This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Salt Lake Utah Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions between a credit counseling agency and a consumer seeking assistance with their personal finances. This agreement sets the foundation for a professional relationship and establishes the obligations and responsibilities of both parties involved. Credit counseling services aim to provide guidance and support to individuals who are facing financial challenges, such as excessive debt, poor credit management, or budgeting problems. By entering into this agreement, consumers can benefit from the expertise of credit counselors who will evaluate their financial situation, develop a personalized action plan, and provide ongoing support throughout the process. Key elements often found in a Salt Lake Utah Agreement for Credit Counseling Services include detailed information about the services to be provided. These may encompass debt analysis, budgeting assistance, financial education, negotiation with creditors, and developing strategies for debt repayment or management. The agreement typically outlines the specific duration of the counseling relationship, the fees associated with the services, and the confidentiality measures in place to protect the consumer's personal and financial information. Different types of Salt Lake Utah Agreements for Credit Counseling Services may vary based on the credit counseling agency and the specific services offered. Some agencies might focus solely on credit counseling, providing educational resources and tools to ensure individuals gain knowledge about managing their finances effectively. Others may offer more comprehensive services, such as debt management plans (Dumps), which involve negotiations with creditors to reduce interest rates and create a structured repayment plan. Additionally, some credit counseling agencies in Salt Lake Utah may specialize in specific areas, including housing counseling, bankruptcy counseling, or student loan counseling. These specialized services address unique financial challenges faced by consumers and provide tailored strategies and advice to navigate through these particular circumstances. Overall, the Salt Lake Utah Agreement for Credit Counseling Services serves as an essential document that protects the rights of both the consumer and the credit counseling agency, ensuring a transparent and mutually beneficial relationship. By seeking professional assistance and adhering to an agreement, individuals can work towards improving their financial well-being and achieving long-term financial stability.The Salt Lake Utah Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions between a credit counseling agency and a consumer seeking assistance with their personal finances. This agreement sets the foundation for a professional relationship and establishes the obligations and responsibilities of both parties involved. Credit counseling services aim to provide guidance and support to individuals who are facing financial challenges, such as excessive debt, poor credit management, or budgeting problems. By entering into this agreement, consumers can benefit from the expertise of credit counselors who will evaluate their financial situation, develop a personalized action plan, and provide ongoing support throughout the process. Key elements often found in a Salt Lake Utah Agreement for Credit Counseling Services include detailed information about the services to be provided. These may encompass debt analysis, budgeting assistance, financial education, negotiation with creditors, and developing strategies for debt repayment or management. The agreement typically outlines the specific duration of the counseling relationship, the fees associated with the services, and the confidentiality measures in place to protect the consumer's personal and financial information. Different types of Salt Lake Utah Agreements for Credit Counseling Services may vary based on the credit counseling agency and the specific services offered. Some agencies might focus solely on credit counseling, providing educational resources and tools to ensure individuals gain knowledge about managing their finances effectively. Others may offer more comprehensive services, such as debt management plans (Dumps), which involve negotiations with creditors to reduce interest rates and create a structured repayment plan. Additionally, some credit counseling agencies in Salt Lake Utah may specialize in specific areas, including housing counseling, bankruptcy counseling, or student loan counseling. These specialized services address unique financial challenges faced by consumers and provide tailored strategies and advice to navigate through these particular circumstances. Overall, the Salt Lake Utah Agreement for Credit Counseling Services serves as an essential document that protects the rights of both the consumer and the credit counseling agency, ensuring a transparent and mutually beneficial relationship. By seeking professional assistance and adhering to an agreement, individuals can work towards improving their financial well-being and achieving long-term financial stability.

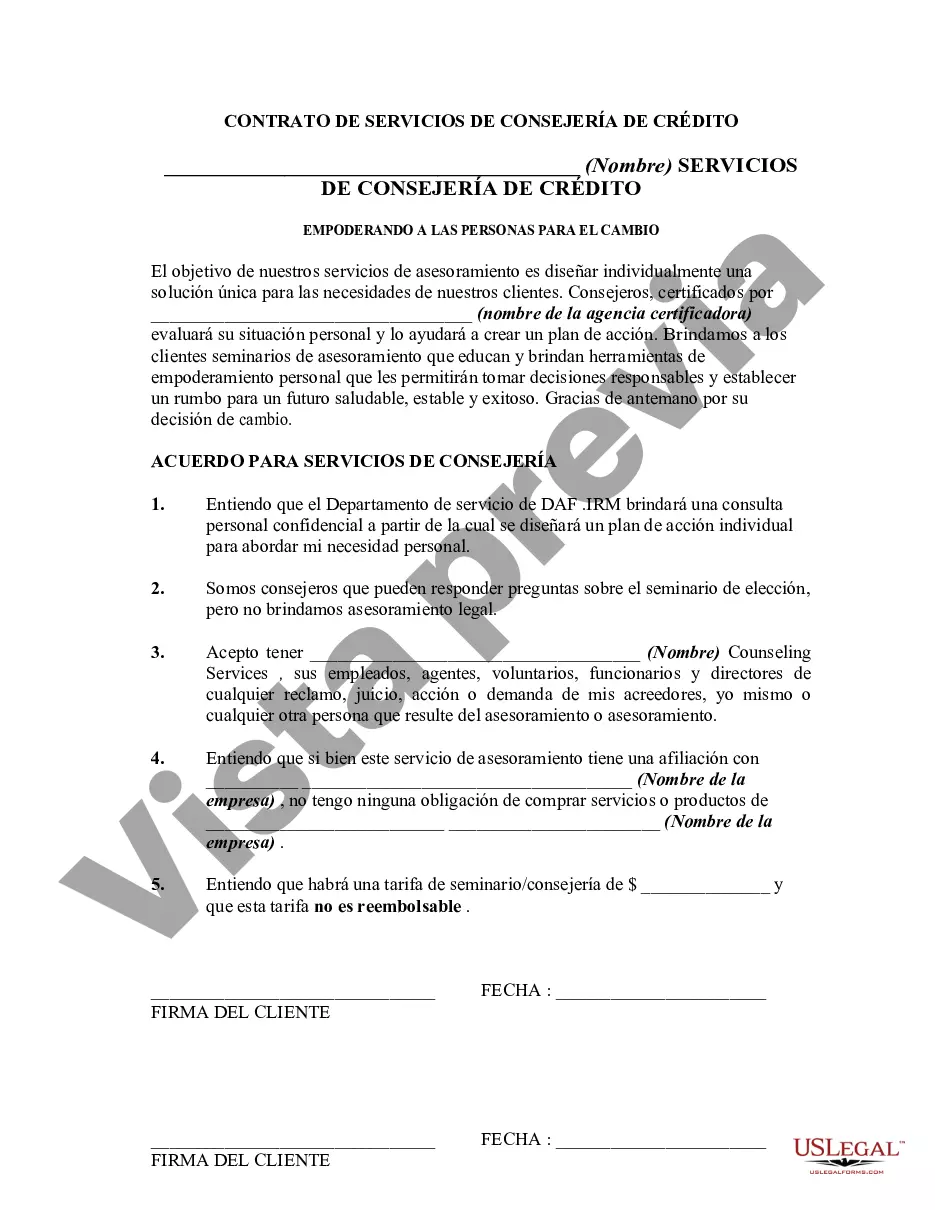

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.