A Salt Lake Utah General and Continuing Guaranty and Indemnification Agreement is a legal document that outlines the responsibilities and obligations of parties involved in a guaranty and indemnification agreement in the state of Utah. This agreement provides a level of protection to a party ("guarantor") who agrees to guarantee the debts, obligations, or liabilities of another party ("principal debtor"). Key terms and keywords commonly associated with a Salt Lake Utah General and Continuing Guaranty and Indemnification Agreement include: 1. Guarantor: The party (individual or entity) assuming the responsibility of guaranteeing the debts or obligations of the principal debtor. 2. Principal Debtor: The party that owes debt or obligations to another party (often a lender or creditor). 3. General and Continuing: Indicates that the guaranty and indemnification agreement remains in effect over time and covers both existing and future debts or obligations of the principal debtor. 4. Indemnification: The process of compensating for any losses, damages, or expenses incurred by one party due to the actions or defaults of the principal debtor. 5. Liability: The legal responsibility or obligation to repay debts or fulfill obligations. 6. Creditors: The individuals or entities to whom the debts or obligations of the principal debtor are owed. Different types of Salt Lake Utah General and Continuing Guaranty and Indemnification Agreements may include: 1. Commercial Guaranty: A guaranty agreement involving commercial transactions between businesses, where one party guarantees the debts or obligations of another party. 2. Real Estate Guaranty: A guaranty agreement specific to real estate transactions, often used when an individual or entity assumes liability for a loan or lease related to real property. 3. Partnership Guaranty: A guaranty agreement entered into by a partner within a partnership, guaranteeing the debts or obligations of the partnership. 4. Secured Guaranty: A guaranty agreement where the guarantor provides collateral to secure the guaranty. The collateral can be seized if the principal debtor defaults. It is crucial to consult with legal professionals or experts to ensure proper preparation, understanding, and execution of a Salt Lake Utah General and Continuing Guaranty and Indemnification Agreement, as the specific terms and requirements may vary based on the nature of the agreement and relevant state laws.

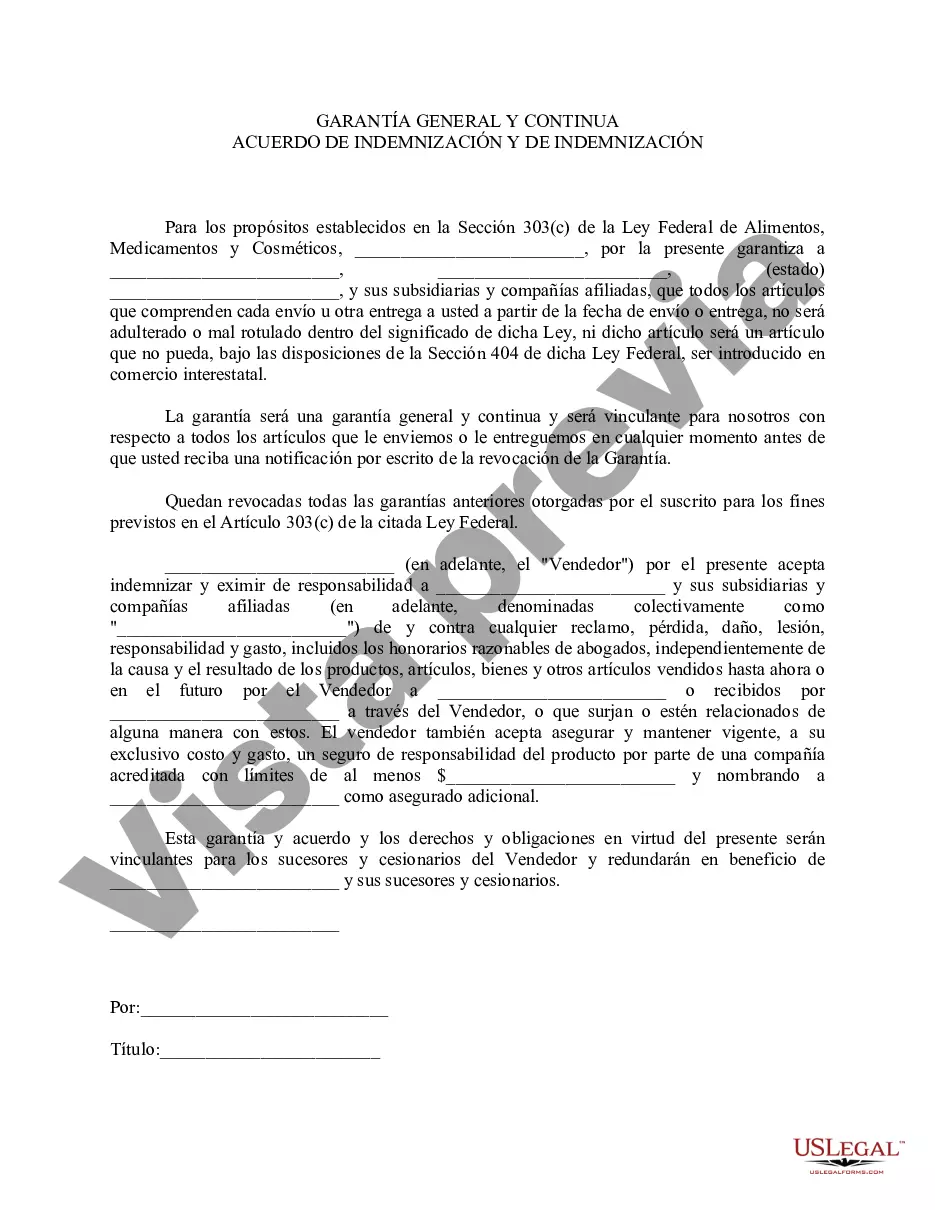

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Acuerdo General y Continuo de Garantía e Indemnización - General and Continuing Guaranty and Indemnification Agreement

Description

How to fill out Salt Lake Utah Acuerdo General Y Continuo De Garantía E Indemnización?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Salt Lake General and Continuing Guaranty and Indemnification Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Salt Lake General and Continuing Guaranty and Indemnification Agreement from the My Forms tab.

For new users, it's necessary to make some more steps to get the Salt Lake General and Continuing Guaranty and Indemnification Agreement:

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!