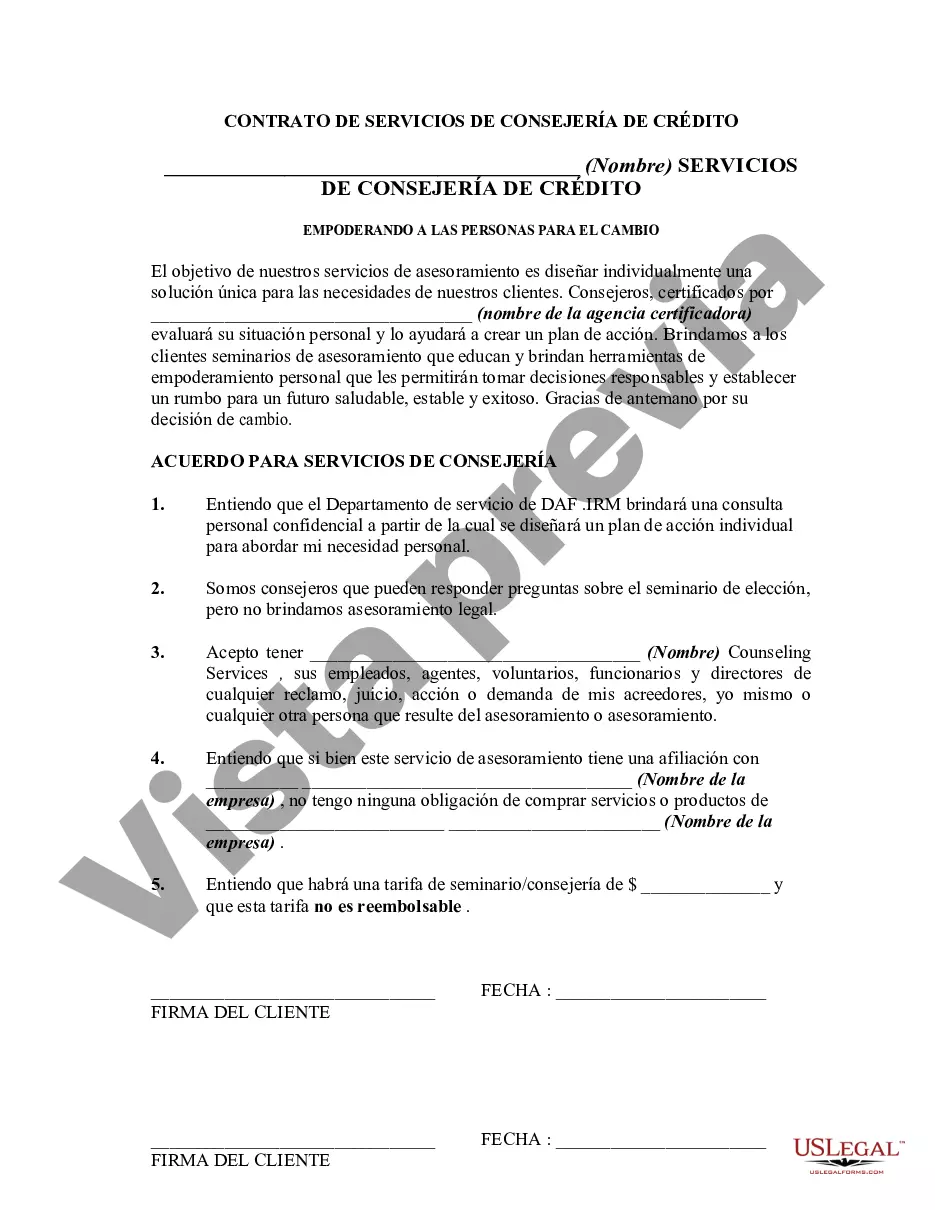

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Travis Texas Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between a credit counseling agency and a consumer seeking professional guidance and assistance in managing their debt, improving credit scores, and achieving financial stability. The agreement sets forth the rights and responsibilities of both parties involved in the credit counseling process. Keywords: Travis Texas Agreement, Credit Counseling Services, detailed description, types. The Travis Texas Agreement for Credit Counseling Services typically includes the following sections: 1. Parties: This section identifies the credit counseling agency, including its name, address, contact information, and license details, as well as the consumer's full name, address, and contact information. 2. Services Offered: This section describes the range of services provided by the credit counseling agency, which may vary depending on the specific agreement type. a. Debt Management Plan (DMP): A DMP is a popular credit counseling service offered to consumers struggling with multiple debts. It involves the credit counseling agency negotiating with creditors to reduce interest rates, waive fees, and create a structured repayment plan. b. Budgeting and Financial Coaching: Some credit counseling agencies provide assistance in creating personalized budgets, improving money management skills, and offering financial education courses to promote long-term financial stability. c. Credit Report Analysis: This service involves reviewing the consumer's credit report, identifying inaccuracies or errors, and providing guidance on how to dispute and correct them. It may also include strategies to improve credit scores. d. Housing Counseling: Certain credit counseling agencies specialize in housing counseling services, assisting consumers with mortgage-related concerns, foreclosure prevention, and mortgage loan modification assistance. 3. Fees and Payment: This section outlines the fees associated with the credit counseling services, including any initial setup fees, monthly maintenance fees for the Debt Management Plan, counseling session fees, and other charges. It also details the accepted payment methods and billing cycles. 4. Confidentiality and Privacy: This section ensures that all the information shared between the consumer and the credit counseling agency remains strictly confidential and complies with applicable privacy laws and regulations. 5. Termination and Cancellation: The agreement specifies the conditions and procedures for terminating or canceling the credit counseling services by either party, along with any potential refunds or penalties. 6. Legal Disclosures: This section includes various legal disclosures required by state or federal laws, informing the consumer about their rights, the agency's certification or accreditation status, any potential risks associated with credit counseling, and consumer protection laws. It is worth noting that the above description provides a general overview of the Travis Texas Agreement for Credit Counseling Services, and specific details and clauses may vary based on the credit counseling agency and the type of agreement chosen. It is essential for consumers to carefully review the agreement and consult with a legal professional if needed, to have a comprehensive understanding of their rights and responsibilities before