A limited partnership is a modified partnership and is a creature of State statutes. Most States have either adopted the Uniform Limited Partnership Act (ULPA) or the Revised Uniform Limited Partnership Act (RULPA). In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. A limited partnership can have one or more general partners and one or more limited partners.

The general partners manage the business of the partnership and are personally liable for its debts. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

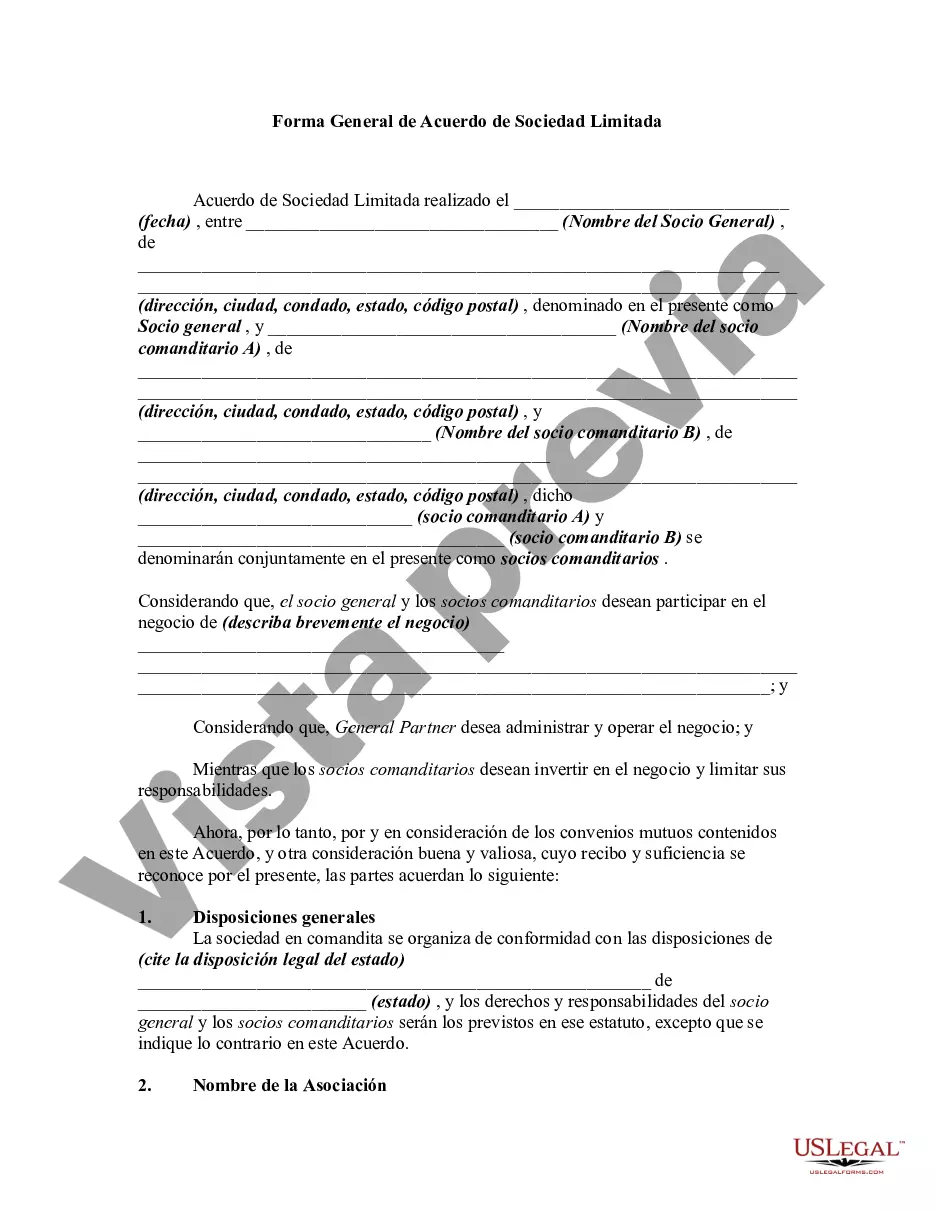

The Harris Texas General Form of Limited Partnership Agreement is a legally binding document that outlines the terms and conditions governing a limited partnership in Harris County, Texas. This agreement serves as a roadmap of the partnership's structure, roles, rights, and responsibilities of the partners involved. It is essential for both existing partnerships and those looking to establish a new limited partnership in the region. The Harris Texas General Form of Limited Partnership Agreement covers various vital aspects, including the name and purpose of the partnership, its principal place of business, and the duration of the partnership. It also outlines the capital contributions made by each partner, their rights to share in profits and losses, and the allocation of income and losses among the partners. Furthermore, this agreement defines the decision-making process within the partnership, including voting procedures, quorum requirements, and any limitations or qualifications on partners' authority. It establishes the roles and responsibilities of the general partner(s) who manage the partnership's affairs and the limited partner(s) who typically invest capital but have limited involvement in day-to-day operations. Other significant provisions within the Harris Texas General Form of Limited Partnership Agreement include the procedures for admitting new partners, the restrictions on transferring partnership interests, and the dissolution or withdrawal process should a partner decide to leave the partnership. It may also address dispute resolution mechanisms and the procedures for amending or terminating the agreement. While there might not be different "types" of Harris Texas General Form of Limited Partnership Agreement, businesses may tailor certain sections of the agreement to suit their specific needs. For instance, partnerships operating in different sectors or industries might include provisions specific to their field, such as intellectual property rights or regulatory compliance requirements. In sum, the Harris Texas General Form of Limited Partnership Agreement is a comprehensive legal document that governs the operations, responsibilities, and rights of partners in a limited partnership formed in Harris County, Texas. Its purpose is to provide clarity, establish expectations, and ensure a fair and equitable business environment for all partners involved.The Harris Texas General Form of Limited Partnership Agreement is a legally binding document that outlines the terms and conditions governing a limited partnership in Harris County, Texas. This agreement serves as a roadmap of the partnership's structure, roles, rights, and responsibilities of the partners involved. It is essential for both existing partnerships and those looking to establish a new limited partnership in the region. The Harris Texas General Form of Limited Partnership Agreement covers various vital aspects, including the name and purpose of the partnership, its principal place of business, and the duration of the partnership. It also outlines the capital contributions made by each partner, their rights to share in profits and losses, and the allocation of income and losses among the partners. Furthermore, this agreement defines the decision-making process within the partnership, including voting procedures, quorum requirements, and any limitations or qualifications on partners' authority. It establishes the roles and responsibilities of the general partner(s) who manage the partnership's affairs and the limited partner(s) who typically invest capital but have limited involvement in day-to-day operations. Other significant provisions within the Harris Texas General Form of Limited Partnership Agreement include the procedures for admitting new partners, the restrictions on transferring partnership interests, and the dissolution or withdrawal process should a partner decide to leave the partnership. It may also address dispute resolution mechanisms and the procedures for amending or terminating the agreement. While there might not be different "types" of Harris Texas General Form of Limited Partnership Agreement, businesses may tailor certain sections of the agreement to suit their specific needs. For instance, partnerships operating in different sectors or industries might include provisions specific to their field, such as intellectual property rights or regulatory compliance requirements. In sum, the Harris Texas General Form of Limited Partnership Agreement is a comprehensive legal document that governs the operations, responsibilities, and rights of partners in a limited partnership formed in Harris County, Texas. Its purpose is to provide clarity, establish expectations, and ensure a fair and equitable business environment for all partners involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.