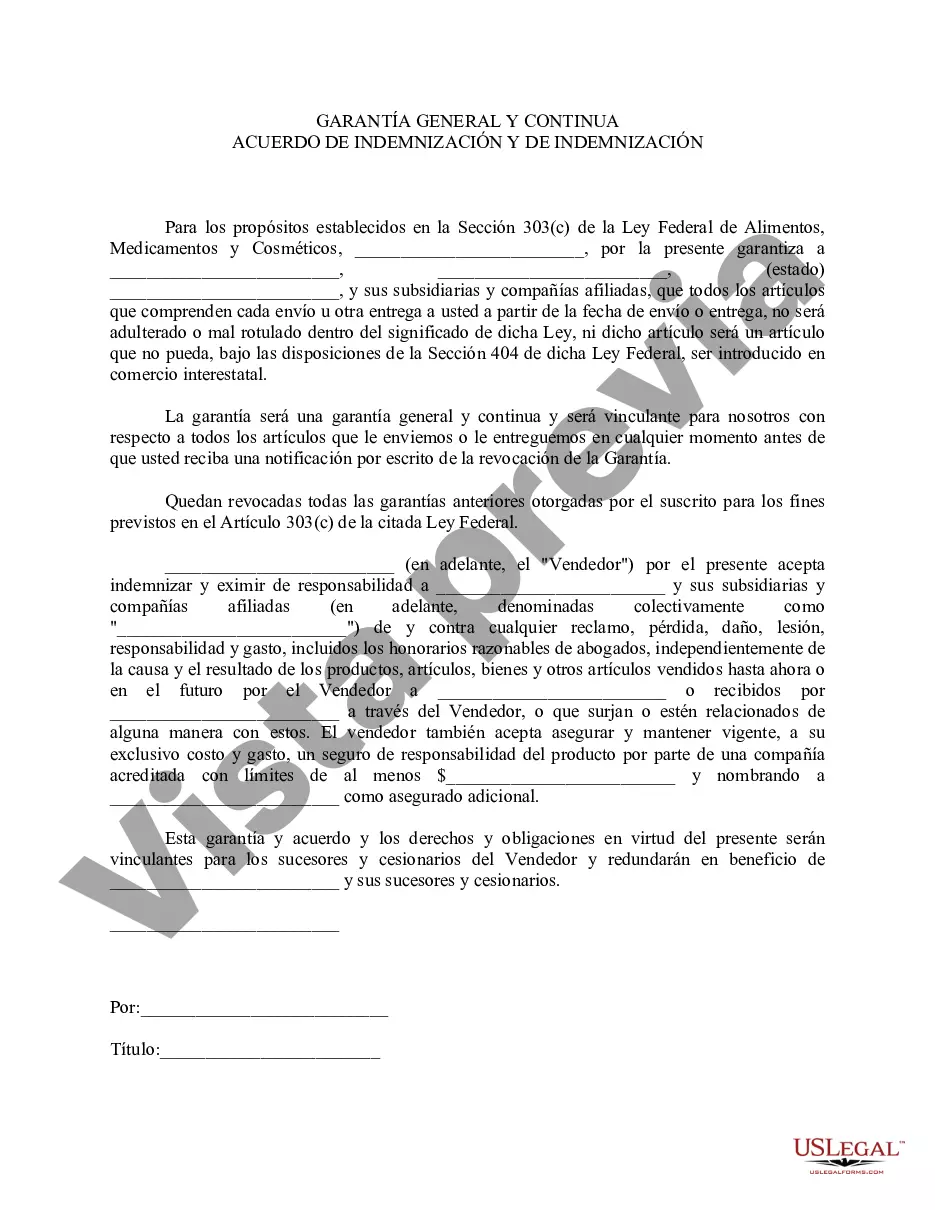

Sacramento California General and Continuing Guaranty and Indemnification Agreement is a legal document that outlines the terms and conditions under which a guarantor agrees to guarantee the obligations of a borrower or debtor. This agreement serves as a protection mechanism for lenders or creditors in Sacramento, California, ensuring that they are able to recover their outstanding debts in case the borrower defaults on their payment obligations. Under the Sacramento California General and Continuing Guaranty and Indemnification Agreement, the guarantor assumes responsibility for the borrower's financial obligations and promises to fulfill them if the borrower fails to do so. This agreement is commonly used in various financial transactions, such as loans, credit lines, or lease agreements, where a third-party guarantor provides additional security on behalf of the primary borrower. The Sacramento California General and Continuing Guaranty and Indemnification Agreement typically includes important provisions such as: 1. Guarantee: The guarantor pledges to guarantee the debts, liabilities, and obligations of the borrower, both present and future. This includes the repayment of principal amounts, interests, fees, and any additional costs incurred. 2. Continuing Obligation: The guarantor's obligation extends beyond a single transaction and continues until all borrower's obligations are fully satisfied or terminated. 3. Indemnification: The guarantor agrees to indemnify and hold the lender harmless from any losses, damages, or expenses incurred due to the borrower's default. 4. Joint and Several liabilities: If there are multiple guarantors, each may be held individually responsible for the entire debt, allowing the lender to seek payment from any or all guarantors at their discretion. 5. Governing Law: The agreement may specify that it is subject to the laws of Sacramento, California, ensuring that any disputes or legal actions relating to the agreement will be resolved in the jurisdiction. While the Sacramento California General and Continuing Guaranty and Indemnification Agreement can vary in its specific terms depending on the nature of the transaction, there are no distinct types of this agreement within the Sacramento region. However, it is important to consult with legal professionals and specific documentation to ensure compliance with local regulations and tailor the agreement to the unique circumstances of each transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Acuerdo General y Continuo de Garantía e Indemnización - General and Continuing Guaranty and Indemnification Agreement

Description

How to fill out Sacramento California Acuerdo General Y Continuo De Garantía E Indemnización?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life scenario, locating a Sacramento General and Continuing Guaranty and Indemnification Agreement meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. In addition to the Sacramento General and Continuing Guaranty and Indemnification Agreement, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Sacramento General and Continuing Guaranty and Indemnification Agreement:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Sacramento General and Continuing Guaranty and Indemnification Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!