entering into the agreement.Travis Texas Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between a credit counseling agency and a consumer seeking professional guidance and assistance in managing their debt, improving credit scores, and achieving financial stability. The agreement sets forth the rights and responsibilities of both parties involved in the credit counseling process. Keywords: Travis Texas Agreement, Credit Counseling Services, detailed description, types. The Travis Texas Agreement for Credit Counseling Services typically includes the following sections: 1. Parties: This section identifies the credit counseling agency, including its name, address, contact information, and license details, as well as the consumer's full name, address, and contact information. 2. Services Offered: This section describes the range of services provided by the credit counseling agency, which may vary depending on the specific agreement type. a. Debt Management Plan (DMP): A DMP is a popular credit counseling service offered to consumers struggling with multiple debts. It involves the credit counseling agency negotiating with creditors to reduce interest rates, waive fees, and create a structured repayment plan. b. Budgeting and Financial Coaching: Some credit counseling agencies provide assistance in creating personalized budgets, improving money management skills, and offering financial education courses to promote long-term financial stability. c. Credit Report Analysis: This service involves reviewing the consumer's credit report, identifying inaccuracies or errors, and providing guidance on how to dispute and correct them. It may also include strategies to improve credit scores. d. Housing Counseling: Certain credit counseling agencies specialize in housing counseling services, assisting consumers with mortgage-related concerns, foreclosure prevention, and mortgage loan modification assistance. 3. Fees and Payment: This section outlines the fees associated with the credit counseling services, including any initial setup fees, monthly maintenance fees for the Debt Management Plan, counseling session fees, and other charges. It also details the accepted payment methods and billing cycles. 4. Confidentiality and Privacy: This section ensures that all the information shared between the consumer and the credit counseling agency remains strictly confidential and complies with applicable privacy laws and regulations. 5. Termination and Cancellation: The agreement specifies the conditions and procedures for terminating or canceling the credit counseling services by either party, along with any potential refunds or penalties. 6. Legal Disclosures: This section includes various legal disclosures required by state or federal laws, informing the consumer about their rights, the agency's certification or accreditation status, any potential risks associated with credit counseling, and consumer protection laws. It is worth noting that the above description provides a general overview of the Travis Texas Agreement for Credit Counseling Services, and specific details and clauses may vary based on the credit counseling agency and the type of agreement chosen. It is essential for consumers to carefully review the agreement and consult with a legal professional if needed, to have a comprehensive understanding of their rights and responsibilities before entering into the agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.