Title: Palm Beach Florida General and Continuing Guaranty and Indemnification Agreement: An Overview of Its Importance and Types Introduction: The Palm Beach Florida General and Continuing Guaranty and Indemnification Agreement serves as a crucial legal instrument for individuals and businesses alike, providing protection against potential financial liabilities and risks. This article offers a detailed description of this agreement, highlighting its significance and various types available in Palm Beach, Florida. 1. Overview of the Palm Beach Florida General and Continuing Guaranty and Indemnification Agreement: The Palm Beach Florida General and Continuing Guaranty and Indemnification Agreement is a legal document that solidifies the guarantor's commitment to assume financial responsibility or indemnify the lender or creditor in case of defaults, losses, or damages incurred by the borrower. It assures the lender that they will be reimbursed for any liabilities arising from the debtor. 2. Key Features and importance of the Agreement: a. Financial Security: The agreement acts as a safeguard for lenders, providing them with a guarantee of repayment, even if the primary borrower is unable to fulfill their obligations. b. Lender's Confidence: By signing the agreement, the guarantor essentially assures the lender of their financial stability and trustworthiness. c. Business Transactions: The agreement is of utmost importance in various business dealings, including loans, leases, partnerships, and other contractual arrangements. 3. Different Types of Palm Beach Florida General and Continuing Guaranty and Indemnification Agreement: a. Personal Guaranty and Indemnification Agreement: In this type, an individual personally guarantees to cover any financial obligations or losses incurred by the borrowing party. It often comes into play when an individual seeks a loan or enters into a business transaction. b. Corporate Guaranty and Indemnification Agreement: This type of agreement involves a business entity guaranteeing the payment or performance obligations of another business or individual. It provides an additional layer of assurance for lenders when dealing with commercial entities. c. Limited Guaranty and Indemnification Agreement: This agreement limits the guarantor's responsibility to a specific amount or a certain period. It is often used in situations where the risks and liabilities are not indefinite. Conclusion: The Palm Beach Florida General and Continuing Guaranty and Indemnification Agreement is an essential legal tool designed to protect lenders and creditors from financial risks. By understanding its significance and the different types available, individuals and businesses can navigate various transactions with enhanced confidence, ensuring stronger financial security for all parties involved.

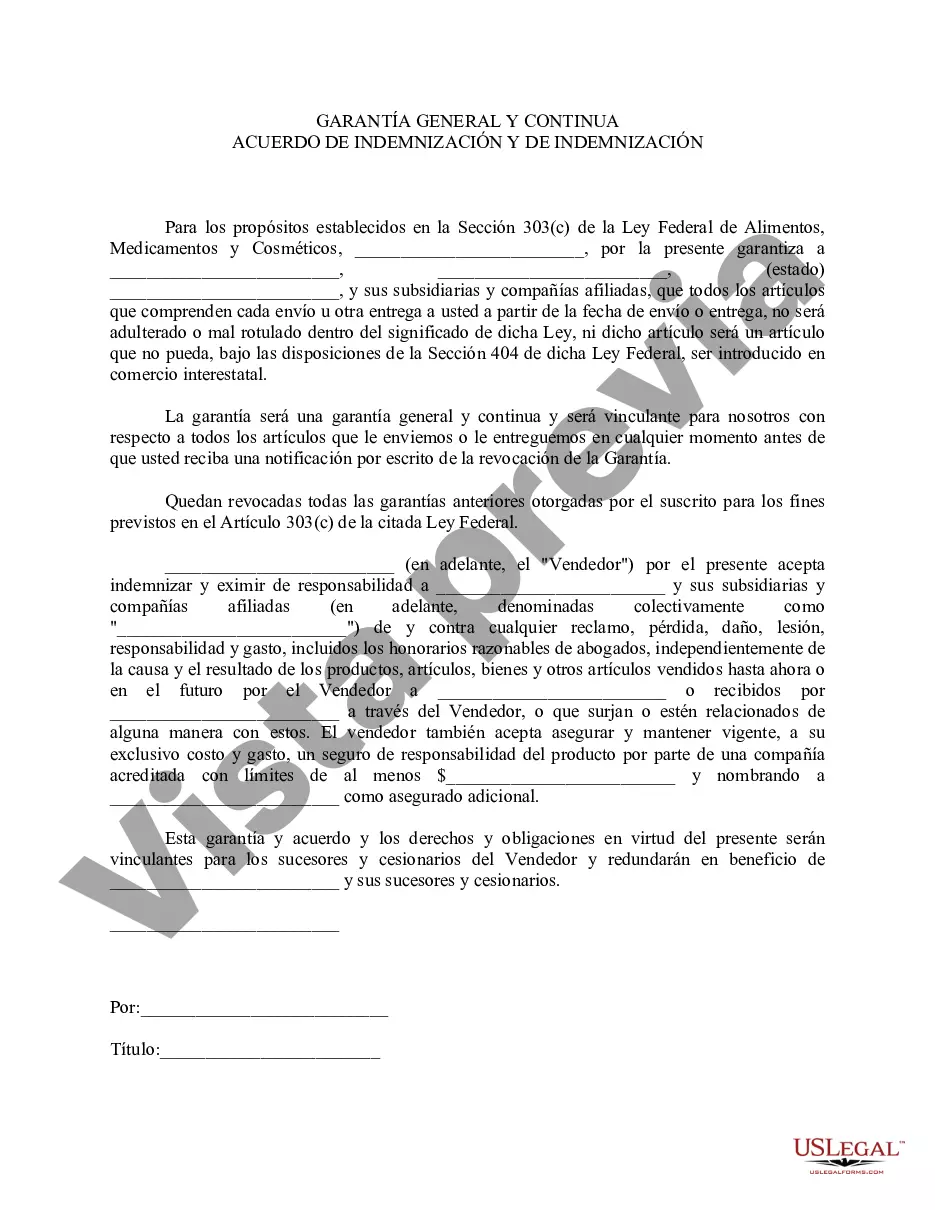

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Acuerdo General y Continuo de Garantía e Indemnización - General and Continuing Guaranty and Indemnification Agreement

Description

How to fill out Palm Beach Florida Acuerdo General Y Continuo De Garantía E Indemnización?

If you need to find a trustworthy legal form provider to get the Palm Beach General and Continuing Guaranty and Indemnification Agreement, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it easy to find and execute various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse Palm Beach General and Continuing Guaranty and Indemnification Agreement, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Palm Beach General and Continuing Guaranty and Indemnification Agreement template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate contract, or complete the Palm Beach General and Continuing Guaranty and Indemnification Agreement - all from the convenience of your sofa.

Sign up for US Legal Forms now!