A Chicago Illinois General and Continuing Guaranty and Indemnification Agreement is a legal document that establishes a contractual relationship between a guarantor and a beneficiary. This agreement is designed to provide protection to the beneficiary in case of default or non-performance of obligations by a third party, usually a borrower or debtor. Keywords: Chicago Illinois, general and continuing, guaranty, indemnification agreement, legal document, contractual relationship, guarantor, beneficiary, protection, default, non-performance, obligations, borrower, debtor. There are several types of Chicago Illinois General and Continuing Guaranty and Indemnification Agreements, each serving a unique purpose. Some of these types include: 1. Commercial Loan Guaranty Agreement: This agreement is commonly used in the commercial lending industry and is executed by a guarantor to provide protection to a lender in case the borrower fails to fulfill their financial obligations under a loan agreement. 2. Lease Guaranty Agreement: This type of agreement is often used in the real estate industry when a person or business acts as a guarantor for the obligations of a tenant under a lease contract. The guarantor ensures that the landlord will receive payment if the tenant defaults on their lease payments. 3. Construction Contract Guaranty and Indemnification Agreement: In the construction industry, this agreement may be used when a contractor or subcontractor guarantees their performance and indemnifies the project owner against any losses, damages, or claims arising from the construction project. 4. Supplier Guaranty Agreement: This agreement is entered into between a supplier and a buyer, with a third-party guarantor involved. It guarantees the supplier's performance and indemnifies the buyer against potential losses, damages, or claims resulting from non-performance or breach of contract. 5. Loan Indemnification Agreement: This type of agreement is often seen in financial transactions, such as mortgages or car loans. It provides indemnification to the lender against any losses incurred due to the borrower's default or non-payment. Chicago Illinois General and Continuing Guaranty and Indemnification Agreements are essential legal tools to mitigate risks and protect the interests of parties involved in various financial transactions or contractual relationships. It is important to consult with legal professionals and understand the specific terms and conditions within each agreement to ensure compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo General y Continuo de Garantía e Indemnización - General and Continuing Guaranty and Indemnification Agreement

