This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cook Illinois Privacy and Confidentiality Policy for Credit Counseling Services is an essential document that outlines the organization's commitment to protecting the privacy and confidentiality of its clients' information during credit counseling sessions. With robust safeguards in place, Cook Illinois ensures that clients' personal and financial details are handled securely and kept confidential. The Privacy and Confidentiality Policy for Credit Counseling Services provided by Cook Illinois encompasses various key aspects, including data collection, storage, usage, sharing, and retention. By strictly adhering to industry best practices and legal requirements, Cook Illinois guarantees the utmost privacy protection for its clients. Keywords: Cook Illinois, privacy policy, confidentiality policy, credit counseling services, data protection, privacy protection, confidential information, secure data handling, personal details, financial details, client information, privacy safeguards, confidentiality assurance, data collection, data storage, data usage, data sharing, data retention. Different types of Cook Illinois Privacy and Confidentiality Policies for Credit Counseling Services: 1. General Privacy and Confidentiality Policy: This policy provides an overview of Cook Illinois' commitment to maintaining privacy and confidentiality for credit counseling services. It covers the organization's practices regarding data handling and security measures without going into specific details. 2. Data Collection and Usage Policy: This policy outlines Cook Illinois' approach to collecting client information during credit counseling sessions and the intended purpose behind its usage. It clearly defines the types of data collected, such as personal identification details and financial records, along with the methods employed for data collection. 3. Data Storage and Security Policy: This policy highlights Cook Illinois' procedures for securely storing client data. It discusses the measures taken to protect information against unauthorized access, misuse, loss, or alteration. This policy also addresses the use of encryption, firewalls, and other security technologies to ensure data safety. 4. Data Sharing and Disclosure Policy: Cook Illinois' Data Sharing and Disclosure Policy lays out the circumstances under which client information may be shared with third parties, such as creditors or credit bureaus. Moreover, it specifies the protocols for obtaining client consent before sharing any confidential information and the legal obligations involved. 5. Data Retention and Destruction Policy: This policy outlines Cook Illinois' guidelines regarding the retention and destruction of client data. It defines the duration for holding client information after credit counseling services are provided and the protocols followed for data disposal to prevent unauthorized access or accidental disclosure. By categorizing and addressing these different aspects of privacy and confidentiality, Cook Illinois ensures a comprehensive framework that protects its clients' sensitive information throughout the credit counseling process.Cook Illinois Privacy and Confidentiality Policy for Credit Counseling Services is an essential document that outlines the organization's commitment to protecting the privacy and confidentiality of its clients' information during credit counseling sessions. With robust safeguards in place, Cook Illinois ensures that clients' personal and financial details are handled securely and kept confidential. The Privacy and Confidentiality Policy for Credit Counseling Services provided by Cook Illinois encompasses various key aspects, including data collection, storage, usage, sharing, and retention. By strictly adhering to industry best practices and legal requirements, Cook Illinois guarantees the utmost privacy protection for its clients. Keywords: Cook Illinois, privacy policy, confidentiality policy, credit counseling services, data protection, privacy protection, confidential information, secure data handling, personal details, financial details, client information, privacy safeguards, confidentiality assurance, data collection, data storage, data usage, data sharing, data retention. Different types of Cook Illinois Privacy and Confidentiality Policies for Credit Counseling Services: 1. General Privacy and Confidentiality Policy: This policy provides an overview of Cook Illinois' commitment to maintaining privacy and confidentiality for credit counseling services. It covers the organization's practices regarding data handling and security measures without going into specific details. 2. Data Collection and Usage Policy: This policy outlines Cook Illinois' approach to collecting client information during credit counseling sessions and the intended purpose behind its usage. It clearly defines the types of data collected, such as personal identification details and financial records, along with the methods employed for data collection. 3. Data Storage and Security Policy: This policy highlights Cook Illinois' procedures for securely storing client data. It discusses the measures taken to protect information against unauthorized access, misuse, loss, or alteration. This policy also addresses the use of encryption, firewalls, and other security technologies to ensure data safety. 4. Data Sharing and Disclosure Policy: Cook Illinois' Data Sharing and Disclosure Policy lays out the circumstances under which client information may be shared with third parties, such as creditors or credit bureaus. Moreover, it specifies the protocols for obtaining client consent before sharing any confidential information and the legal obligations involved. 5. Data Retention and Destruction Policy: This policy outlines Cook Illinois' guidelines regarding the retention and destruction of client data. It defines the duration for holding client information after credit counseling services are provided and the protocols followed for data disposal to prevent unauthorized access or accidental disclosure. By categorizing and addressing these different aspects of privacy and confidentiality, Cook Illinois ensures a comprehensive framework that protects its clients' sensitive information throughout the credit counseling process.

