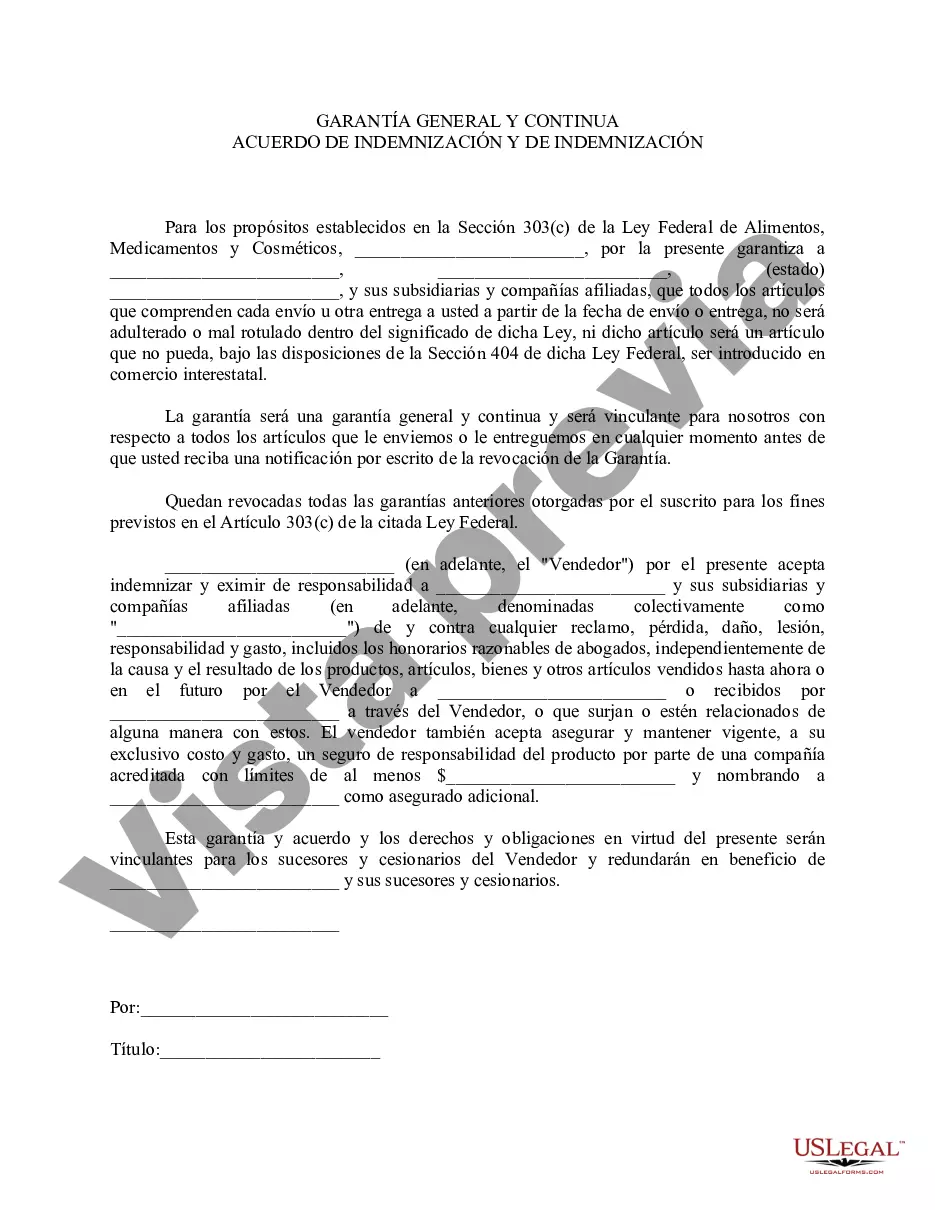

Orange California Acuerdo General y Continuo de Garantía e Indemnización - General and Continuing Guaranty and Indemnification Agreement

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Acuerdo General Y Continuo De Garantía E Indemnización?

Drafting legal documents can be tedious.

