The Lima Arizona General and Continuing Guaranty and Indemnification Agreement is a legal document that outlines the terms and conditions of a guarantor's obligation to reimburse and indemnify a lender or creditor in the event of a default by the primary borrower. It is an essential tool in the financial sector, particularly in commercial transactions and loan agreements. The agreement provides a guarantee to the lender, assuring them that they will be compensated if the borrower is unable to fulfill their obligations. This agreement covers various aspects of the guarantor's responsibilities, rights, and liabilities. It clarifies the extent of the guarantor's obligation, which is generally unlimited and extends to both present and future debt incurred by the borrower. The document may include provisions regarding the guarantor's financial condition, representations and warranties, events of default, remedies in case of default, and applicable jurisdiction. It also outlines the indemnification process, specifying the circumstances under which the guarantor will be held responsible for covering the lender's losses, expenses, and legal fees resulting from the borrower's default. In Lima, Arizona, there may be different types of General and Continuing Guaranty and Indemnification Agreements depending on the specific context and parties involved. Some examples include: 1. Commercial Loan Guaranty Agreement: This type of agreement is commonly used in commercial lending transactions, where a guarantor assures repayment and indemnification for a loan taken by a business entity. 2. Real Estate Guaranty and Indemnification Agreement: This agreement is specific to real estate transactions, where a guarantor guarantees the performance of a borrower's obligations related to a real estate loan and provides indemnification for any resulting losses or damages. 3. Equipment Financing Guaranty Agreement: In cases where the loan is acquired for the purchase or lease of equipment or machinery, an equipment financing guarantor agrees to be responsible for the repayment of the debt and indemnifies the lender if the borrower defaults. 4. Personal Guaranty and Indemnification Agreement: This type of agreement involves an individual acting as a guarantor, providing a personal guarantee for a loan or credit extended to a business entity, ensuring repayment and indemnification in case of default. It is important to consult with legal professionals or seek professional advice when entering into a Lima Arizona General and Continuing Guaranty and Indemnification Agreement, as the terms and provisions may vary depending on the specific circumstances and legal requirements.

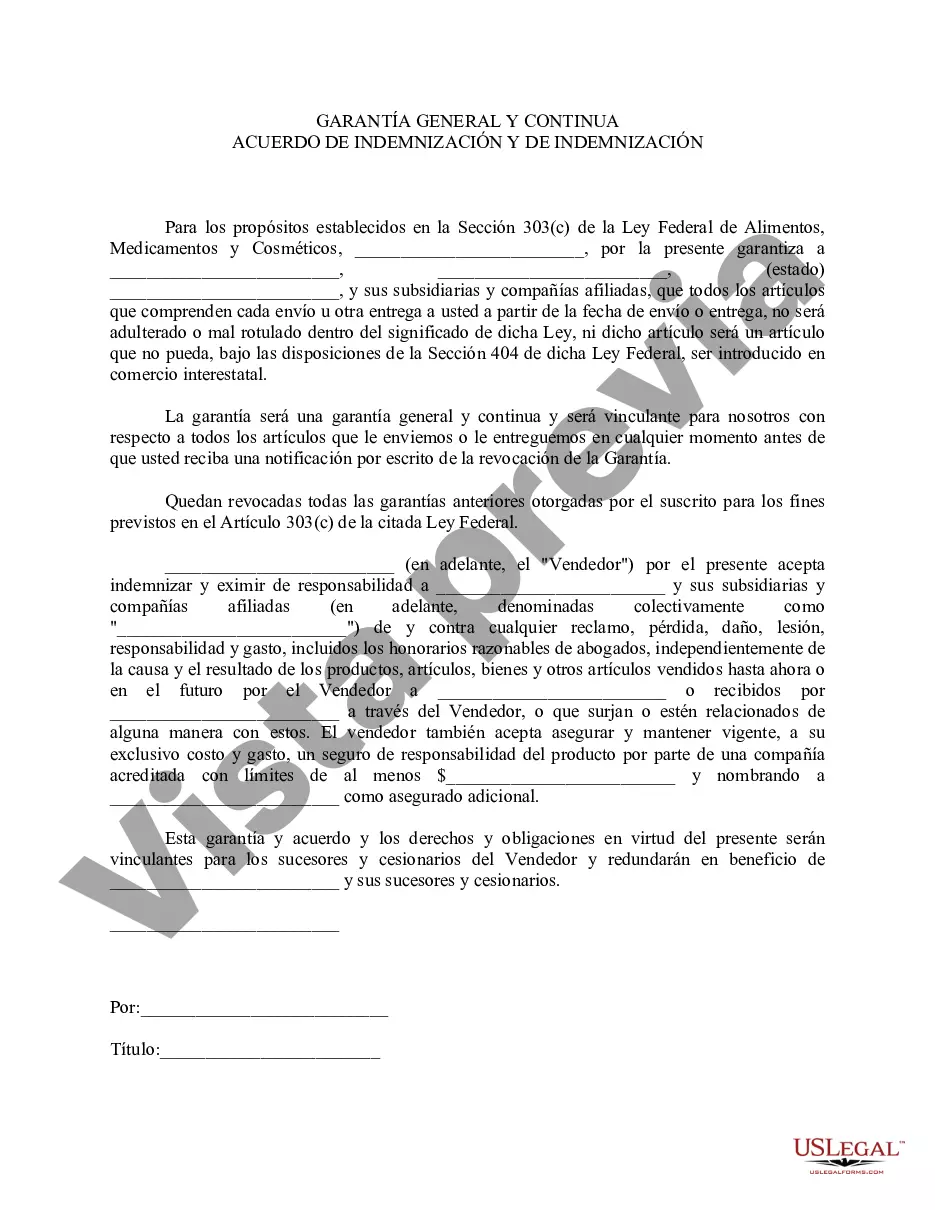

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Acuerdo General y Continuo de Garantía e Indemnización - General and Continuing Guaranty and Indemnification Agreement

Description

How to fill out Pima Arizona Acuerdo General Y Continuo De Garantía E Indemnización?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Pima General and Continuing Guaranty and Indemnification Agreement, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the recent version of the Pima General and Continuing Guaranty and Indemnification Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Pima General and Continuing Guaranty and Indemnification Agreement:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Pima General and Continuing Guaranty and Indemnification Agreement and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!