A limited partnership is a modified partnership and is a creature of State statutes. Most States have either adopted the Uniform Limited Partnership Act (ULPA) or the Revised Uniform Limited Partnership Act (RULPA). In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. A limited partnership can have one or more general partners and one or more limited partners.

The general partners manage the business of the partnership and are personally liable for its debts. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

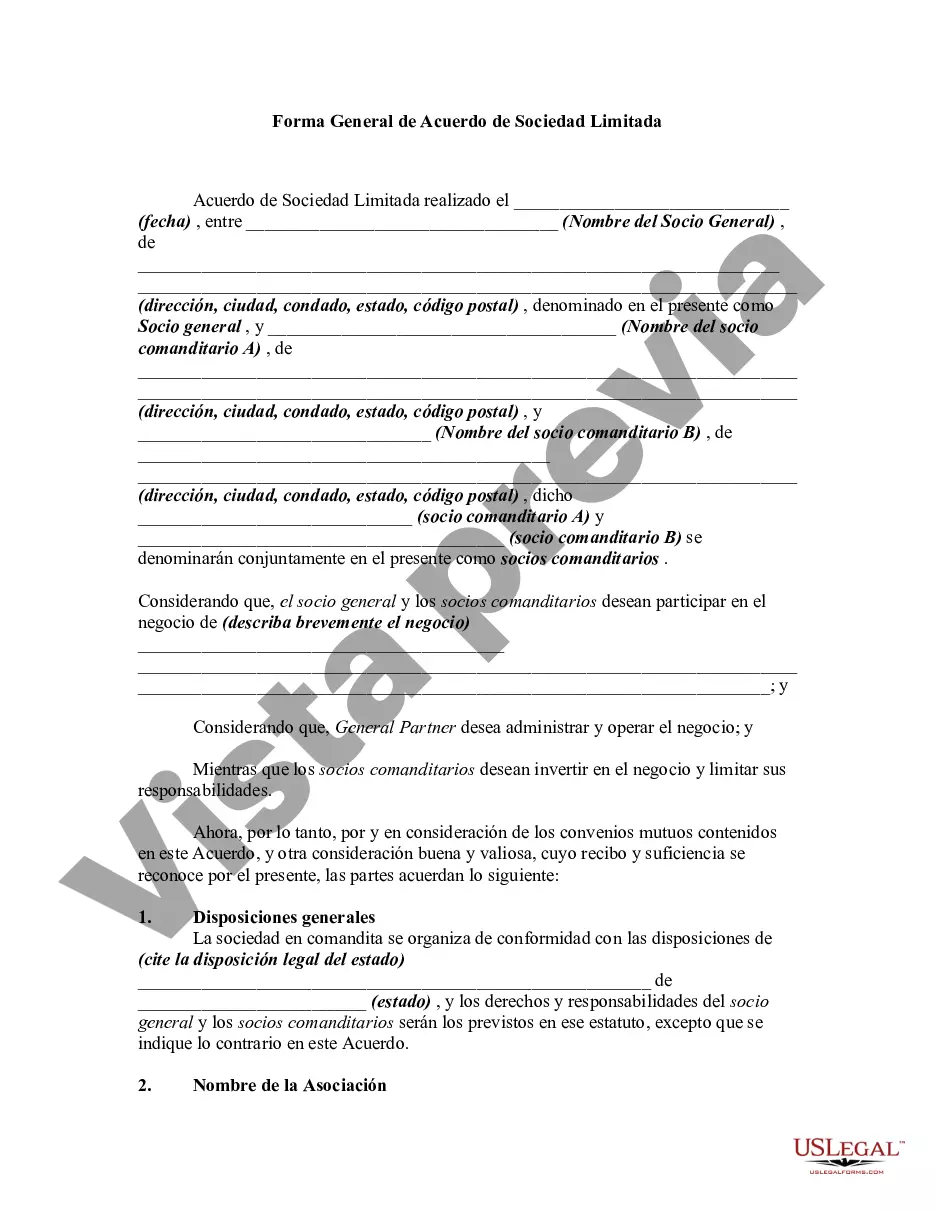

The Collin Texas General Form of Limited Partnership Agreement is a legally binding document that outlines the terms and conditions for establishing a limited partnership in Collin County, Texas. This agreement sets forth the rights, obligations, and responsibilities of the partners involved in the partnership, as well as the procedures for operating the business. The Collin Texas General Form of Limited Partnership Agreement typically includes key provisions such as the partnership's name, purpose, and duration. It also outlines the total amount of capital contributed by each partner, their respective shares and ownership percentages, and any restrictions on transferring or assigning partnership interests. Additionally, the agreement covers the roles and responsibilities of the general partner(s), who have full management control and unlimited personal liability, and the limited partner(s), who have limited involvement in the partnership and liability only up to their capital contribution. Furthermore, the Collin Texas General Form of Limited Partnership Agreement addresses the distribution of profits and losses, the allocation of tax liabilities, and the procedures for decision-making, including voting and quorum requirements for partners' meetings. It may also specify the circumstances and procedures for admitting new partners or withdrawing existing ones from the partnership. It is important to note that there may be different types or variations of the Collin Texas General Form of Limited Partnership Agreement, depending on the specific needs and preferences of the partners involved. Some common types include: 1. Limited Liability Limited Partnership (LL LP): This type of partnership offers limited liability protection to both the general and limited partners, shielding their personal assets from partnership obligations and debts. 2. Master Limited Partnership (MLP): Typically used in the energy sector, Maps allow for the trading of partnership units (similar to stock) on public exchanges, providing increased financial flexibility. 3. Family Limited Partnership (FLP): This type of limited partnership is commonly used for estate planning and asset protection within families, allowing the older generation to transfer assets to younger generations while maintaining control and minimizing estate taxes. 