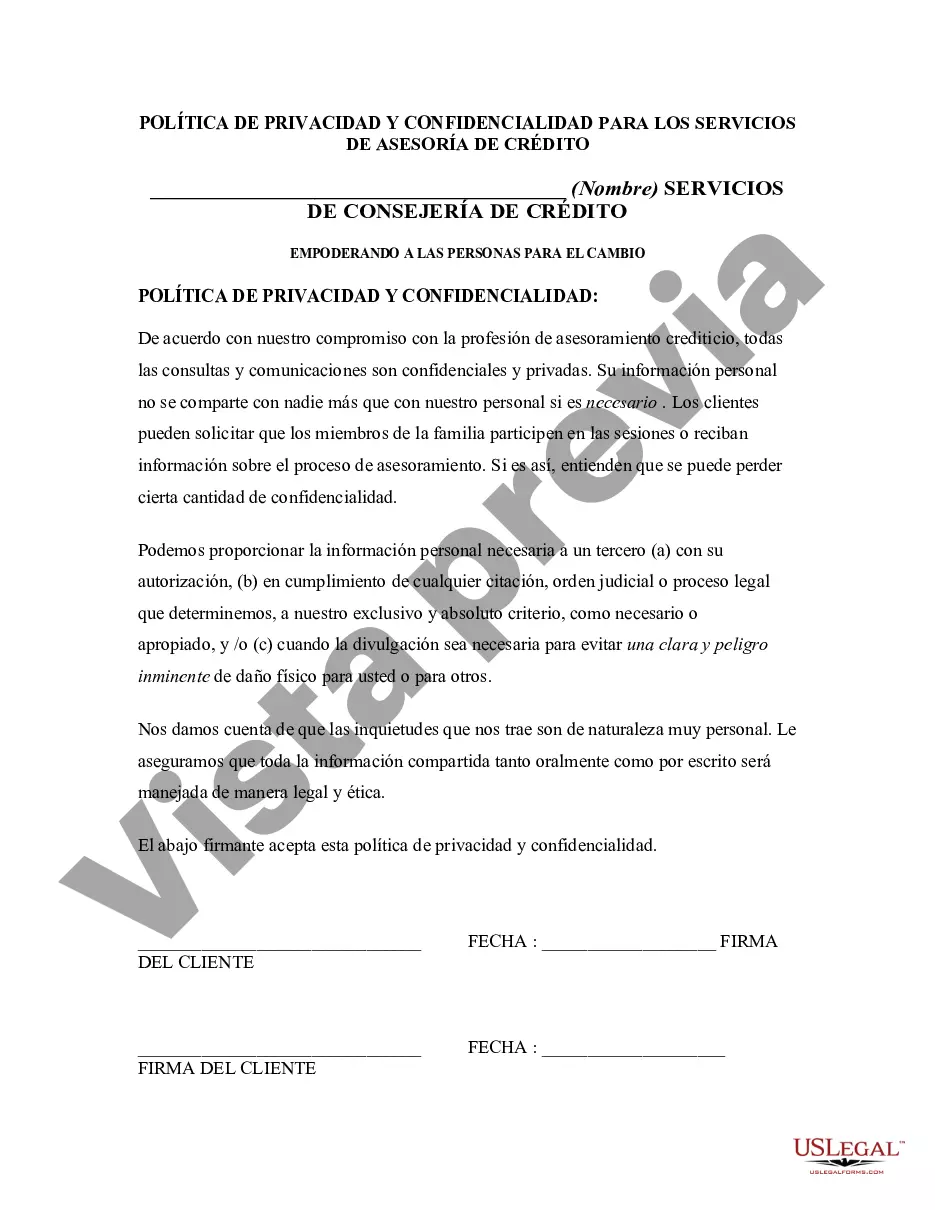

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Diego California Privacy and Confidentiality Policy for Credit Counseling Services aims to protect the personal information and ensure the utmost confidentiality of clients seeking credit counseling services in the San Diego area. This policy is designed to comply with all applicable state and federal laws and regulations governing privacy and confidentiality. The San Diego California Privacy and Confidentiality Policy for Credit Counseling Services covers a wide range of client information, including but not limited to: 1. Personal Information: The policy ensures the safeguarding of personal details such as names, addresses, phone numbers, social security numbers, and other identifying information shared during the credit counseling process. 2. Financial Information: It includes procedures for handling financial data, including bank account details, income statements, credit card information, and other sensitive financial records provided by clients for credit counseling purposes. 3. Consent and Authorization: The policy outlines the necessity of obtaining explicit consent from clients before collecting, using, or disclosing their personal information. It also highlights the importance of maintaining written authorization from clients for any disclosure of their information to third parties. 4. Data Collection and Storage: The policy provides guidelines for the collection and storage of client data. It emphasizes the use of secure methods and technology to prevent unauthorized access, disclosure, or alteration of personal information. 5. Employee Training and Responsibilities: It outlines the responsibility of credit counseling service employees to protect client information and receive appropriate training on privacy and confidentiality practices. This ensures that employees understand the importance of maintaining client privacy and adhering to all relevant policies and procedures. 6. Third-Party Disclosures: The policy describes circumstances in which client information may be shared with third parties, such as creditors or credit reporting agencies. It specifies that such disclosures should only occur with the client's knowledge and consent unless required by law. Different types of San Diego California Privacy and Confidentiality Policies for Credit Counseling Services may include variations based on the organization's specific practices, but the overall objective remains the same: safeguarding client information and maintaining strict confidentiality. In conclusion, the San Diego California Privacy and Confidentiality Policy for Credit Counseling Services is a comprehensive framework designed to protect client privacy and ensure the secure handling of personal and financial information. It assures clients that their information will be treated with the utmost confidentiality, in compliance with all