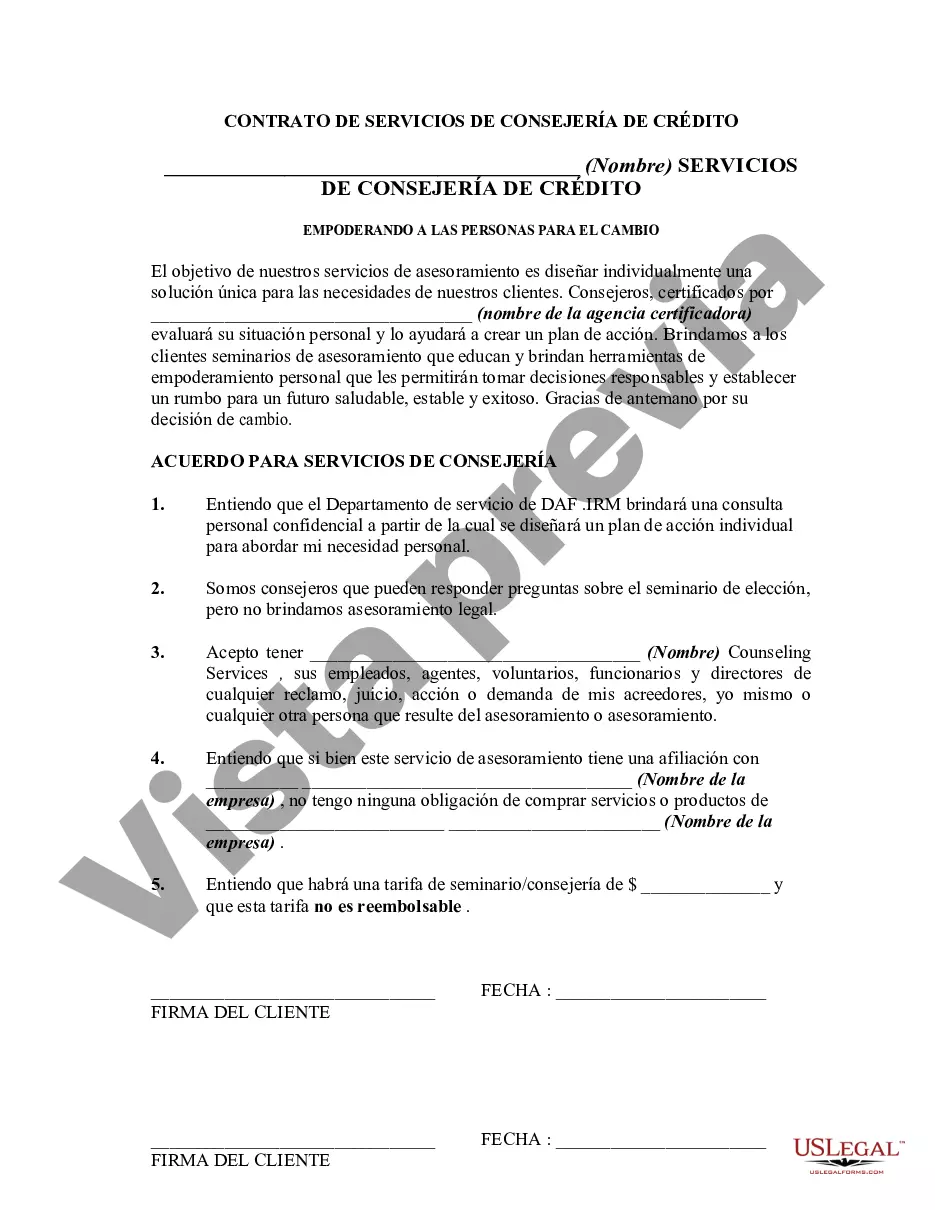

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Queens New York Agreement for Credit Counseling Services: A Comprehensive Overview Credit counseling services play a crucial role in assisting individuals who are burdened by debt, providing them with the necessary tools and strategies to regain control over their finances. In Queens, New York, the Queens New York Agreement for Credit Counseling Services is designed to offer residents reliable and professional support in managing their debt. This agreement is tailored to the unique financial challenges faced by individuals in the borough of Queens, ensuring that they receive targeted assistance. The Queens New York Agreement for Credit Counseling Services encompasses a range of services aimed at educating individuals on debt management and financial literacy. These services are typically provided by certified credit counselors who possess the expertise to guide clients through their specific financial situations. With their help, clients can develop a deep understanding of their debt, create budgets, and learn effective money management techniques. The agreement offers various types of credit counseling services to address diverse needs and circumstances: 1. Debt Management Programs (Dumps): Dumps are designed for individuals struggling with overwhelming debt. Through this type of credit counseling service, clients work closely with their credit counselor to consolidate their debts into a single monthly payment plan. Making payments through a DMP helps individuals repay their debts efficiently, based on their financial abilities and the negotiated terms with creditors. 2. Budgeting and Financial Education: This type of credit counseling service focuses on empowering individuals with the knowledge and tools necessary for successful budgeting and financial management. Credit counselors guide clients in creating personalized budgets, tracking expenses, understanding credit reports, and improving credit scores. By enhancing financial literacy, individuals are better equipped to make informed financial decisions for their future. 3. Housing Counseling: For individuals facing challenges related to their mortgage or rental obligations, the Queens New York Agreement includes housing counseling services. Credit counselors provide guidance on navigating foreclosure prevention, negotiating loan modifications, understanding the rental market, and accessing affordable housing options. This form of counseling ensures that individuals can maintain their housing stability while managing their financial difficulties. 4. Bankruptcy Counseling: In situations where individuals explore bankruptcy as a potential solution, credit counseling services cover this area as well. The counselors provide comprehensive information on the bankruptcy process, including the required steps, potential consequences, and alternatives to bankruptcy. By obtaining bankruptcy counseling, individuals can make informed decisions regarding debt relief options. As part of this agreement, credit counseling services in Queens, New York, prioritize the integrity and professionalism of the counselors. This ensures individuals receive the highest quality counseling, tailored to their specific financial circumstances. The agreement also emphasizes the importance of confidentiality and compliance with relevant laws and regulations. In summary, the Queens New York Agreement for Credit Counseling Services comprises various types of counseling programs and services designed to assist individuals in managing their debt effectively. By offering debt management programs, budgeting support, housing counseling, and bankruptcy counseling, the agreement provides comprehensive solutions to the diverse financial challenges faced by residents