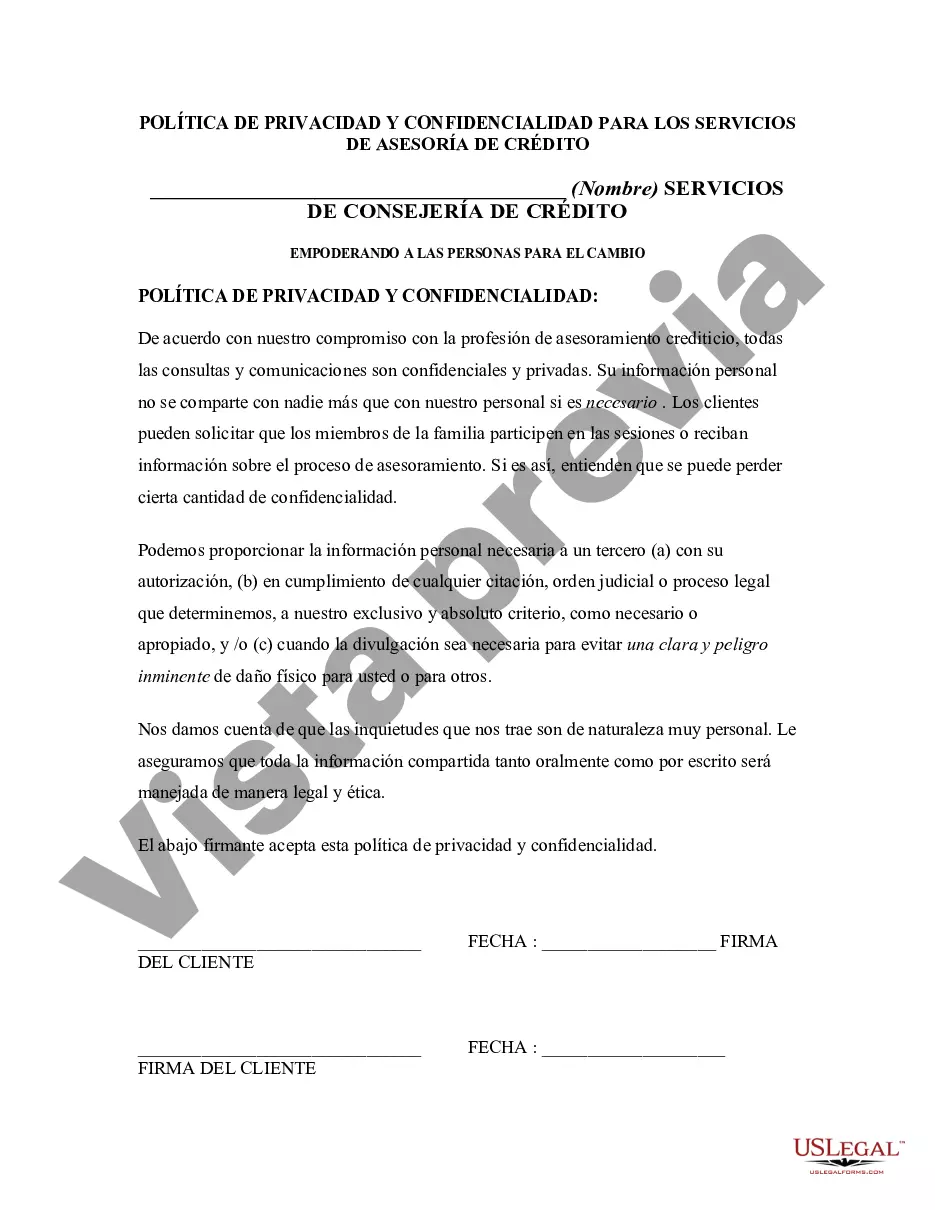

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Orange California privacy and confidentiality policies for credit counseling services are crucial to maintaining trust and security between the service providers and their clients. These policies outline the measures and protocols implemented by credit counseling agencies to protect the personal and financial information of individuals seeking their assistance. Adhering to these policies ensures that sensitive data is handled responsibly and treated with utmost confidentiality. Keywords: Orange California, privacy policy, confidentiality policy, credit counseling services, personal information, financial data, data protection, trust, security, responsible handling, sensitive data, confidentiality. There may be different types of Orange California privacy and confidentiality policies for credit counseling services, including: 1. General Privacy and Confidentiality Policy: This policy is designed to safeguard all personal and financial information shared with the credit counseling agency by their clients. It provides an overview of the agency's commitment to protecting client data, the rules governing access and usage, and the procedures in place to ensure confidentiality. 2. Data Security Policy: This policy specifically focuses on the technical and organizational measures implemented by the credit counseling agency to protect client data from unauthorized access, misuse, alteration, or destruction. It may outline encryption methods, firewalls, password protection, secure servers, and other security measures to safeguard sensitive information. 3. Employee Confidentiality Policy: This policy highlights the responsibilities and obligations of credit counseling agency employees regarding client data confidentiality. It enforces strict rules on handling client information, prohibiting unauthorized disclosure or use of such data. It may include provisions for employee training, signed confidentiality agreements, and consequences for policy violations. 4. Third-Party Data Handling Policy: In cases where credit counseling agencies need to share client information with third parties, this policy regulates the handling and disclosure of such data to ensure its confidentiality is maintained. It may require third parties to sign confidentiality agreements and follow rigorous data protection standards. 5. Non-Disclosure Agreement: While not a policy per se, credit counseling agencies may require clients to sign a non-disclosure agreement (NDA). This legally binding document ensures that both parties understand the confidential nature of the information disclosed during the credit counseling process and prohibits the client from sharing any sensitive details with unauthorized individuals. Orange California credit counseling services understand the importance of protecting their clients' personal and financial information. Their privacy and confidentiality policies demonstrate a commitment to data security, trust, and ethical practices in handling sensitive data, ultimately enabling clients to seek guidance and