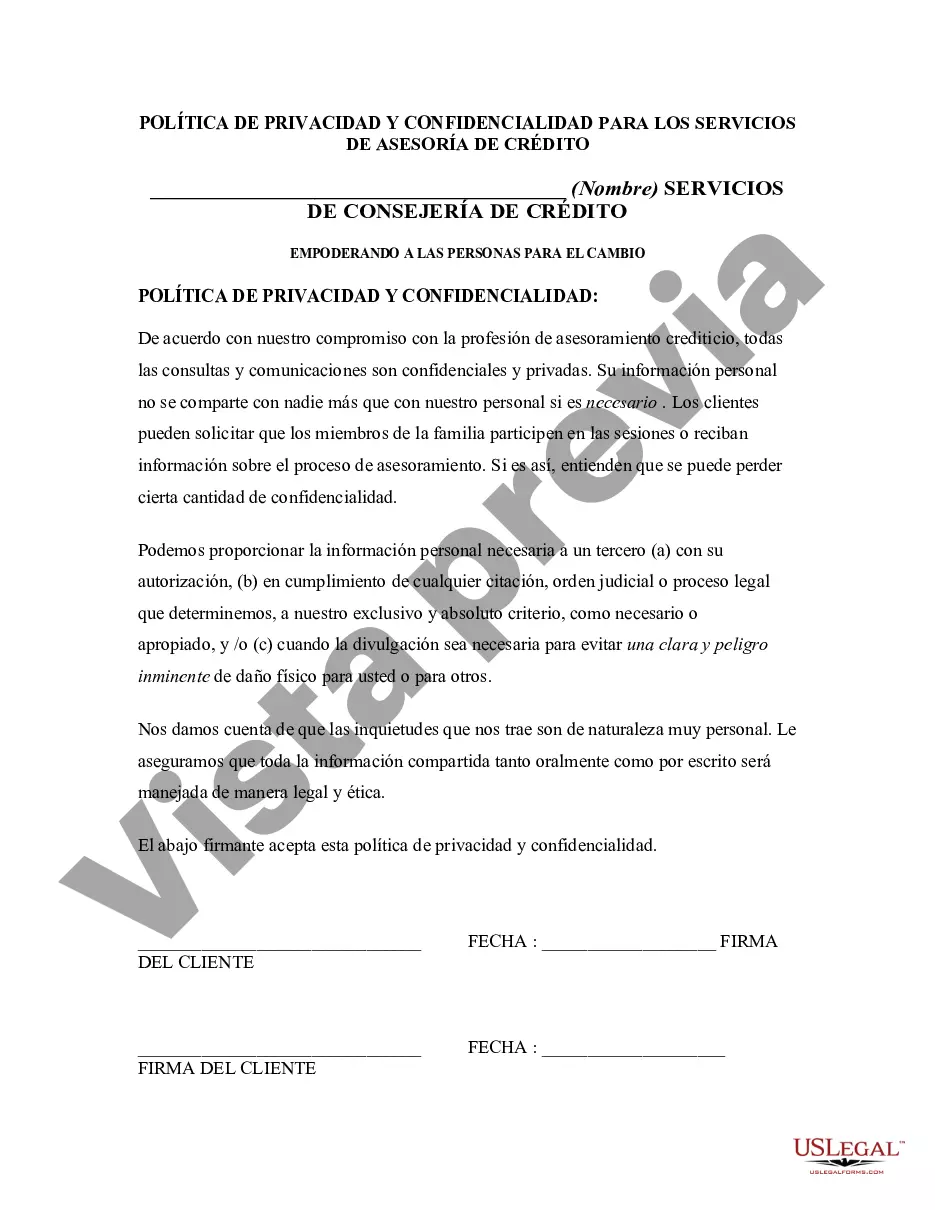

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.