of Queens, New York.Queens New York Agreement for Credit Counseling Services: A Comprehensive Overview Credit counseling services play a crucial role in assisting individuals who are burdened by debt, providing them with the necessary tools and strategies to regain control over their finances. In Queens, New York, the Queens New York Agreement for Credit Counseling Services is designed to offer residents reliable and professional support in managing their debt. This agreement is tailored to the unique financial challenges faced by individuals in the borough of Queens, ensuring that they receive targeted assistance. The Queens New York Agreement for Credit Counseling Services encompasses a range of services aimed at educating individuals on debt management and financial literacy. These services are typically provided by certified credit counselors who possess the expertise to guide clients through their specific financial situations. With their help, clients can develop a deep understanding of their debt, create budgets, and learn effective money management techniques. The agreement offers various types of credit counseling services to address diverse needs and circumstances: 1. Debt Management Programs (Dumps): Dumps are designed for individuals struggling with overwhelming debt. Through this type of credit counseling service, clients work closely with their credit counselor to consolidate their debts into a single monthly payment plan. Making payments through a DMP helps individuals repay their debts efficiently, based on their financial abilities and the negotiated terms with creditors. 2. Budgeting and Financial Education: This type of credit counseling service focuses on empowering individuals with the knowledge and tools necessary for successful budgeting and financial management. Credit counselors guide clients in creating personalized budgets, tracking expenses, understanding credit reports, and improving credit scores. By enhancing financial literacy, individuals are better equipped to make informed financial decisions for their future. 3. Housing Counseling: For individuals facing challenges related to their mortgage or rental obligations, the Queens New York Agreement includes housing counseling services. Credit counselors provide guidance on navigating foreclosure prevention, negotiating loan modifications, understanding the rental market, and accessing affordable housing options. This form of counseling ensures that individuals can maintain their housing stability while managing their financial difficulties. 4. Bankruptcy Counseling: In situations where individuals explore bankruptcy as a potential solution, credit counseling services cover this area as well. The counselors provide comprehensive information on the bankruptcy process, including the required steps, potential consequences, and alternatives to bankruptcy. By obtaining bankruptcy counseling, individuals can make informed decisions regarding debt relief options. As part of this agreement, credit counseling services in Queens, New York, prioritize the integrity and professionalism of the counselors. This ensures individuals receive the highest quality counseling, tailored to their specific financial circumstances. The agreement also emphasizes the importance of confidentiality and compliance with relevant laws and regulations. In summary, the Queens New York Agreement for Credit Counseling Services comprises various types of counseling programs and services designed to assist individuals in managing their debt effectively. By offering debt management programs, budgeting support, housing counseling, and bankruptcy counseling, the agreement provides comprehensive solutions to the diverse financial challenges faced by residents of Queens, New York.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.