support with confidence.Orange California privacy and confidentiality policies for credit counseling services are crucial to maintaining trust and security between the service providers and their clients. These policies outline the measures and protocols implemented by credit counseling agencies to protect the personal and financial information of individuals seeking their assistance. Adhering to these policies ensures that sensitive data is handled responsibly and treated with utmost confidentiality. Keywords: Orange California, privacy policy, confidentiality policy, credit counseling services, personal information, financial data, data protection, trust, security, responsible handling, sensitive data, confidentiality. There may be different types of Orange California privacy and confidentiality policies for credit counseling services, including: 1. General Privacy and Confidentiality Policy: This policy is designed to safeguard all personal and financial information shared with the credit counseling agency by their clients. It provides an overview of the agency's commitment to protecting client data, the rules governing access and usage, and the procedures in place to ensure confidentiality. 2. Data Security Policy: This policy specifically focuses on the technical and organizational measures implemented by the credit counseling agency to protect client data from unauthorized access, misuse, alteration, or destruction. It may outline encryption methods, firewalls, password protection, secure servers, and other security measures to safeguard sensitive information. 3. Employee Confidentiality Policy: This policy highlights the responsibilities and obligations of credit counseling agency employees regarding client data confidentiality. It enforces strict rules on handling client information, prohibiting unauthorized disclosure or use of such data. It may include provisions for employee training, signed confidentiality agreements, and consequences for policy violations. 4. Third-Party Data Handling Policy: In cases where credit counseling agencies need to share client information with third parties, this policy regulates the handling and disclosure of such data to ensure its confidentiality is maintained. It may require third parties to sign confidentiality agreements and follow rigorous data protection standards. 5. Non-Disclosure Agreement: While not a policy per se, credit counseling agencies may require clients to sign a non-disclosure agreement (NDA). This legally binding document ensures that both parties understand the confidential nature of the information disclosed during the credit counseling process and prohibits the client from sharing any sensitive details with unauthorized individuals. Orange California credit counseling services understand the importance of protecting their clients' personal and financial information. Their privacy and confidentiality policies demonstrate a commitment to data security, trust, and ethical practices in handling sensitive data, ultimately enabling clients to seek guidance and support with confidence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.