4. Publicly Traded Limited Partnership (PULP): These partnerships are typically involved in real estate, energy, or natural resource industries and offer partnership units to the public for investment. Pulps provide tax advantages and the ability to access public capital markets for funding. In conclusion, the Collin Texas General Form of Limited Partnership Agreement is a comprehensive legal document that governs the establishment, operation, and management of limited partnerships in Collin County, Texas. It ensures transparency, clarity, and protection for all partners involved in the business venture.The Collin Texas General Form of Limited Partnership Agreement is a legally binding document that outlines the terms and conditions for establishing a limited partnership in Collin County, Texas. This agreement sets forth the rights, obligations, and responsibilities of the partners involved in the partnership, as well as the procedures for operating the business. The Collin Texas General Form of Limited Partnership Agreement typically includes key provisions such as the partnership's name, purpose, and duration. It also outlines the total amount of capital contributed by each partner, their respective shares and ownership percentages, and any restrictions on transferring or assigning partnership interests. Additionally, the agreement covers the roles and responsibilities of the general partner(s), who have full management control and unlimited personal liability, and the limited partner(s), who have limited involvement in the partnership and liability only up to their capital contribution. Furthermore, the Collin Texas General Form of Limited Partnership Agreement addresses the distribution of profits and losses, the allocation of tax liabilities, and the procedures for decision-making, including voting and quorum requirements for partners' meetings. It may also specify the circumstances and procedures for admitting new partners or withdrawing existing ones from the partnership. It is important to note that there may be different types or variations of the Collin Texas General Form of Limited Partnership Agreement, depending on the specific needs and preferences of the partners involved. Some common types include: 1. Limited Liability Limited Partnership (LL LP): This type of partnership offers limited liability protection to both the general and limited partners, shielding their personal assets from partnership obligations and debts. 2. Master Limited Partnership (MLP): Typically used in the energy sector, Maps allow for the trading of partnership units (similar to stock) on public exchanges, providing increased financial flexibility. 3. Family Limited Partnership (FLP): This type of limited partnership is commonly used for estate planning and asset protection within families, allowing the older generation to transfer assets to younger generations while maintaining control and minimizing estate taxes. 4. Publicly Traded Limited Partnership (PULP): These partnerships are typically involved in real estate, energy, or natural resource industries and offer partnership units to the public for investment. Pulps provide tax advantages and the ability to access public capital markets for funding. In conclusion, the Collin Texas General Form of Limited Partnership Agreement is a comprehensive legal document that governs the establishment, operation, and management of limited partnerships in Collin County, Texas. It ensures transparency, clarity, and protection for all partners involved in the business venture.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.