Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement are legal contracts that provide protection and assurance to parties involved in various business transactions. These agreements are commonly used in commercial real estate, financing, and other business ventures. The purpose of the Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement is to guarantee the performance of contractual obligations and safeguard against any potential losses or liabilities. It serves as a legal document that ensures one party (the guarantor) will be responsible for fulfilling the obligations of another party (the principal debtor) in case of default or non-performance. The Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement outline the terms and conditions of the guarantee, including the extent of liability, duration, and any specific provisions related to the underlying contract. These agreements are often used in real estate transactions, such as securing a loan or lease, where the guarantor ensures the payment of rent or debt in case the tenant or borrower defaults. There may be variations of the Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement based on specific business needs or industries. For instance, there could be agreements tailored for financial institutions, construction companies, or service providers. In a Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement, keywords are essential to understanding the legal implications and terms involved. Some relevant keywords include: 1. Guarantor: The party assuming responsibility for the obligations of the principal debtor. 2. Principal debtor: The party originally obligated to perform under the contract. 3. Indemnity: The security or protection provided by the guarantor against any losses or damages. 4. Liability: The degree of financial responsibility the guarantor assumes. 5. Default: Failure to fulfill contractual obligations within the specified terms. 6. Financial institution: A specific type of guaranty tailored for banks or lending institutions. 7. Construction: A guaranty designed for construction projects, ensuring payment to contractors and suppliers. 8. Lease: A guaranty that protects landlords against tenant defaults on rent payment or lease obligations. 9. Service provider: A guaranty applicable in service-based industries, safeguarding against non-payment or breach of contract. In conclusion, the Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement is a legal contract that provides assurance and financial protection for parties engaging in various business transactions. These agreements can vary based on industry and specific business needs, offering guarantees against default, non-performance, and other contractual obligations.