Description

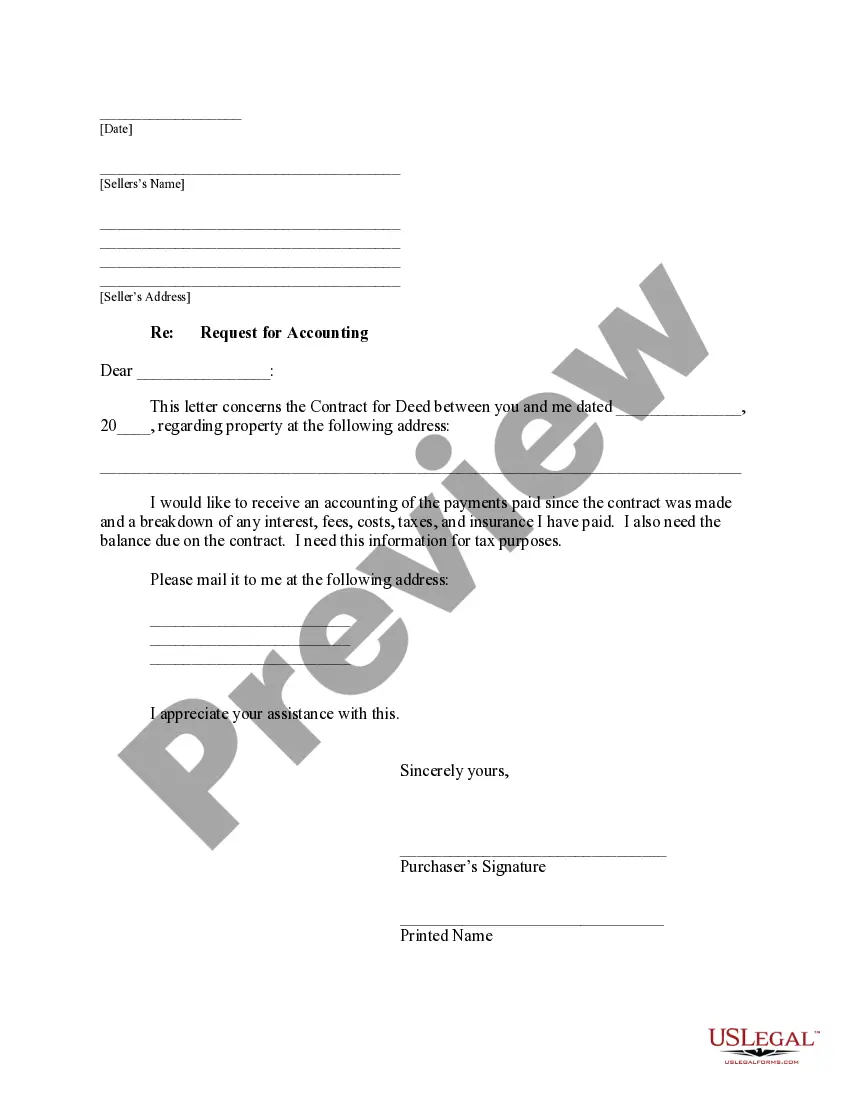

How to fill out Chicago Illinois Acuerdo General Y Continuo De Garantía E Indemnización?

If you need to get a trustworthy legal form provider to obtain the Chicago General and Continuing Guaranty and Indemnification Agreement, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support make it simple to locate and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Chicago General and Continuing Guaranty and Indemnification Agreement, either by a keyword or by the state/county the form is created for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Chicago General and Continuing Guaranty and Indemnification Agreement template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less pricey and more affordable. Create your first company, arrange your advance care planning, draft a real estate contract, or execute the Chicago General and Continuing Guaranty and Indemnification Agreement - all from the convenience of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

Programa de instruccion y capacitacion en seguridad de la aviacion civil (AVSEC) SCT-02-185 Mas informacion Secretaria de Comunicaciones y Transportes Gobierno gob.mx.

El Convenio sobre Aviacion Civil Internacional (1944), tambien conocido como el Convenio de Chicago, tuvo por objetivo actualizar las normas sobre aviacion. Es el tratado normativo mas importante en relacion al Derecho Publico Internacional Aeronautico.

En cuanto al articulo 7 del Convenio, dispone el derecho de cada Estado a reservar los servicios aereos domesticos o de cabotaje a las aeronaves o explotadores de su nacionalidad, principio conocido como de reserva de cabotaje.

Anexos al Convenio Anexo 1 - Licencias al personal. Anexo 2 - Reglamento del aire. Anexo 3 - Servicio meterologico para la navegacion aerea internacional. Anexo 4 - Cartas aeronauticas. Anexo 5 - Unidades de medida que se emplearan en las operaciones aereas y terrestres. Anexo 6 - Operacion de aeronaves -Parte I.

ANEXO 17 AL CONVENIO DE LA OACI SEGURIDAD 2.1.1 El objetivo primordial es la seguridad de los pasajeros, tripulaciones, el personal de tierra y el publico en general en todos los asuntos relacionados con la salvaguarda contra actos de inferencia licita en la aviacion civil.

El texto de dicho Convenio en los idiomas espanol y frances anexados al Protocolo sobre el texto autentico trilingue del Convenio sobre Aviacion Civil Internacional (Chicago, 1944) que fue firmado en Buenos Aires el 24 de septiembre de 1968 y entro en vigor, entre los Estados que to firmaron sin reserva de aceptacion,

El Convenio sobre Aviacion Civil Internacional, redactado en 1944 por 54 naciones, se establecio para promover la cooperacion y contribuir a crear y a preservar la amistad y el entendimiento entre las naciones y los pueblos del mundo.

La Organizacion tendra su sede permanente en el lugar que determine en su reunion final la Asamblea Interina de la Organizacion Provisional de Aviacion Civil Internacional, creada por el Convenio Provisional de Aviacion Civil Internacional, firmado en Chicago el 7 de diciembre de 1944.

El Convenio sobre Aviacion Civil Internacional, redactado en 1944 por 54 naciones, se establecio para promover la cooperacion y contribuir a crear y a preservar la amistad y el entendimiento entre las naciones y los pueblos del mundo.

Fecha de entrada en vigor: El Convenio entro en vigor el 4 de abril de 1947. Situacion: 193 partes. Esta lista esta basada en la informacion recibida del depositario, el Gobierno de los Estados Unidos.