applicable laws and regulations.San Diego California Privacy and Confidentiality Policy for Credit Counseling Services aims to protect the personal information and ensure the utmost confidentiality of clients seeking credit counseling services in the San Diego area. This policy is designed to comply with all applicable state and federal laws and regulations governing privacy and confidentiality. The San Diego California Privacy and Confidentiality Policy for Credit Counseling Services covers a wide range of client information, including but not limited to: 1. Personal Information: The policy ensures the safeguarding of personal details such as names, addresses, phone numbers, social security numbers, and other identifying information shared during the credit counseling process. 2. Financial Information: It includes procedures for handling financial data, including bank account details, income statements, credit card information, and other sensitive financial records provided by clients for credit counseling purposes. 3. Consent and Authorization: The policy outlines the necessity of obtaining explicit consent from clients before collecting, using, or disclosing their personal information. It also highlights the importance of maintaining written authorization from clients for any disclosure of their information to third parties. 4. Data Collection and Storage: The policy provides guidelines for the collection and storage of client data. It emphasizes the use of secure methods and technology to prevent unauthorized access, disclosure, or alteration of personal information. 5. Employee Training and Responsibilities: It outlines the responsibility of credit counseling service employees to protect client information and receive appropriate training on privacy and confidentiality practices. This ensures that employees understand the importance of maintaining client privacy and adhering to all relevant policies and procedures. 6. Third-Party Disclosures: The policy describes circumstances in which client information may be shared with third parties, such as creditors or credit reporting agencies. It specifies that such disclosures should only occur with the client's knowledge and consent unless required by law. Different types of San Diego California Privacy and Confidentiality Policies for Credit Counseling Services may include variations based on the organization's specific practices, but the overall objective remains the same: safeguarding client information and maintaining strict confidentiality. In conclusion, the San Diego California Privacy and Confidentiality Policy for Credit Counseling Services is a comprehensive framework designed to protect client privacy and ensure the secure handling of personal and financial information. It assures clients that their information will be treated with the utmost confidentiality, in compliance with all applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.