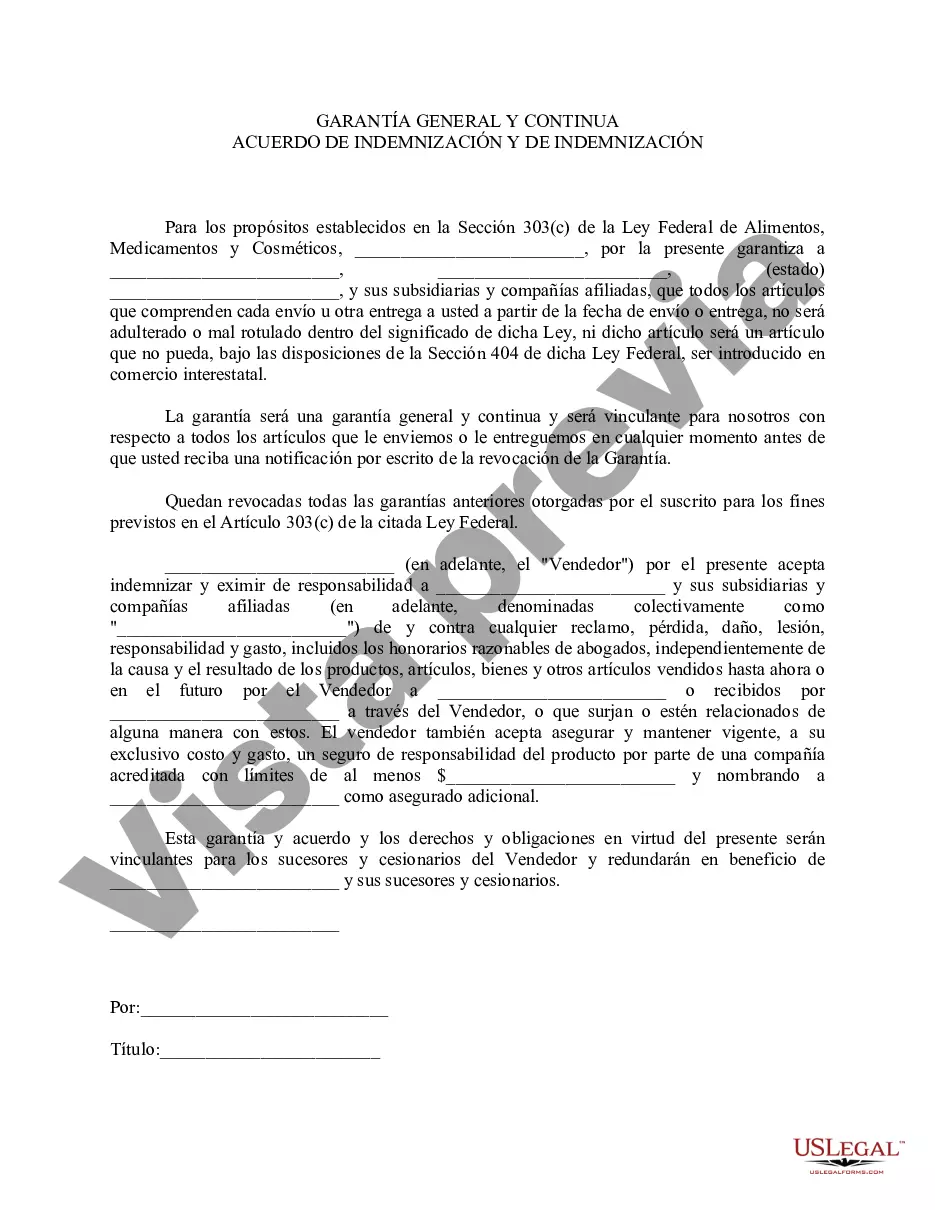

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Acuerdo General y Continuo de Garantía e Indemnización - General and Continuing Guaranty and Indemnification Agreement

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-01617

Format:

Word

Instant download

Description

This form states that the guaranty shall be a general and continuing guaranty and shall be binding with respect to all such articles shipped or delivered at any time before the receipt of written notice of the revocation of the guarantee.

Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement are legal contracts that provide protection and assurance to parties involved in various business transactions. These agreements are commonly used in commercial real estate, financing, and other business ventures. The purpose of the Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement is to guarantee the performance of contractual obligations and safeguard against any potential losses or liabilities. It serves as a legal document that ensures one party (the guarantor) will be responsible for fulfilling the obligations of another party (the principal debtor) in case of default or non-performance. The Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement outline the terms and conditions of the guarantee, including the extent of liability, duration, and any specific provisions related to the underlying contract. These agreements are often used in real estate transactions, such as securing a loan or lease, where the guarantor ensures the payment of rent or debt in case the tenant or borrower defaults. There may be variations of the Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement based on specific business needs or industries. For instance, there could be agreements tailored for financial institutions, construction companies, or service providers. In a Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement, keywords are essential to understanding the legal implications and terms involved. Some relevant keywords include: 1. Guarantor: The party assuming responsibility for the obligations of the principal debtor. 2. Principal debtor: The party originally obligated to perform under the contract. 3. Indemnity: The security or protection provided by the guarantor against any losses or damages. 4. Liability: The degree of financial responsibility the guarantor assumes. 5. Default: Failure to fulfill contractual obligations within the specified terms. 6. Financial institution: A specific type of guaranty tailored for banks or lending institutions. 7. Construction: A guaranty designed for construction projects, ensuring payment to contractors and suppliers. 8. Lease: A guaranty that protects landlords against tenant defaults on rent payment or lease obligations. 9. Service provider: A guaranty applicable in service-based industries, safeguarding against non-payment or breach of contract. In conclusion, the Miami-Dade Florida General and Continuing Guaranty and Indemnification Agreement is a legal contract that provides assurance and financial protection for parties engaging in various business transactions. These agreements can vary based on industry and specific business needs, offering guarantees against default, non-performance, and other contractual obligations.

Free preview