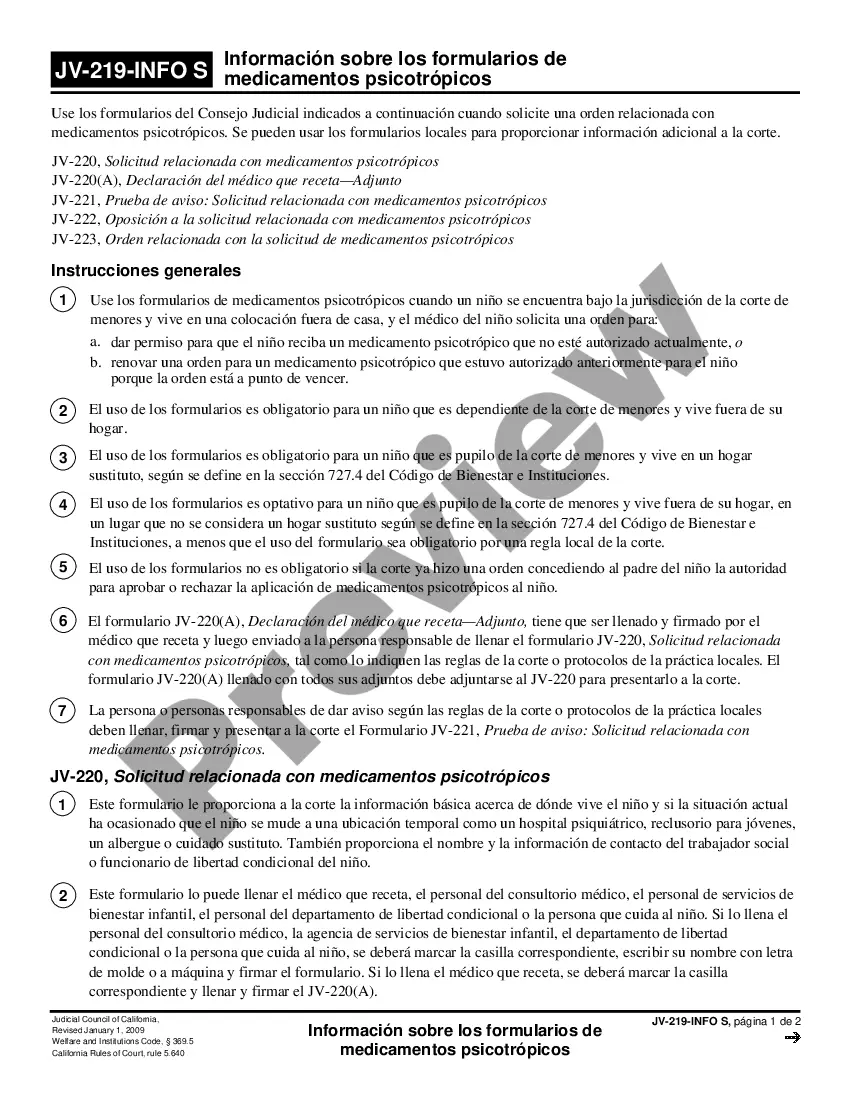

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.