Furthermore, if you choose to hire a legal expert to prepare a commercial agreement, ownership transfer documents, pre-nuptial contract, divorce forms, or the Orange General and Continuing Guaranty and Indemnification Agreement, it might cost you a significant amount. So, what is the most practical method to conserve time and finances while generating valid forms that comply with your state and local laws.

Review the form description and utilize the Preview option if accessible to confirm it's the template you seek. Don't stress if the form doesn't meet your needs—look for the appropriate one in the header. Click Buy Now once you find the necessary sample and select the most suitable subscription. Log In or create an account to buy your subscription. Complete the transaction using a credit card or via PayPal. Choose the document format for your Orange General and Continuing Guaranty and Indemnification Agreement and save it. Afterwards, you can print it out and fill it in by hand or upload the templates to an online editor for quicker and more efficient completion. US Legal Forms enables you to re-use all paperwork acquired multiple times—you can find your templates in the My documents tab within your profile. Give it a try now!

- US Legal Forms is an outstanding option, whether you're seeking templates for individual or corporate purposes.

- US Legal Forms boasts the largest online repository of state-specific legal documents, supplying users with current and professionally verified templates for any situation, all conveniently centralized.

- Consequently, if you need the latest edition of the Orange General and Continuing Guaranty and Indemnification Agreement, you can promptly locate it on our platform.

- Acquiring the documents requires minimal time.

- Users with existing accounts should confirm their subscription validity, Log In, and select the sample using the Download button.

- If you haven't registered yet, here’s how to obtain the Orange General and Continuing Guaranty and Indemnification Agreement.

- Browse the page to confirm there is a template for your location.

Form popularity

FAQ

¿Que documentacion necesito para darme de alta o pasarme a contrato o hacer una portabilidad? Para espanoles: NIF/CIF. Para extranjeros de la U.E.Para el resto de paises: Pasaporte y Tarjeta de Residencia. Aportar recibo bancario o libreta de ahorro donde se te pasaran las facturas al cobro.

Accede a tu App Mi Orange y podras consultar el detalle de tu consumo y tus facturas. Selecciona la "linea de telefono" en la que quieres realizar la consulta en la flecha de selector de lineas que encuentras sobre la bola de movil.

Si se aceptan mejores condiciones para tu tarifa Orange (como la adquisicion de un movil), se aplican 12 meses. Si se da de alta una linea fija o servicio de datos con movil suponen 12 meses. Con un movil a plazos a un mejor precio, la permanencia alcanza los 24 meses.

El Renove prepago es un servicio que presta Orange a los clientes prepago, mediante el cual puedes estrenar un nuevo movil con tres opciones de precio en funcion de la recarga que realices. Todo renove requiere de una recarga previa de 10 20ac, 20 20ac, 30 20ac o mas.

Al adquirir el segundo terminal, se anaden otros 24 meses de permanencia. El cambio es valido para nuevos clientes como para los que lleven mas de 3 meses en la compania.

Con operadores: sin intereses peroOperadorPlazosPermanenciaMovistar12, 24 o 30 meses18 meses (subvencionados) Sin permanenciaVodafone24 meses24 mesesOrange24 meses24 mesesYoigo24 meses24 meses1 more row ?

Darse de baja en Orange no es una tarea imposible, llama al telefono de atencion al cliente de Orange: 1470 y cancela tu contrato.

Si te das de baja o modificas tu oferta antes de que termine este compromiso tendras que pagar una penalizacion. Para evitarlo es necesario que mantengas tu linea activa en Orange durante el tiempo minimo recogido en tu compromiso. Cada linea fija o movil tiene su compromiso de permanencia propio.

¿Que puedo conseguir haciendo un amago de portabilidad a Orange? Puedes conseguir hasta un 60% de descuento en tarifas moviles o packs de fibra y movil durante 12 meses, Orange TV gratis, rebajas de precios en movil de gama media o alta y moviles de gama baja o media por 1 centimo al mes (24 centimos en total).

Si deseas cancelar la solicitud de activacion de una linea fija o movil contratada con Orange podras hacerlo llamando al 1470 (particulares) o al 1471 (empresas).